Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

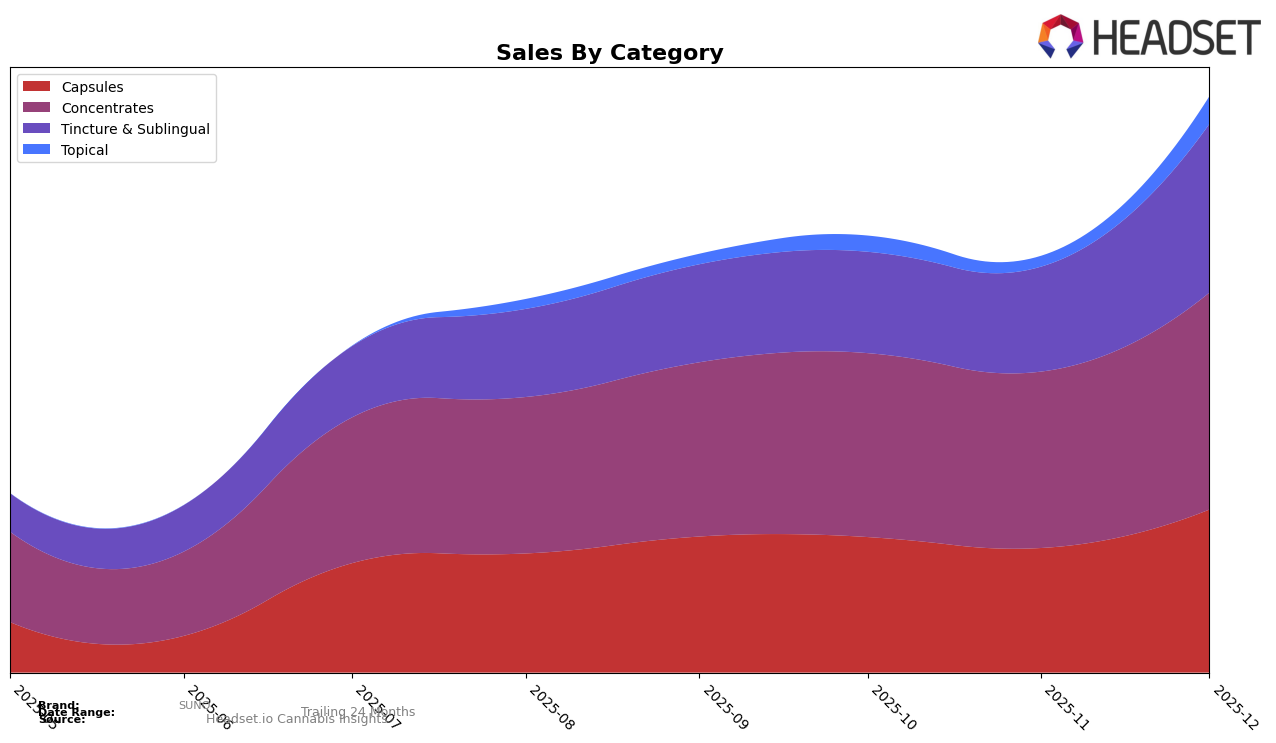

SUNO has demonstrated a stable performance in the Arizona market, maintaining a consistent rank across various product categories. In the Capsules category, SUNO held its ground at the third position from September to December 2025, indicating a strong foothold in this segment. The Tincture & Sublingual category also saw SUNO maintaining a top-three position, with a slight improvement from third to second place by December. This upward movement suggests an increasing consumer preference for SUNO's products in this category, potentially driven by their expanding product range or improved distribution strategies.

Conversely, SUNO's performance in the Concentrates category in Arizona reflects a more challenging scenario. Although they managed to break into the top 30 by November, their position remained at the lower end of the ranking spectrum, suggesting room for growth and improvement. The brand's ability to enter the top 30 in this competitive category, however, is a positive sign of potential market penetration. As SUNO continues to refine its strategies, it will be crucial to monitor whether these efforts translate into higher rankings and sales figures in the coming months.

Competitive Landscape

In the competitive landscape of concentrates in Arizona, SUNO has shown a steady presence, maintaining a rank of 30th in both November and December 2025, after climbing from 32nd in October. This consistent performance suggests a stable market position, though there is room for growth compared to competitors. For instance, High Grade improved its ranking from 22nd in October to 20th, before dropping out of the top 20 in November, indicating a volatile yet competitive edge. Similarly, Varz has shown fluctuations, starting at 17th in September and stabilizing at 28th by December. Meanwhile, Halo Cannabis (formerly The Green Halo) experienced a decline, moving from 22nd in October to 36th by December. These dynamics highlight SUNO's potential to capitalize on the shifting ranks of its competitors, particularly as it maintains consistent sales figures amidst these changes.

Notable Products

In December 2025, the top-performing product for SUNO was the Hybrid Rso Tablets 10-Pack (100mg) in the Capsules category, maintaining its first-place position from previous months with a notable sales figure of 1006 units. The Hybrid RSO Tincture (100mg) in the Tincture & Sublingual category held steady at the second spot, showing a consistent ranking from October and November. The CBG/CBD/THC 1:1:1 AM Tincture (100mg CBG, 100mg CBD, 100mg THC) remained in third place, reflecting stable demand. The CBD/CBN/THC 1:1:1 PM Tablets 10-Pack (100mg CBN, 100mg CBD, 100mg THC) in the Capsules category also retained its fourth position, indicating steady sales performance. Notably, the CBD/CBN/THC 1:1:1 PM Tincture (100mg CBN, 100mg CBD, 100mg THC) entered the rankings at fifth place, marking its debut in the top five.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.