Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

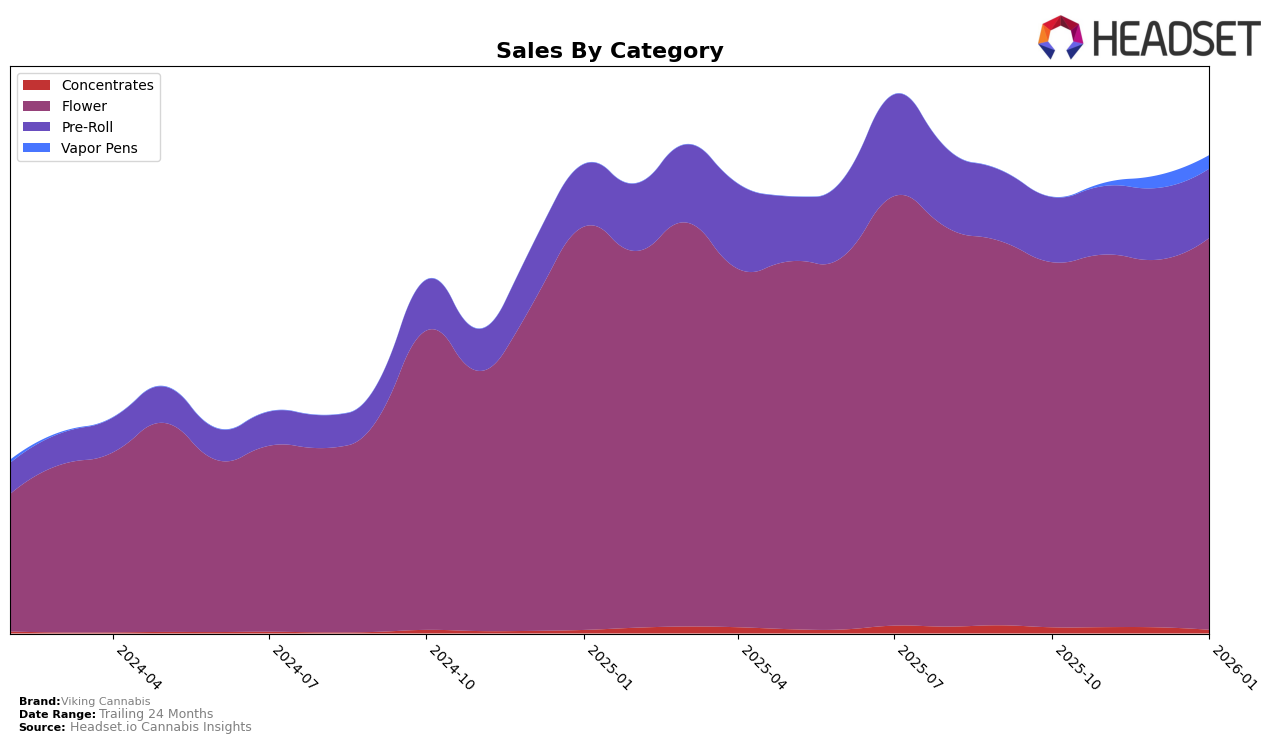

Viking Cannabis has shown consistent performance in the Washington market, particularly in the Flower category. Over the four-month period from October 2025 to January 2026, the brand maintained a solid presence within the top 10 rankings, peaking at the 7th position in November before settling at 8th in January. This upward movement from October to November indicates a strengthening market position, although the slight dip in December suggests fluctuations in consumer demand or competitive dynamics. Despite these minor shifts, Viking Cannabis's sales figures in the Flower category have shown a steady increase, suggesting a robust consumer base and effective market strategies.

In contrast, the Pre-Roll category tells a different story for Viking Cannabis in Washington. The brand did not make it into the top 30 rankings, holding positions in the 40s across the observed months. While this indicates a challenge in gaining a significant foothold compared to the Flower category, there is a positive trend in its rank improvement from 51st in October to 41st in January. This gradual climb suggests that Viking Cannabis might be implementing strategies to enhance its competitive edge in the Pre-Roll segment, although it still faces substantial competition. The sales figures reflect a similar trend, with a modest increase over the months, pointing towards potential growth opportunities if the brand continues to refine its approach in this category.

Competitive Landscape

In the competitive landscape of the Washington flower market, Viking Cannabis has shown a steady performance with a rank improvement from 10th in October 2025 to 8th by January 2026. This upward trend in rank is accompanied by a consistent increase in sales, peaking at 491,984 in January 2026. Notably, Sweetwater Farms emerged as a significant competitor, climbing from 14th in October 2025 to 6th by January 2026, surpassing Viking Cannabis in both rank and sales during this period. Meanwhile, Fifty Fold and Torus experienced fluctuating ranks, with Fifty Fold dropping to 10th in January 2026 and Torus rising to 9th, indicating a volatile market environment. The consistent top performance of EZ Flower / EZ Puff / EZ-Joint, despite a drop from 4th to 7th, highlights the competitive pressure Viking Cannabis faces from established brands with higher sales volumes. This analysis underscores the importance for Viking Cannabis to maintain its growth trajectory and strategize effectively against rising competitors like Sweetwater Farms to capture a larger market share.

Notable Products

In January 2026, Candy Mac (3.5g) maintained its top position in the Viking Cannabis lineup, with sales reaching 2068 units, continuing its dominance from December. Oil Tanker (3.5g) held steady in second place, showing a consistent performance despite being briefly ranked first in November. Old School Lemons (3.5g) climbed to the third spot, improving from its fourth position in December. The Oil Tanker Hash Infused Pre-Roll 2-Pack (1g) dropped to fourth place after a strong third-place finish in December. Notably, Blockberry (3.5g) entered the rankings for the first time in January, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.