Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

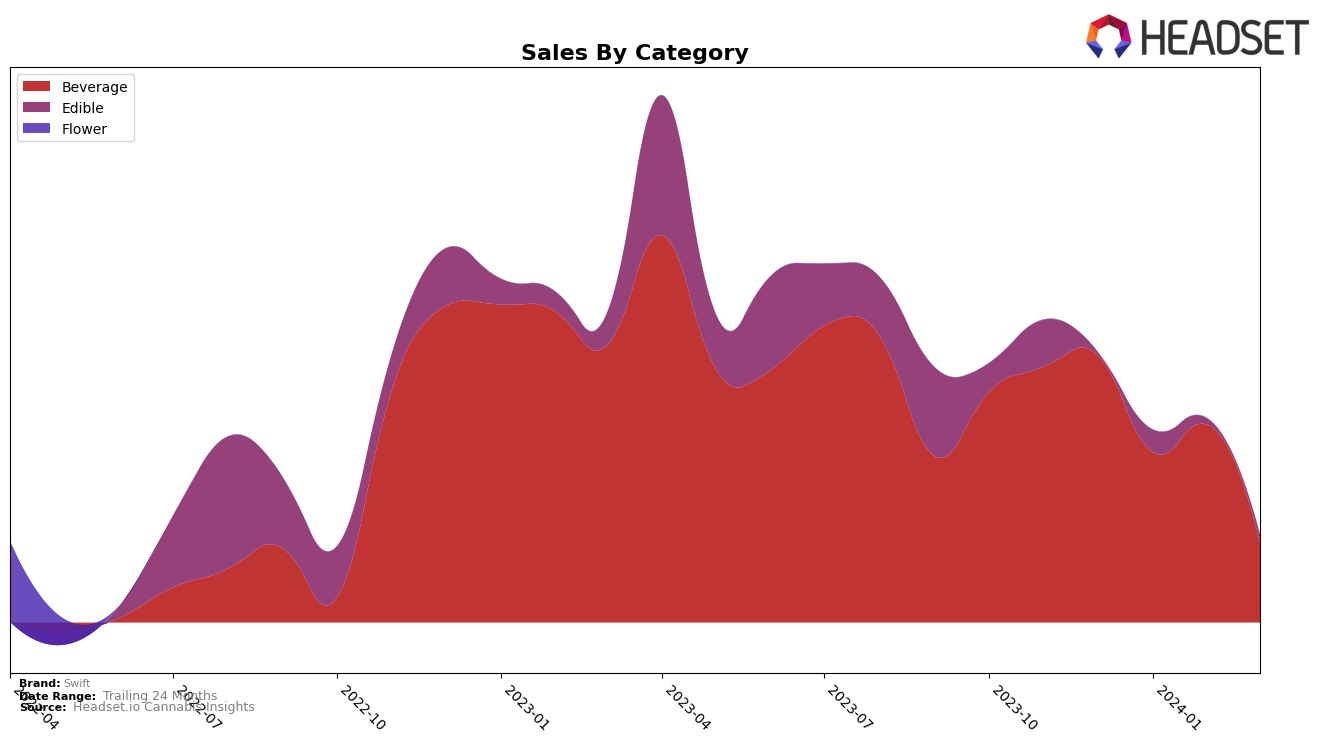

In the competitive cannabis market, Swift has shown varied performance across categories and regions, demonstrating both strengths and challenges in its market positioning. In Alberta, Swift maintained a consistent ranking in the Beverage category at 29th position from December 2023 through February 2024, before experiencing a slight dip to 32nd in March 2024, indicating a potential area for improvement. This downward trend is mirrored in their sales figures, with a notable decrease from 1406 units in December 2023 to 516 units in March 2024. Conversely, Swift's foray into the Edible category in Alberta saw a significant jump into the rankings at 61st in January 2024, though no further rankings were provided, suggesting a fluctuating presence in this category.

Swift's performance in British Columbia and Ontario presents a mixed bag of results, particularly in the Beverage category. In British Columbia, the brand maintained a steady presence, ranging from 22nd to 25th place from December 2023 through March 2024, showcasing a stable but slightly declining market position amidst competitive pressures. Ontario, however, tells a story of both challenge and opportunity for Swift; the brand saw an improvement in the Beverage category, moving from 71st in December 2023 to 63rd in January and February 2024, yet failed to secure a ranking in March 2024, highlighting potential volatility in market acceptance. The introduction into the Edible category in Ontario at 93rd position in March 2024 opens a new avenue for Swift, albeit starting from a lower baseline, indicating room for growth and market penetration efforts.

Competitive Landscape

In the competitive landscape of the beverage category in Alberta, Swift has experienced fluctuations in its market position, reflecting the dynamic nature of consumer preferences and market competition. Despite a consistent rank around the 29th position from December 2023 to February 2024, Swift saw a slight decline to the 32nd rank by March 2024. This shift can be attributed to the emergence of new competitors such as Hover Beverages, which made a notable entry at the 29th rank in March 2024, directly impacting Swift's position. Other competitors like House of Terpenes, Impromptu, and Bedfellows Liquid Arts have also shown varying degrees of sales and rank changes, indicating a highly competitive market. Swift's sales trajectory, with a peak in February followed by a decline in March, suggests challenges in maintaining market share amidst these competitive dynamics. Understanding these trends is crucial for Swift to strategize and navigate the competitive Alberta beverage market effectively.

Notable Products

In March 2024, Swift's top-performing product was the Hybrid Flavorless Dissolvable Powder (10mg) from the Beverage category, climbing to the number 1 rank with sales reaching 90 units. Following closely was the CBD Nano Infused Blooming Rose Black Tea (20mg CBD), also in the Beverage category, maintaining a strong presence at rank 2, showcasing its consistent popularity. The Saffron Pistachio Gummies 2-Pack (10mg), a newcomer in the Edible category, made an impressive debut by securing the 3rd rank with notable sales figures. Both the CBD Mango Dragon Fruit Nano Infused Tea (20mg CBD) and the THC Strawberry Lemonade Nano Infused Tea (10mg) from the Beverage category shared the 4th rank, indicating a decline in their popularity compared to previous months. This shift in rankings and the introduction of new products highlight changing consumer preferences within Swift's product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.