Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

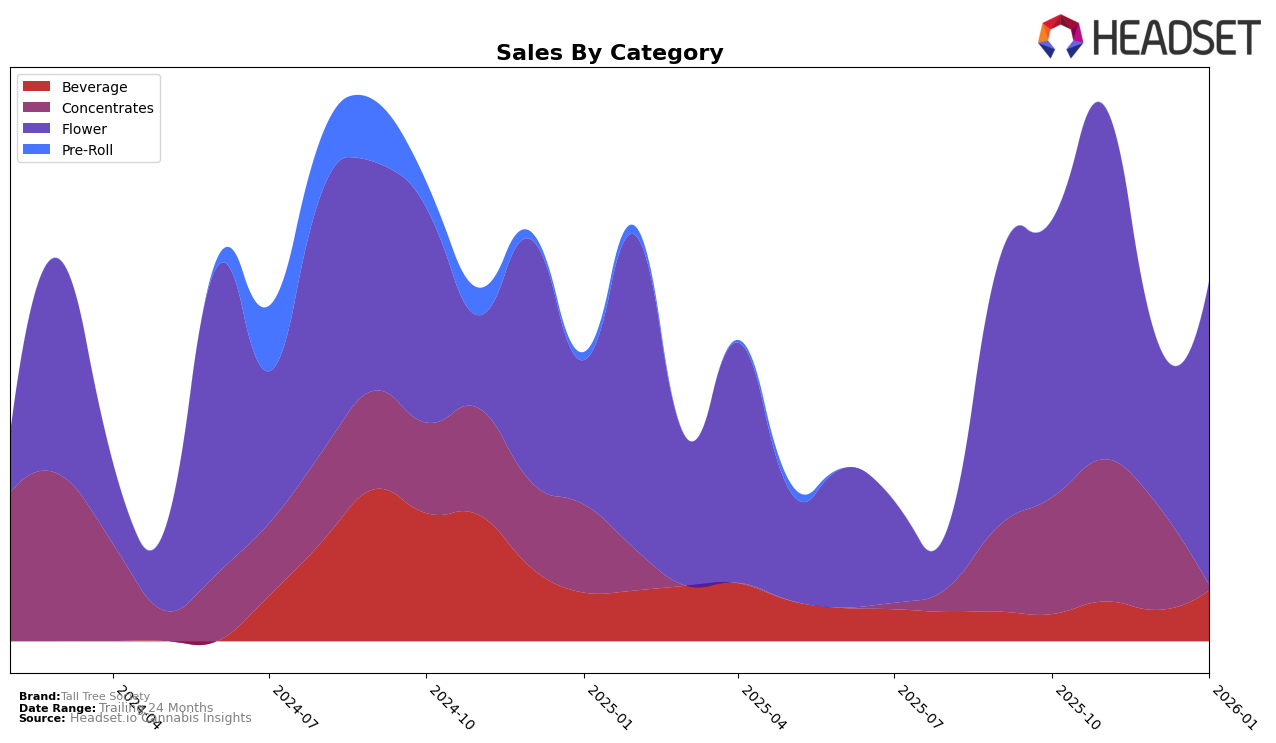

The performance of Tall Tree Society, a notable cannabis brand, across various categories and states shows interesting trends. In the California market, the brand has not managed to secure a spot in the top 30 for the Concentrates category from October 2025 through January 2026. This absence from the rankings suggests a potential struggle in gaining traction or visibility in this highly competitive market. Despite this, the brand recorded sales of $13,826 in October 2025, indicating some level of consumer engagement, albeit not enough to break into the top-tier rankings.

Such data can be critical for understanding the competitive landscape and identifying areas for improvement or investment. The fact that Tall Tree Society did not appear in the top 30 rankings over several months could be seen as a challenge that needs addressing, particularly in a robust market like California. While the sales figures provide a glimpse into their performance, the lack of ranking highlights the need for strategic adjustments to enhance their market presence and appeal to a broader consumer base. For a complete picture of their performance and strategies, further analysis would be beneficial, especially considering the dynamic nature of the cannabis industry.

Competitive Landscape

In the competitive landscape of California's concentrates market, Tall Tree Society has faced notable challenges in maintaining its rank and sales momentum. As of November 2025, Tall Tree Society was ranked 100th, indicating a struggle to penetrate the top tier of the market. In contrast, competitors such as Gramlin and Alien Labs have shown stronger performances, with Gramlin climbing from 37th to 24th place between October and November 2025, and Alien Labs maintaining a solid sales figure despite not ranking in the top 20. Additionally, Eighth Brother, Inc. has consistently held positions in the 50s range, suggesting a more stable presence in the market. These dynamics highlight the competitive pressure on Tall Tree Society to enhance its market strategies and product offerings to improve its standing and sales figures in the coming months.

Notable Products

In January 2026, the top-performing product for Tall Tree Society was the Dark Berry Seltzer (5mg THC, 12oz) in the Beverage category, maintaining its first-place ranking from previous months with a notable sales figure of 949 units. Hash Burger (4g) emerged as a strong contender in the Flower category, securing the second position. Save the Bees - Moroccan Peaches (14g) saw a slight drop, moving from second place in December 2025 to third in January 2026. Governmintz Oasis (4g) remained consistent in fourth place over the last three months. Save the Bees - Shiskaberry (14g) held steady in fifth place, showing stable sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.