Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

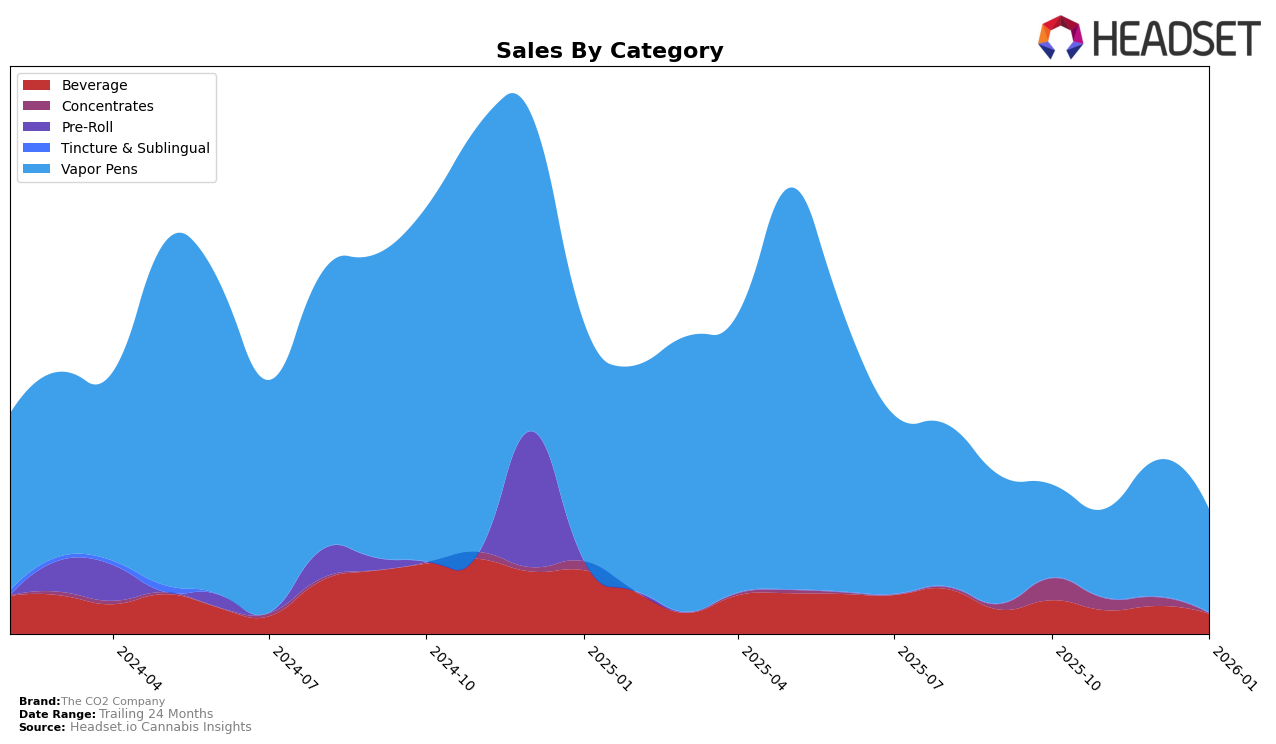

The CO2 Company, primarily known for its vapor pens, has shown varied performance across different states and categories. Notably, in Colorado, the brand did not rank in the top 30 for vapor pens from October 2025 to January 2026, indicating a challenging competitive landscape in this category. This absence from the top rankings could suggest either a decline in market presence or insufficient sales to compete with top-tier brands in the state. Despite this, the brand recorded sales of $10,055 in November 2025, which provides a baseline for understanding its market activity during this period.

While the data does not provide a comprehensive view of The CO2 Company's performance across all states and categories, the lack of top 30 rankings in Colorado highlights potential opportunities for growth or areas needing strategic adjustments. Brands often face such hurdles in competitive markets, and the ability to adapt to consumer preferences and market dynamics can be crucial for regaining or enhancing market position. Observing how The CO2 Company navigates these challenges in the coming months could provide insights into its strategic priorities and market adaptability.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, The CO2 Company has faced significant challenges in maintaining a strong market presence. Notably, The CO2 Company did not rank in the top 20 brands from October 2025 to January 2026, indicating a struggle to capture market share in this category. In contrast, Concentrate Supply Co. consistently held a position within the top 80, although its rank slipped from 72nd in October 2025 to 80th by January 2026, reflecting a downward trend in sales. Meanwhile, Nuhi entered the rankings in December 2025 at 76th and slightly declined to 81st by January 2026, suggesting a competitive but volatile presence. Old Pal demonstrated strong performance earlier on, ranking 46th in October 2025, but was absent from the top 20 in subsequent months, indicating potential market shifts or strategic changes. Lastly, In House Melts showed intermittent ranking, appearing in October 2025 and December 2025, but missing in other months, highlighting an inconsistent market strategy. These dynamics suggest that The CO2 Company needs to innovate or adjust its strategies to regain competitive footing in the vapor pen market in Colorado.

Notable Products

In January 2026, Blueberry Bubble Oil Disposable (1g) maintained its top position as the leading product for The CO2 Company in the Vapor Pens category, with impressive sales of 184 units. Mango Kush Oil Disposable (1g) secured the second spot, showing consistency in its ranking from December 2025. Banana Kush Oil Disposable (1g) remained in third place, despite a drop in sales compared to the previous month. Tangerine Haze Oil Disposable (1g) fell to fourth place, indicating a decline in popularity or demand. Meanwhile, Mango Syrup (1000mg) in the Beverage category dropped to fifth place, continuing its downward trend from previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.