Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

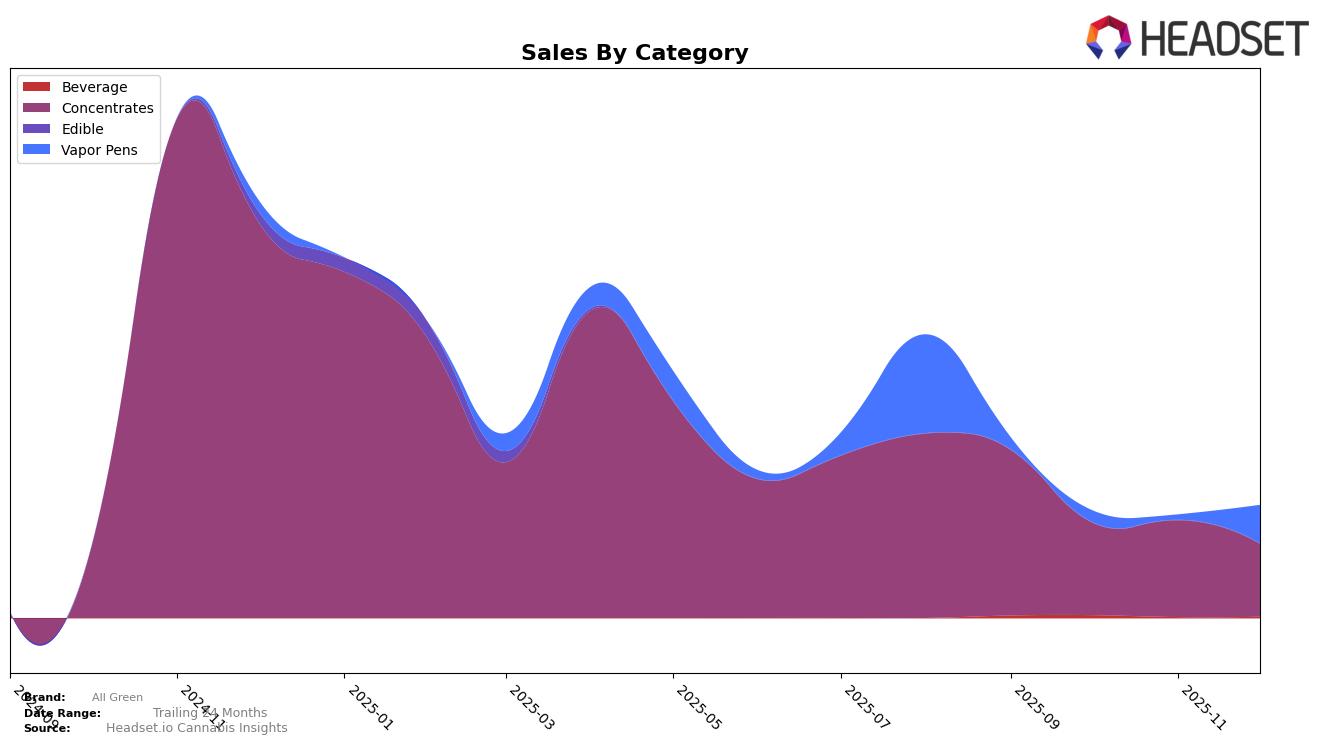

All Green has experienced fluctuating performance across different categories and states, with notable movements in rankings and sales. In the Concentrates category within Colorado, the brand has not managed to break into the top 30 rankings from September to December 2025, indicating a challenging market environment. Despite this, there was a slight improvement in November, moving up from 59th to 54th, before slipping again in December. This suggests a volatile market position where All Green is struggling to gain a significant foothold, potentially due to intense competition or changing consumer preferences in Colorado's concentrates market.

Sales figures for All Green's Concentrates in Colorado have shown a downward trend from September to December, with a notable decrease in December compared to previous months. This decline could be attributed to seasonal factors or increased competition, which might have impacted their visibility and consumer reach. The absence from the top 30 rankings throughout these months highlights the brand's need to reassess its strategies to capture more market share and improve its standing. Overall, while there are challenges, the small uptick in November suggests potential areas of growth that All Green could explore further.

Competitive Landscape

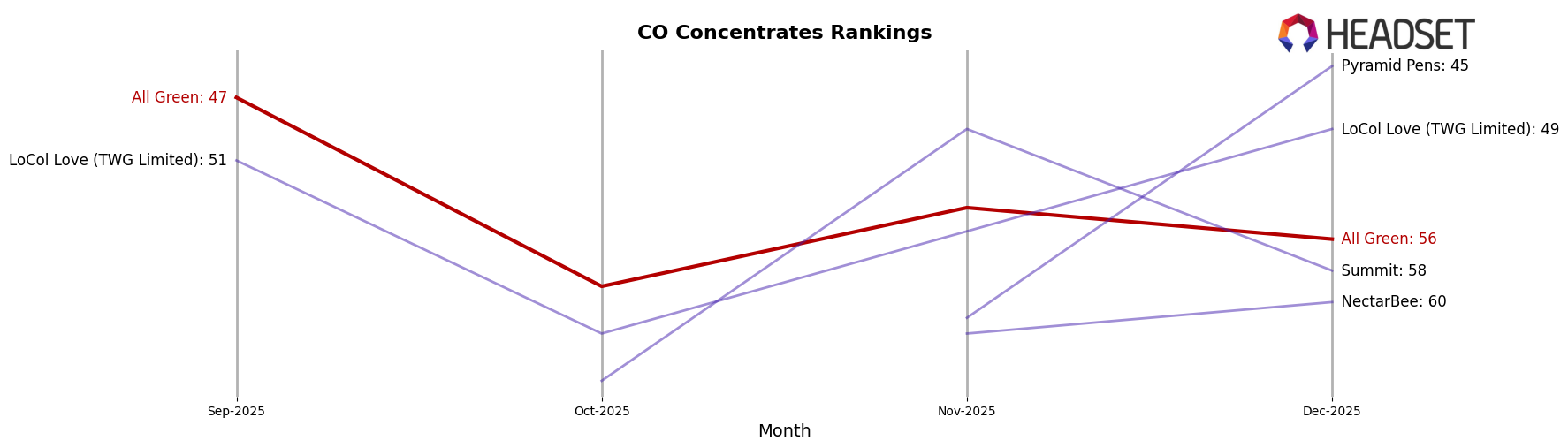

In the competitive landscape of the Colorado concentrates market, All Green has experienced a notable decline in both rank and sales from September to December 2025. Despite starting at 47th place in September, All Green's rank dropped to 56th by December, indicating a consistent downward trend. This decline is contrasted by competitors such as Pyramid Pens, which improved its rank from outside the top 20 to 45th in December, and Summit, which saw a significant sales boost in November, climbing to 49th place. Meanwhile, NectarBee and LoCol Love (TWG Limited) have shown mixed performance, with NectarBee entering the top 20 in December at 60th and LoCol Love reappearing at 49th after missing the top 20 in November. These shifts suggest a dynamic market where All Green faces increasing competition, necessitating strategic adjustments to regain its standing.

Notable Products

In December 2025, All Green's top-performing product was Rainbow Road Rosin Disposable (0.5g) in the Vapor Pens category, securing the number one rank with notable sales of 74 units. Following closely, Superboof Rosin Disposable (0.5g) also in the Vapor Pens category, achieved the second rank with strong sales figures. Rainbow Push Popp Live Rosin (2g) in the Concentrates category maintained its third position from November, showing consistent performance over the months. Powder Puff Live Rosin (2g) debuted at the fourth rank in December, indicating a successful entry into the top ranks. Sour Diesel Rosin Badder (2g) also reached the fourth position, having previously ranked fourth in September, showing a return to form after a brief absence from the top ranks.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.