Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

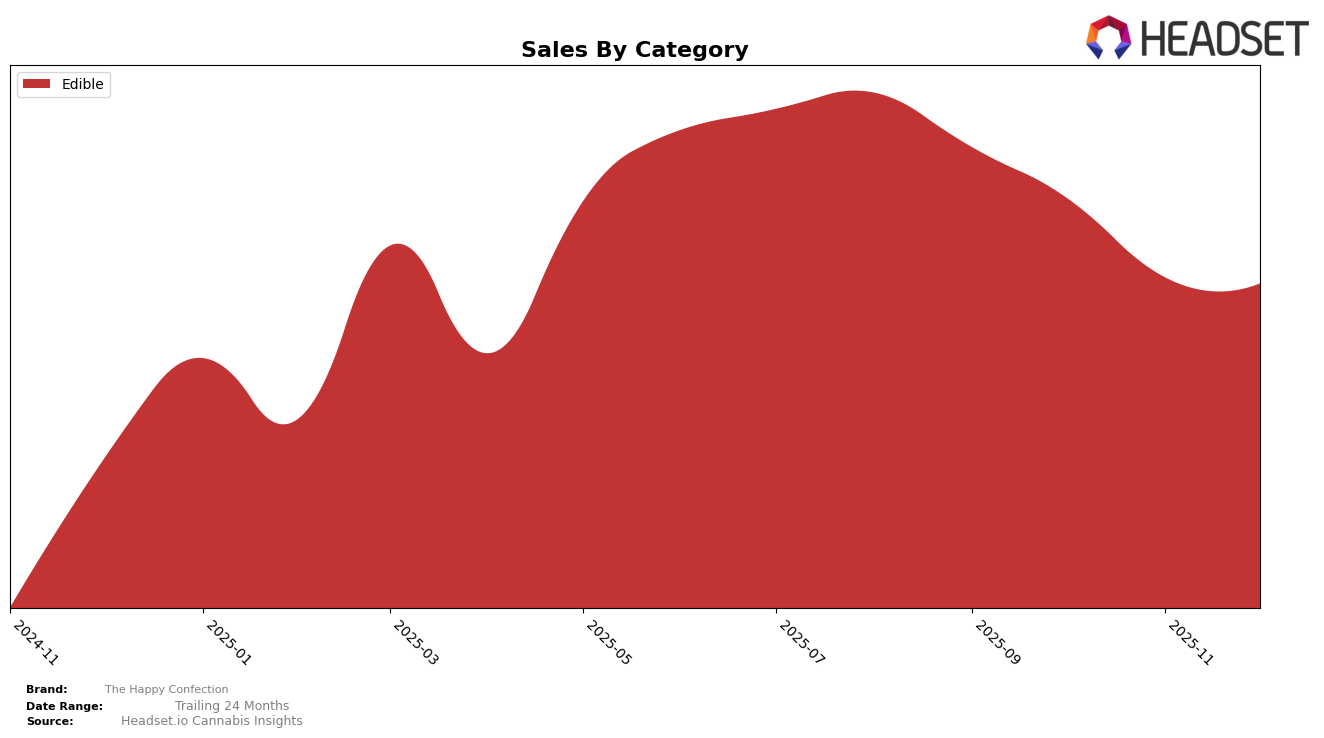

The Happy Confection has shown a consistent presence in the Connecticut edible market over the last few months. Despite a slight dip in sales from September to October, dropping from $201,086 to $179,278, the brand maintained a steady rank, oscillating between 6th and 7th place. This consistency suggests a strong brand loyalty and a solid foothold in the Connecticut market, even as sales figures fluctuate. The slight variations in rank indicate a competitive landscape where The Happy Confection continues to hold its ground among the top players.

However, it is important to note that The Happy Confection's presence is limited to the Connecticut market, as indicated by the lack of rankings in other states or provinces. This absence from the top 30 in other regions could be seen as a potential area for growth or a strategic decision to focus efforts on a specific market. The brand's ability to maintain its rank in Connecticut amidst declining sales suggests a need to explore new strategies to boost sales while leveraging its established market position. Such insights could be crucial for stakeholders looking to understand the brand's performance trajectory and potential areas for expansion.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Connecticut, The Happy Confection has experienced fluctuations in its ranking from September to December 2025, consistently hovering around the 6th and 7th positions. Despite a slight decline in sales over these months, The Happy Confection remains a strong contender, facing stiff competition from brands like Coast Cannabis Co. and Jams, which have maintained or improved their rankings, with Jams notably climbing to the 5th position by December. Meanwhile, On The Rocks and Rodeo Cannabis Co. have shown varying performances, with On The Rocks maintaining a steady rank around the 11th position and Rodeo Cannabis Co. improving its position to 10th by December. These dynamics highlight the competitive pressure on The Happy Confection to innovate and capture market share in a rapidly evolving industry.

Notable Products

In December 2025, the top-performing product from The Happy Confection was Boosted Berry Micro Dose Gummies 20-Pack (50mg), which ascended to the number one rank with sales hitting 865 units. Following closely was the CBD/CBG/THC 1:1:1 Coasting Cherry Punch Medium Dose Gummies 20-Pack (100mg CBD, 100mg CBG, 100mg THC), which dropped from its previous first position in November to second place. Boosted Berry High Dose Gummies 20-Pack (500mg) made a significant leap from its previous absence in the rankings to secure the third position. Crushin' It Cran-Raspberry Medium Dose Gummies 20-Pack (100mg) entered the rankings for the first time, taking the fourth spot. The CBD/CBG/THC 1:1:1 Chillaxing Cherry Limeade Micro Dose Gummies 20-Pack (50mg CBD, 50mg CBG, 50mg THC) rounded out the top five, maintaining a consistent presence in the rankings despite a slight drop from third in October to fifth in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.