Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

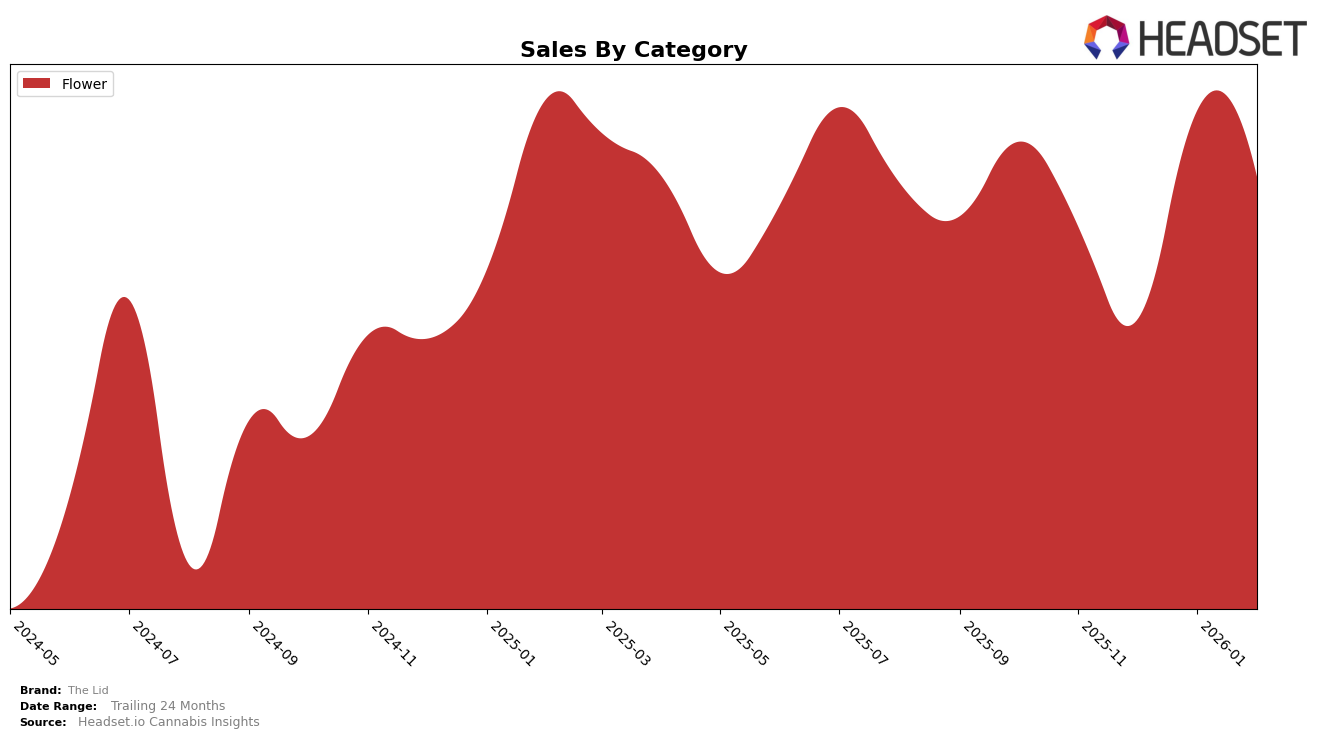

The Lid has shown notable performance fluctuations across different categories and states, with a particular emphasis on its Flower category in New Jersey. In November 2025, The Lid held the 16th position in the Flower category, but experienced a slight dip to 21st in December. However, a significant recovery was observed in January 2026, where the brand climbed to the 10th position, maintaining a strong presence by ranking 11th in February. This upward trend in early 2026 suggests a robust market strategy or possibly increased consumer demand for their Flower products. The absence of The Lid from the top 30 brands in other states or in different categories during this period highlights areas where the brand might not be as competitive or could be focusing less of its resources.

The sales figures further support The Lid's dynamic presence in New Jersey, with a noticeable increase in sales from December 2025 to January 2026, indicating a potential seasonal boost or successful promotional activities. The sales in November 2025 were substantial, but the subsequent dip in December followed by a recovery in January suggests a possible volatility in consumer purchasing patterns or inventory adjustments. Despite these fluctuations, The Lid's ability to rebound and improve its ranking in the Flower category demonstrates resilience and adaptability. However, the absence of rankings in other states and categories may point to opportunities for growth and expansion that the brand could explore to enhance its market presence.

Competitive Landscape

In the competitive landscape of the flower category in New Jersey, The Lid has demonstrated notable fluctuations in its market position over the analyzed months. Starting with a rank of 16th in November 2025, The Lid experienced a dip to 21st in December, before making a significant leap to 10th in January 2026, and slightly dropping to 11th in February. This upward trend in early 2026 suggests a positive reception of their products or marketing strategies, as evidenced by a substantial increase in sales from December to January. In comparison, Kind Tree Cannabis maintained a consistently strong position, ranking within the top 10 throughout the period, which indicates a stable consumer base and effective brand loyalty strategies. Meanwhile, Seed & Strain Cannabis Co. also showed resilience, maintaining a top 12 position, highlighting their competitive edge in the market. Conversely, Triple Seven (777) and Good Green exhibited more volatility, with Triple Seven climbing from 21st to 12th by February, suggesting a recovery or successful new initiatives. These dynamics underline the competitive pressures The Lid faces, emphasizing the need for strategic marketing and product differentiation to sustain and improve its market position.

Notable Products

In February 2026, Hudson County Kush Shake (14g) emerged as the top-performing product for The Lid, climbing from third place in January to first with sales of $955. West Orange Oreoz Pre Ground (14g) debuted strongly in second place, indicating a successful market entry. Deptford Diesel Pre Ground (14g) saw a modest improvement, moving up to third place from an unranked position in December. Roselle Runtz Pre-Ground (28g) and Camden Cake Shake (14g) also made notable entries, securing third and fourth places respectively, highlighting a competitive shake-up in the product lineup. These shifts suggest a dynamic market environment with new products gaining traction rapidly.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.