Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

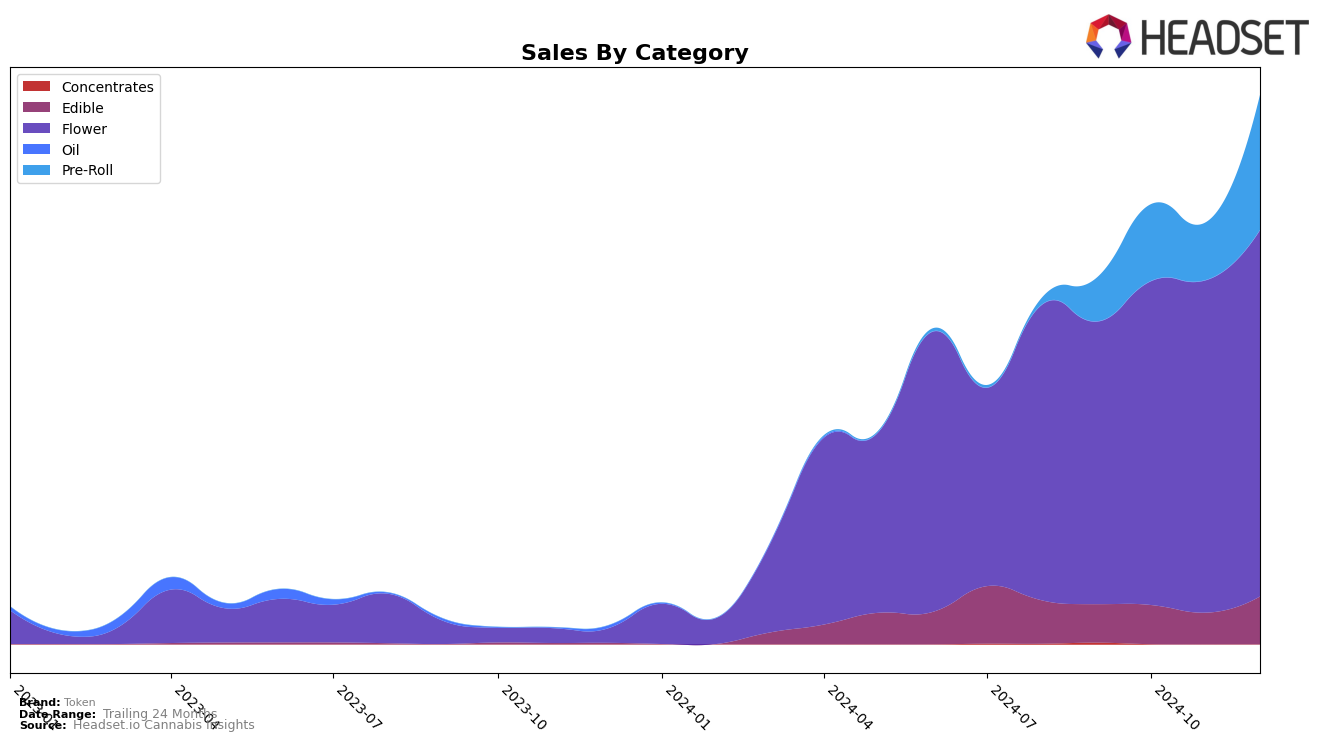

Token has shown notable shifts in its market performance across various states and product categories. In Alberta, Token made a significant entry into the Edible category by securing the 28th rank in December 2024, indicating a positive reception in this segment. However, the brand's performance in the Flower category in Alberta has seen a downward trend, dropping from 58th place in September to 93rd by December. This decline suggests challenges in maintaining market share in the Flower category, which could be attributed to increased competition or shifting consumer preferences.

In New York, Token's presence in the Flower category has been more promising. The brand entered the rankings in November 2024 at 87th place and improved to 77th by December, reflecting a growing acceptance among consumers. This upward movement in New York's Flower category contrasts with its performance in Alberta, highlighting regional differences in brand strength and consumer behavior. The absence of Token from the top 30 brands in other categories and states during these months could point to areas where the brand might need to strategize for better penetration and visibility.

Competitive Landscape

In the competitive landscape of the Flower category in New York, Token has shown a notable upward trajectory in its ranking, entering the top 100 in November 2024 at 87th place and further improving to 77th by December 2024. This rise is significant, especially when compared to competitors like Packs (fka Packwoods), which experienced a decline from 30th in October to being unranked by December, and Generic AF, which dropped from 39th in September to 92nd by December. Meanwhile, Tyson 2.0 saw fluctuating ranks, peaking at 51st in October but falling to 76th by December. Despite these shifts among competitors, Token's consistent sales growth from November to December indicates a strengthening market position, suggesting that consumers are increasingly favoring Token over its competitors, who are either experiencing declining sales or inconsistent rankings.

Notable Products

In December 2024, Token's top-performing product was Peanut Butter Chocolate (10mg) in the Edible category, maintaining its first-place rank from previous months and achieving a notable sales figure of 2557 units. Garlic Breath (3.5g) in the Flower category debuted at the second position, showcasing its popularity among consumers. Stoned Panda (3.5g), also in the Flower category, ranked third, dropping from its second position in November. Ritchie Cherry Infused Pre-Roll (1g) and Alaskan Purple Pre-Roll 3-Pack (1.5g) were ranked fourth and fifth, respectively, as they entered the top five for the first time. These changes indicate a growing consumer interest in Flower and Pre-Roll products as compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.