Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

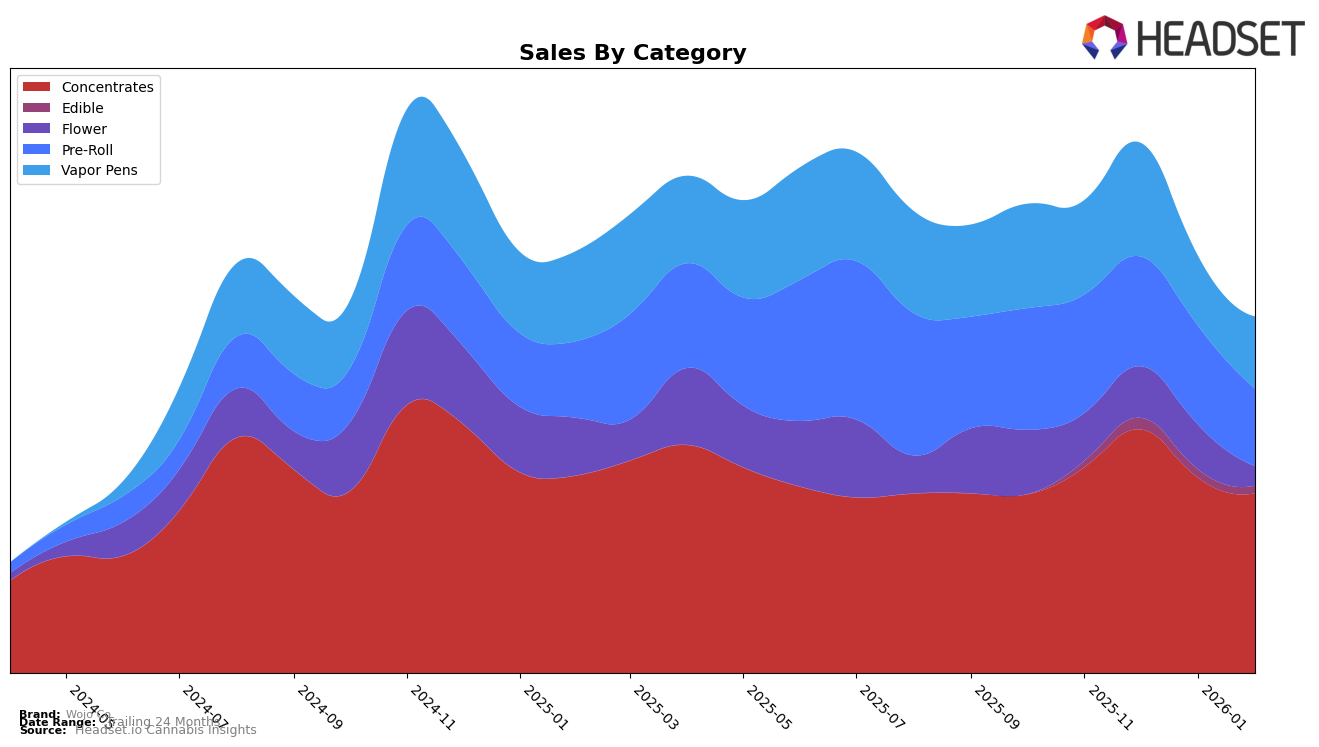

Wojo Co has shown notable performance in the Michigan market, particularly in the Concentrates category. Over the months from November 2025 to February 2026, Wojo Co maintained a strong presence, consistently ranking within the top five, with a peak at the second position in December 2025. This indicates a solid customer base and effective market strategies in this category. However, in the Edible category, Wojo Co did not appear in the top 30 rankings, except for a brief appearance at position 81 in December 2025, suggesting potential areas for growth or reevaluation of their edible products strategy.

In other categories, Wojo Co's performance has been more varied. For Pre-Rolls, the brand hovered around the lower end of the top 30 rankings, with a slight dip in February 2026, where they fell to 37th position. This suggests a competitive landscape or potential challenges in maintaining a steady market share. Meanwhile, their Vapor Pens category saw fluctuating rankings, with a notable drop to 43rd position in January 2026, before recovering slightly in February. The sales figures in these categories reflect these trends, with some volatility indicating possible shifts in consumer preferences or competitive pressures. Overall, Wojo Co's performance across categories in Michigan suggests strengths in certain areas and opportunities for growth in others.

Competitive Landscape

In the Michigan concentrates market, Wojo Co has shown a dynamic performance with its rank fluctuating between 2nd and 4th place from November 2025 to February 2026. Notably, Wojo Co secured the 2nd position in December 2025, indicating a strong sales performance, although it slipped to 4th in January 2026 before recovering to 3rd in February 2026. This fluctuation suggests competitive pressure from brands like Rkive Cannabis, which climbed to 2nd place in January 2026, and Traphouse Cannabis Co., which showed a remarkable rise from 22nd in November 2025 to 3rd in January 2026. Meanwhile, The Limit consistently held the top spot, highlighting the competitive landscape Wojo Co faces. Despite these challenges, Wojo Co's ability to maintain a top 4 position underscores its resilience and potential for growth in this competitive market.

Notable Products

In February 2026, Donny Double Live Rosin (1g) from the Concentrates category maintained its top position for Wojo Co, with sales reaching 1127 units. Oishii Live Rosin (1g) climbed to the second spot, showing a significant rise from its previous fourth position in November 2025. Sundae Driver Live Rosin Disposable (0.5g), a Vapor Pen, entered the rankings at third place, indicating strong consumer interest. Malibu Marsha Live Rosin (1g) dropped to fourth place from its previous second position in December 2025. Lastly, Strawberry Candy Pre-Roll (1g) debuted in the rankings at fifth place, rounding out the top performers for the month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.