Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

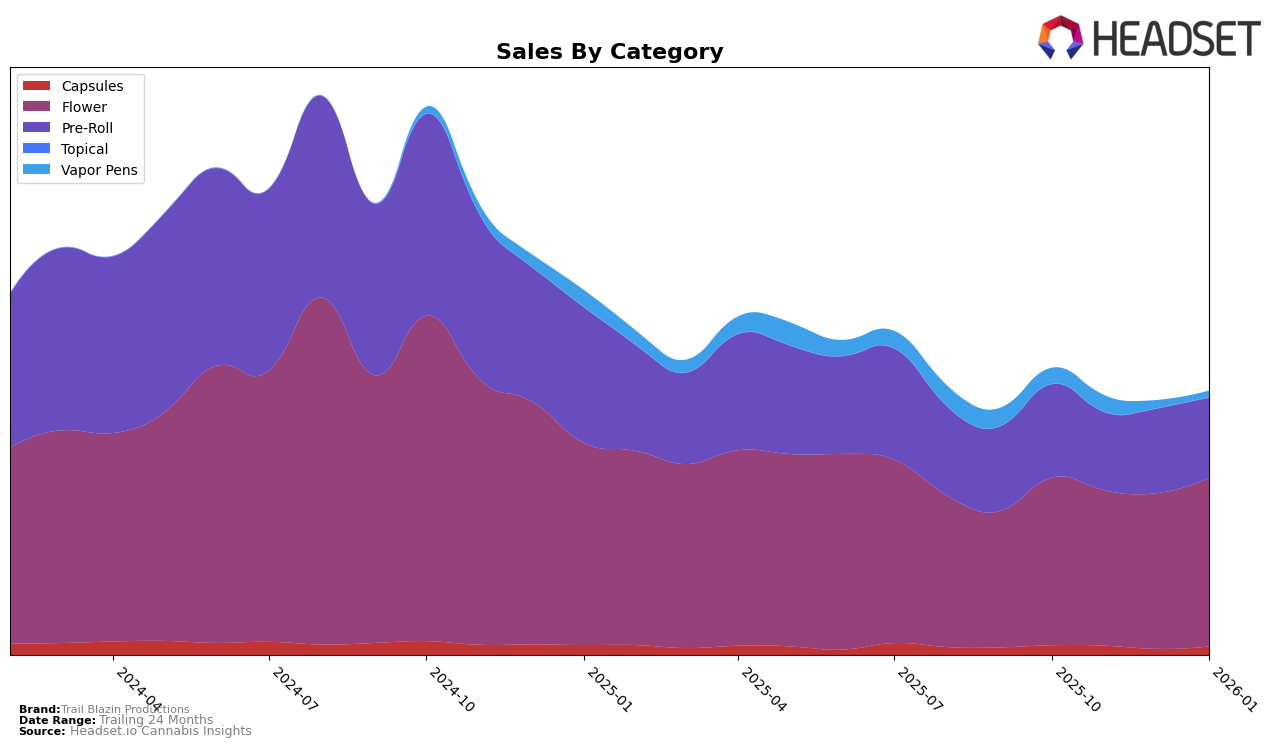

Trail Blazin Productions has shown varied performance across different product categories in Washington. In the Flower category, they were not ranked in the top 30 brands for two consecutive months, November and December 2025, indicating a potential challenge in maintaining market presence during this period. However, they made a notable comeback in January 2026, achieving a rank of 89, which suggests a positive shift in consumer demand or possibly strategic adjustments by the brand. This fluctuation highlights the competitive nature of the Flower category and the need for consistent performance to stay within the top rankings.

In the Pre-Roll category, Trail Blazin Productions experienced a similar pattern of performance in Washington. The brand was not ranked in November 2025, but managed to regain visibility in December 2025 and improved further by January 2026, reaching rank 89. This recovery in ranking, despite not being in the top 30 for a month, demonstrates resilience and the potential impact of market strategies or consumer preferences. The sales figures, although not detailed here, suggest that the brand's ability to re-enter the rankings is indicative of a potential upward trend in this category.

Competitive Landscape

In the competitive landscape of the Washington flower market, Trail Blazin Productions has experienced a notable shift in its rank and sales trajectory from October 2025 to January 2026. Initially ranked at 100th place in October and November 2025, Trail Blazin Productions improved its position to 89th by January 2026. This upward movement is significant, especially when compared to competitors like Buddy Boy Farms, which saw a decline in rank from 78th to outside the top 20 by December 2025, and Khush Kush, which re-emerged in January 2026 at 85th after not ranking in the top 20 for two months. Meanwhile, Walden Cannabis maintained a relatively stable position, hovering around the high 80s to low 90s, and EZ Vape made a strong entry into the rankings at 90th in December, climbing to 82nd by January. These dynamics suggest that Trail Blazin Productions is gaining momentum in the market, potentially benefiting from shifts in consumer preferences or strategic adjustments that have bolstered its competitive standing.

Notable Products

In January 2026, Trail Blazin Productions' top-performing product was 9# Hammer (3.5g) in the Flower category, which rose to the number one rank with sales of 217 units. Amnesia (3.5g) maintained its second-place position from December 2025, showcasing consistent popularity. Purple Urkle (3.5g) made a remarkable return to the rankings, tying for second place, after being unranked in December. The Amnesia Pre-Roll 2-Pack (1.2g) saw a drop from first to third place compared to the previous month, with sales decreasing to 206 units. Meanwhile, the 9 Pound Hammer Pre-Roll 2-Pack (1.2g) held steady at fourth place, indicating stable demand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.