Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

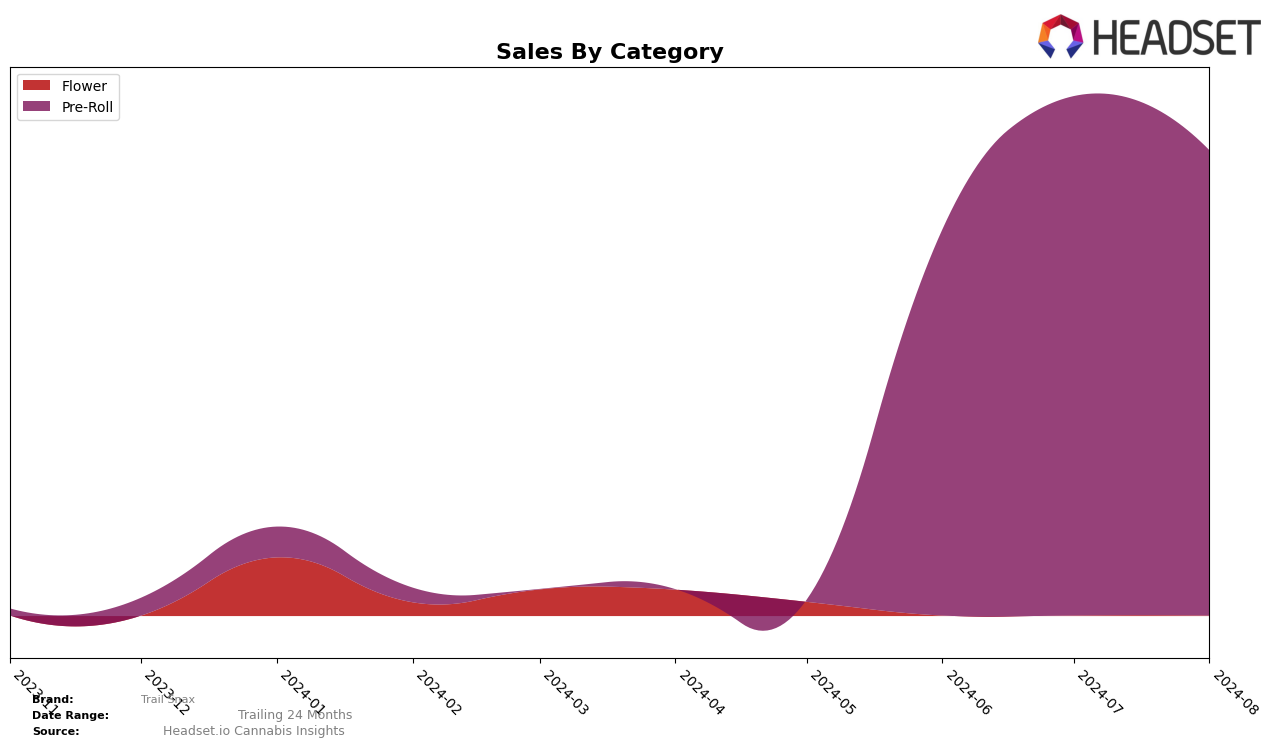

Trail Snax has shown a notable performance in the Pre-Roll category across different states, with particular movements in Colorado. The brand was not in the top 30 in May 2024 but made a significant leap to rank 27th in June and further improved to 26th in July. This upward trend indicates a growing presence and acceptance among consumers. However, it is important to note that Trail Snax did not maintain its position in the top 30 by August, which could suggest a need for strategic adjustments or increased competition in the market.

The sales data also reflects this performance trajectory, with a peak in June 2024 before experiencing a slight decline in the following month. This fluctuation could be attributed to seasonal demand or promotional activities that boosted sales temporarily. While the absence from the top 30 in May and August is a setback, the ability to climb into the rankings in June and July demonstrates potential for recovery and growth. Monitoring these trends closely will be crucial for Trail Snax to sustain and improve its market position in the competitive landscape of Colorado.

Competitive Landscape

In the competitive landscape of Colorado's Pre-Roll category, Trail Snax has shown a notable upward trend in rank and sales over the recent months. Starting from an unranked position in May 2024, Trail Snax climbed to 41st in June, 27th in July, and maintained a strong 26th position in August. This positive trajectory is significant when compared to competitors like Willie's Reserve, which fluctuated between 25th and 29th, and Fuego Farms (CO), which saw a dip to 32nd in July before recovering to 24th in August. Meanwhile, brands like Nuhi and Indico also experienced significant rank improvements but started from much lower positions. Trail Snax's consistent rise in rank and sales indicates a growing market presence and consumer preference, setting it apart from its competitors in Colorado's Pre-Roll market.

Notable Products

In August 2024, the top-performing product from Trail Snax was Marsh Mellow Pre-Roll (1g) in the Pre-Roll category, maintaining its number one rank from July with notable sales of $4401. Cherry Punch Pre-Roll (1g) also held steady at the second position for the second consecutive month, following a previous top rank in June. Ice Cream Cake Pre-Roll (1g) consistently ranked third from June through August. Apple Fritter (3.5g) in the Flower category, which had a strong start in May, did not appear in the rankings for the subsequent months. This stability in the rankings for the pre-roll products indicates a strong and consistent preference among customers for these top three offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.