Jul-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

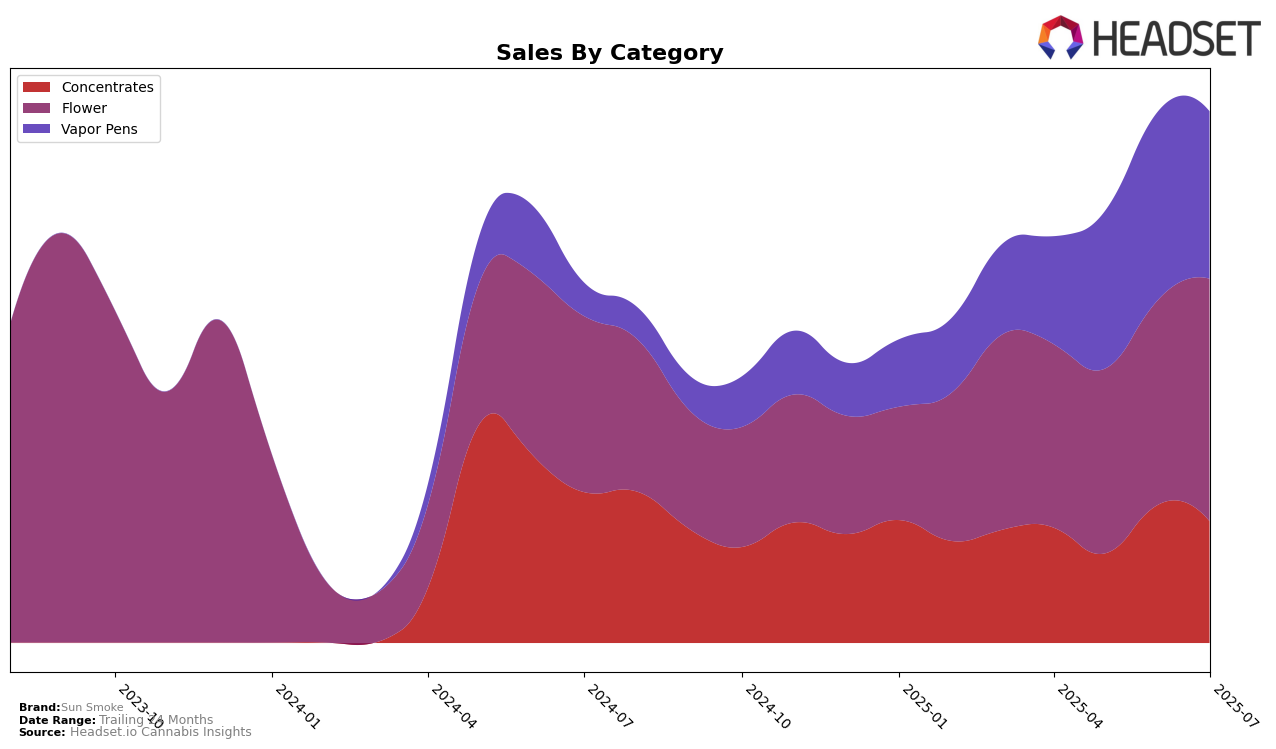

Sun Smoke has shown varied performance across different product categories and states. In the California market, their presence in the concentrates category has been relatively stable, with rankings fluctuating between 22nd and 27th place from April to July 2025. Notably, the brand saw a significant dip in May, dropping out of the top 30, but made a strong comeback in June, achieving their highest rank of 22nd. This suggests a potential seasonal or promotional influence driving sales. In contrast, their performance in the flower category has not been as strong, with Sun Smoke not appearing in the top 30 until June and July, where they ranked 97th and 84th, respectively. This late entry into the rankings might indicate either a new product launch or an improvement in brand strategy.

In the vapor pens category, Sun Smoke has demonstrated a more consistent upward trajectory in California. Starting at 86th place in April, the brand improved its position to 60th by June, although it experienced a slight setback in July, falling to 65th. This overall positive trend is underscored by a steady increase in sales from April to June, peaking in June before a slight decline in July. The fluctuations in rankings and sales across these categories highlight the dynamic nature of the cannabis market and suggest that Sun Smoke is actively navigating these changes to optimize their market presence. However, there are still areas, such as the flower category, where the brand could focus on improving its competitive standing.

Competitive Landscape

In the competitive landscape of the California flower category, Sun Smoke has shown a promising upward trajectory in recent months. After not ranking in the top 20 in April and May 2025, Sun Smoke emerged at rank 97 in June and improved to rank 84 by July. This rise is notable when compared to competitors such as 710 Labs, which has seen a consistent decline from rank 58 in April to 90 in July, and TRENDI, which fluctuated but ended at rank 92 in July. Meanwhile, Seed Junky Genetics and Preferred Gardens have experienced variable rankings, with Preferred Gardens notably dropping from rank 55 in June to 76 in July. Sun Smoke's sales have also shown a positive trend, increasing from June to July, indicating a growing consumer preference and potential for further market penetration.

Notable Products

In July 2025, Sun Smoke's top-performing product was THC Bomb Live Resin Badder (1g) in the Concentrates category, securing the number one rank with notable sales figures of 2348 units. The Hybrid Blend Preground (14g) maintained its strong performance, holding steady at the second position, showing an increase from its previous sales figures. Indica Blend Preground (28g) ranked third, consistent with its position from May 2025, indicating stable demand. Skywalker OG Distillate Cartridge (1g) entered the rankings at fourth place, highlighting a significant rise in popularity. Watermelon Dreams Live Resin Diamonds Wax (1g) remained the fifth most popular product, maintaining its position from June 2025 with steady sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.