Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

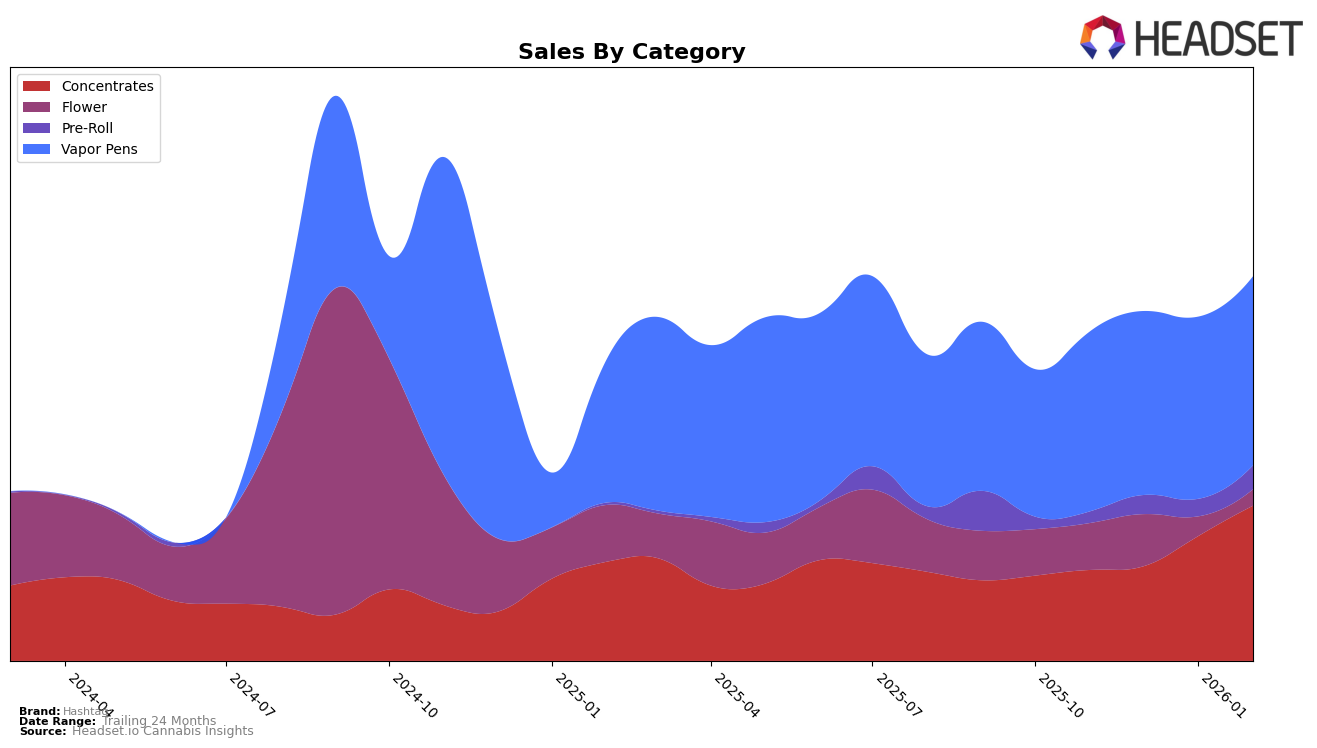

In California, Hashtag has shown a promising upward trajectory in the concentrates category. Starting from a rank of 30 in November 2025, the brand climbed to 18 by February 2026. This climb in rankings indicates a positive reception and growing market share within the state. The sales figures support this trend, with a notable increase from $101,546 in November to $173,570 in February. This steady improvement in rank and sales suggests that Hashtag is becoming a more significant player in the California concentrates market.

Conversely, in New York, Hashtag's performance in the vapor pens category has been relatively stagnant. The brand has consistently hovered around the 39th and 41st positions from November 2025 to February 2026, not making it into the top 30. Despite slight fluctuations in sales figures, the lack of movement in rankings highlights a challenge for Hashtag in gaining a stronger foothold in the New York vapor pens market. This stagnation could suggest a need for strategic adjustments to improve their competitive position in this category.

Competitive Landscape

In the competitive landscape of Vapor Pens in New York, Hashtag has maintained a relatively stable position, fluctuating slightly between the 39th and 41st ranks from November 2025 to February 2026. Notably, Hashtag's sales have shown a modest upward trend, increasing from November 2025 to February 2026, which suggests a positive reception in the market despite its lower rank. Meanwhile, competitors such as To The Moon and AiroPro have experienced more significant fluctuations in rank, with To The Moon maintaining a higher rank overall, though its sales have slightly decreased over the same period. Olio and Ruby Farms have remained consistently lower in rank, with Olio showing a notable increase in sales, indicating potential future competition for Hashtag. This competitive analysis highlights the importance for Hashtag to leverage its steady sales growth to improve its market position against these fluctuating competitors.

Notable Products

In February 2026, Wedding Cake Distillate Disposable (1g) maintained its position as the top-performing product for Hashtag, with sales reaching 1710 units. Super Jack Distillate Disposable (1g) held steady at the second position, showing consistent demand from January. Permanent Marker Distillate Disposable (1g) ranked third, despite a slight decline in sales compared to the previous month. Jelly Breath Badder (1g) climbed to fourth place, continuing its upward trend from December and January. Notably, Strawberry Diesel Distillate Disposable (1g) re-entered the top five, securing the fifth position after being unranked in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.