Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

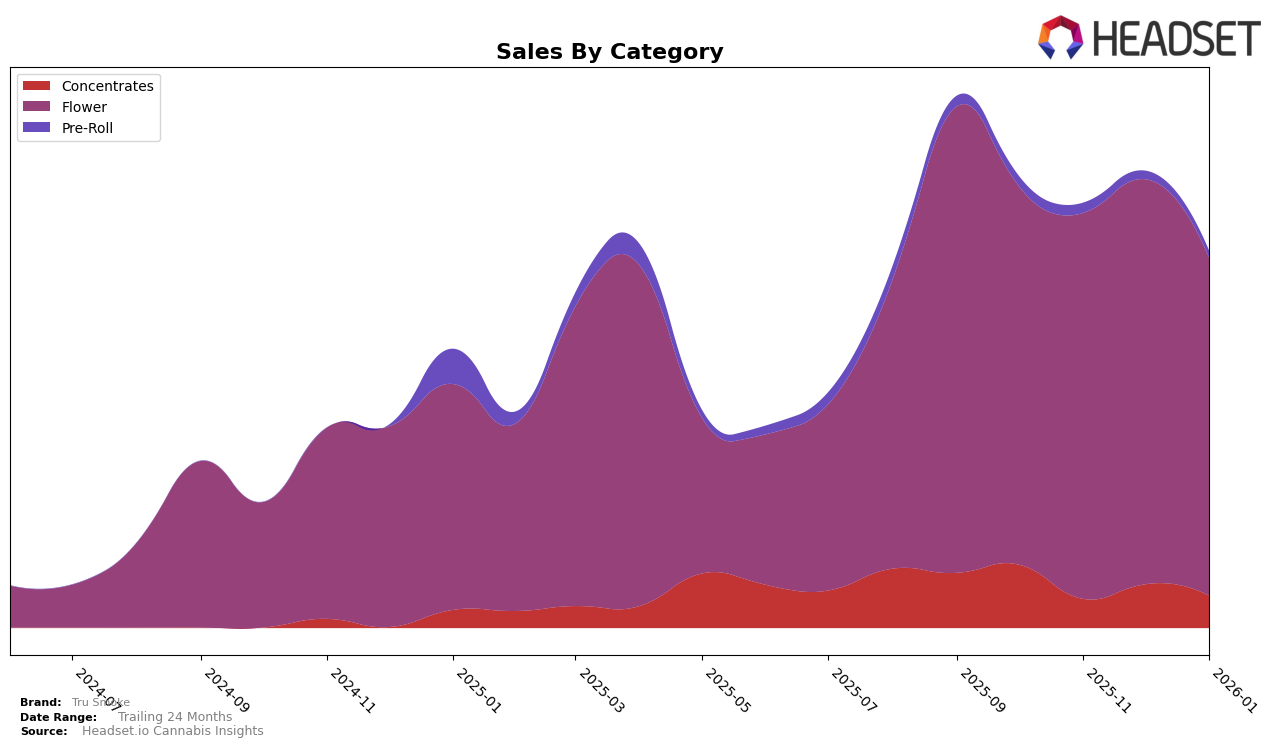

Tru Smoke has shown a varied performance across different categories in Michigan. In the Concentrates category, the brand experienced a notable decline in rankings over the months, starting at 17th place in October 2025 and dropping out of the top 30 by November. Although it managed to climb back to 35th place in December, it fell again to 41st in January 2026. This volatility suggests challenges in maintaining a strong hold within the Concentrates market, potentially due to increased competition or shifts in consumer preferences. The sales figures, reflecting a peak in December, further indicate fluctuating consumer interest or promotional activities that might have temporarily boosted sales.

In contrast, Tru Smoke's performance in the Flower category in Michigan has been relatively stable. The brand consistently ranked within the top 30, starting at 23rd place in October 2025 and improving slightly to 19th by December before settling at 21st in January 2026. This stability within the Flower category suggests a more consistent consumer base or effective brand loyalty strategies that have helped maintain its market presence. The sales trend reflects a strong performance in November and December, with a slight dip in January, which could be attributed to seasonal factors or market saturation. Overall, while Tru Smoke faces challenges in the Concentrates category, its performance in Flower indicates a stronger market position.

Competitive Landscape

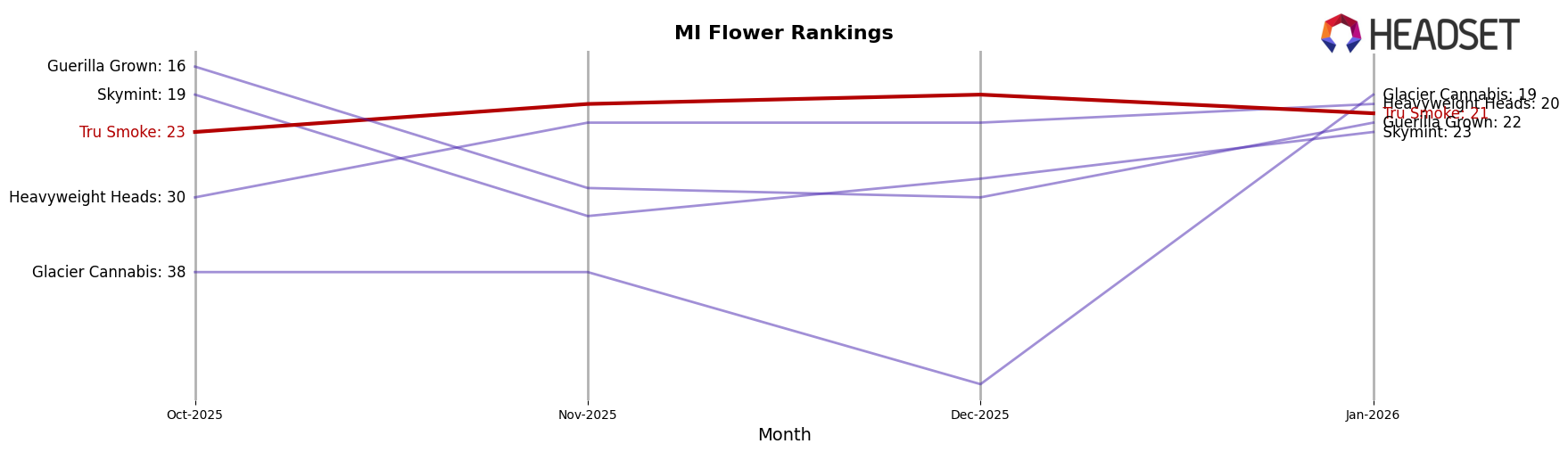

In the competitive landscape of the Michigan flower category, Tru Smoke has demonstrated a consistent presence, maintaining a rank within the top 25 brands over the past four months. Notably, Tru Smoke's rank improved from 23rd in October 2025 to 19th in December 2025, before slightly declining to 21st in January 2026. This fluctuation indicates a stable yet competitive position amidst brands like Heavyweight Heads, which consistently outperformed Tru Smoke by maintaining a rank between 20th and 22nd during the same period. Meanwhile, Glacier Cannabis showed a significant jump from 50th in December 2025 to 19th in January 2026, suggesting a potential threat to Tru Smoke's market share. Despite these competitive pressures, Tru Smoke's sales figures remained robust, although slightly lower than Guerilla Grown, which also experienced rank fluctuations but maintained higher sales. This analysis highlights Tru Smoke's need to strategize against emerging competitors and capitalize on its stable market presence to enhance its sales trajectory.

Notable Products

In January 2026, Tru Smoke's top-performing product was Tru Gas (Bulk) from the Flower category, which climbed to the number one rank from fourth place in December 2025, achieving sales of 8,737 units. Z Clair (Bulk) secured the second position, marking its debut in the rankings. Nana Glue (Bulk) maintained its third-place ranking from December 2025, although its sales decreased. Keeper (Bulk) entered the rankings at fourth place, while Detroit Shuffle (Bulk) rounded out the top five. The notable rise of Tru Gas (Bulk) highlights its increasing popularity and market demand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.