Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

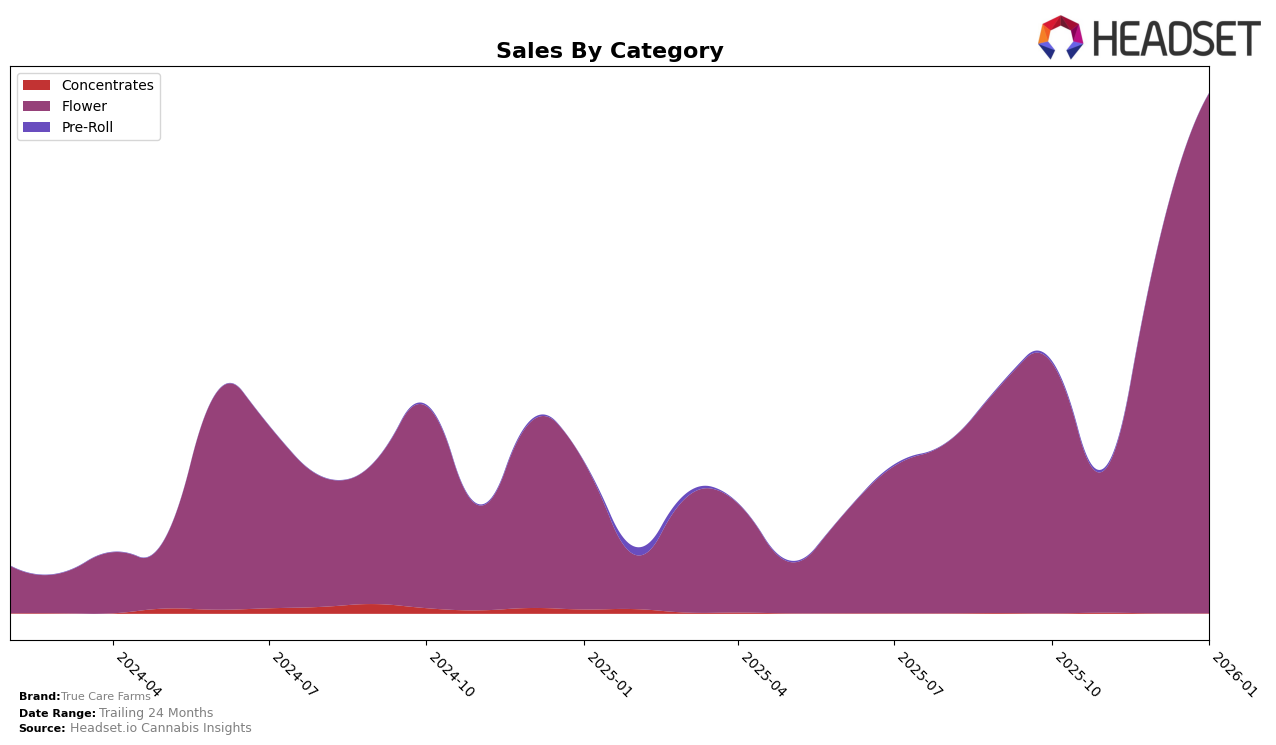

True Care Farms has shown a notable trajectory in the Flower category in Oregon. Starting from the 58th position in October 2025, the brand experienced a dip in November, falling to the 86th rank. However, the subsequent months demonstrated a significant rebound, with True Care Farms climbing to the 40th position in December and further improving to the 25th rank by January 2026. This upward movement indicates a strong market presence and growing consumer preference in Oregon. The brand's sales numbers also reflect this positive trend, with a substantial increase in January 2026 compared to previous months.

While True Care Farms has not consistently ranked within the top 30 brands in Oregon's Flower category, its recent performance suggests a potential for sustained growth. The absence from the top 30 in earlier months could have been a concern, but the marked improvement in rankings and sales indicates strategic adjustments that have resonated well with consumers. This performance in Oregon could serve as a model for expansion or improvement in other states or provinces where the brand might be operating. Observers and stakeholders will likely be keen to see if True Care Farms can maintain or even enhance this momentum in the coming months.

```Competitive Landscape

In the competitive landscape of the Oregon flower market, True Care Farms has demonstrated a remarkable upward trajectory from October 2025 to January 2026. Initially ranked at 58th place in October, True Care Farms made significant strides to reach 25th by January, indicating a strong recovery and growth in market presence. This improvement is particularly notable when compared to competitors like Oregon Roots, which saw a decline from 9th to 23rd place, and William's Wonder Farms, which also fell out of the top 20 by January. Meanwhile, Gud Gardens maintained a relatively stable position, ending just one rank below True Care Farms in January. This positive shift for True Care Farms suggests effective strategic adjustments and a growing consumer preference, positioning them as a rising contender in the Oregon flower market.

Notable Products

In January 2026, Dirty Little Secret (Bulk) emerged as the top-performing product for True Care Farms, achieving the number one rank with sales of 1077 units. Greasy Runtz (Bulk) maintained its position at rank two from December 2025 to January 2026, showing consistent demand. Creamz (Bulk) entered the rankings at the third position, indicating a strong debut in the new year. Pineapple Milkshake (Bulk) and Power Sherb (28g) followed closely, securing the fourth and fifth positions, respectively. This lineup suggests a stable preference for bulk flower products, with Dirty Little Secret (Bulk) and Greasy Runtz (Bulk) leading the charge in sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.