Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

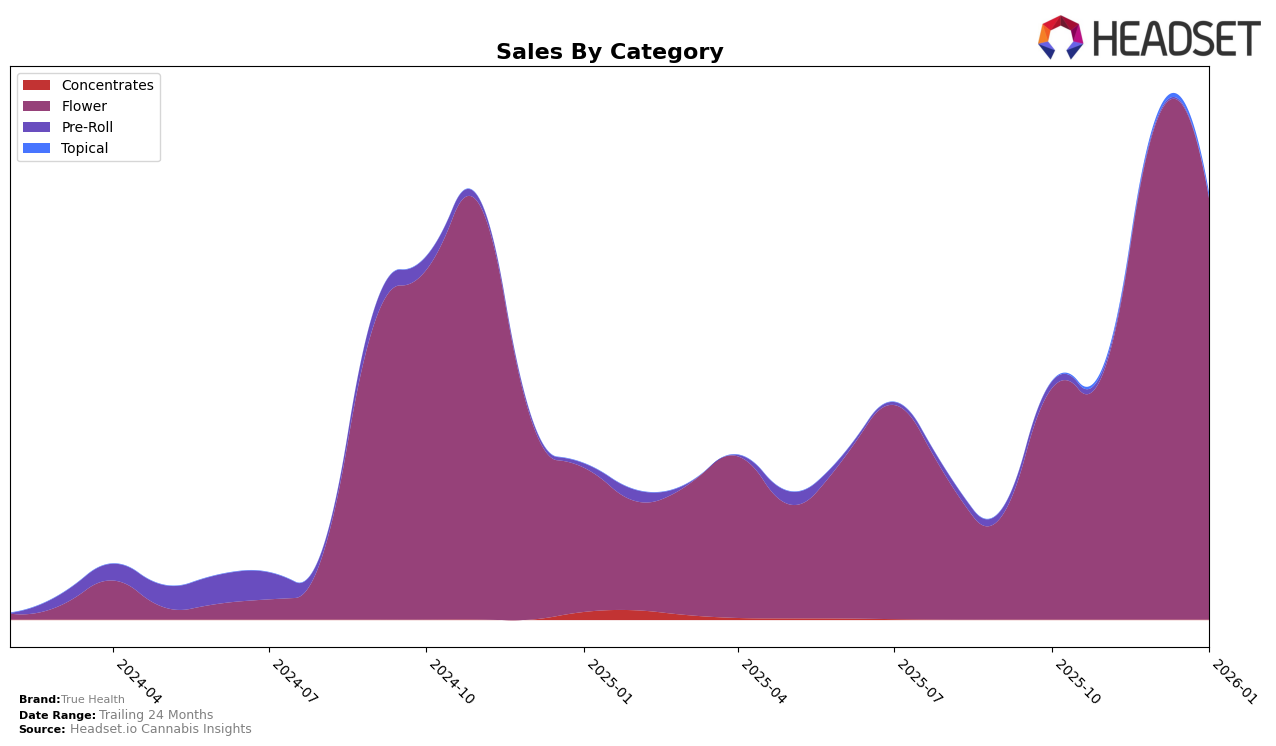

True Health's performance in the Michigan market, particularly in the Flower category, has shown notable fluctuations over the recent months. Despite not being ranked in the top 30 brands in October and November 2025, True Health's presence in the Flower category became evident by December 2025 with a ranking of 66, which slightly declined to 67 in January 2026. This movement suggests a struggle to maintain a strong foothold in the highly competitive Flower segment. The sales figures indicate a decrease from $440,592 in December to $371,637 in January, which may reflect seasonal trends or increased competition.

Across other categories and states, the absence of True Health in the top 30 rankings could be interpreted as a strategic focus or an area for potential growth. The lack of ranking information in other states or categories may highlight opportunities for market expansion or indicate challenges in penetrating those markets. Understanding the dynamics of True Health's performance requires a closer examination of state-specific regulations, consumer preferences, and competitive landscape, which could provide insights into the brand's strategic positioning and potential areas for improvement.

Competitive Landscape

In the competitive landscape of Michigan's flower category, True Health has shown a noteworthy presence, securing the 66th rank in December 2025 and slightly declining to 67th in January 2026. This positioning reflects a competitive environment where brands like Zips consistently maintain higher ranks, fluctuating between 55th and 62nd over the same period. Meanwhile, Cloud Cover (C3) experienced a significant jump in rank from 98th in November 2025 to 39th in December 2025, indicating a potential threat to True Health's market share. Additionally, Pleasantrees emerged in January 2026 at the 58th position, suggesting increased competition. Despite these dynamics, True Health's sales figures in December 2025 were competitive, although slightly lower than Zips, indicating room for growth and the necessity for strategic adjustments to improve its market position.

Notable Products

In January 2026, the top-performing product for True Health was Caps Frozen Lemon (28g) in the Flower category, which climbed to the number one spot with sales reaching 5052 units. This product showed a significant improvement from its third-place ranking in December 2025. P41 (Bulk) and Sweet Sorbet (Bulk), both in the Flower category, tied for the second position, with P41 (Bulk) previously holding the top rank in December 2025. Love Letters (Bulk) emerged in the rankings for the first time in January, securing third place, while Pink Runtz (Bulk) made its debut at fourth place. The overall rankings indicate a dynamic shift in preference towards Caps Frozen Lemon, reflecting its growing popularity among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.