Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

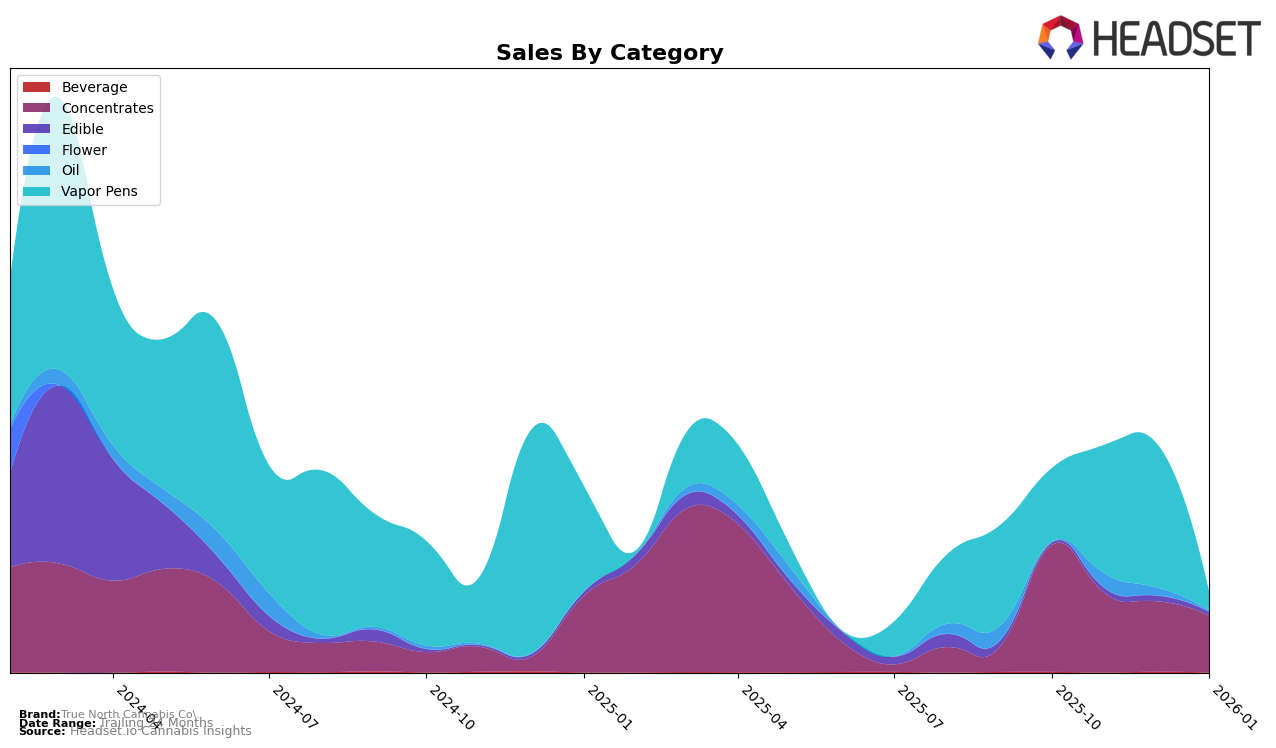

True North Cannabis Co. has demonstrated varied performance across different categories and regions, particularly in Saskatchewan. In the concentrates category, the brand secured the 13th position in October 2025, showcasing a strong presence in this segment. However, it did not maintain a top 30 rank in the subsequent months through January 2026, indicating a potential decline or increased competition in the market. This fluctuation could suggest either a shift in consumer preferences or increased competition within the concentrates category, warranting further investigation into market dynamics or product offerings.

In the vapor pens category, True North Cannabis Co. did not appear in the top 30 rankings for October through December 2025 in Saskatchewan, but made a notable entry at the 31st position in January 2026. This upward movement suggests an improvement in market strategy or product acceptance, hinting at a potential upward trajectory if the trend continues. The absence from the top 30 in previous months highlights a challenge in gaining traction in this competitive category, yet the recent entry into the rankings could mark the beginning of a positive trend for the brand in the vapor pens market.

Competitive Landscape

In the competitive landscape of the concentrates category in Saskatchewan, True North Cannabis Co. experienced a notable shift in its market position. In October 2025, True North Cannabis Co. was ranked 13th, but it did not maintain a top 20 position in the subsequent months, indicating a decline in its competitive standing. This contrasts sharply with Endgame, which consistently held the top rank in October and November before slipping to second place in December. Meanwhile, Phant demonstrated volatility, peaking at 6th in November but dropping to 15th by January 2026. Phyto Extractions and Solid Gold both appeared in the rankings intermittently, with Phyto Extractions entering the top 20 in January 2026 at 14th place. These dynamics suggest that while True North Cannabis Co. initially held a competitive edge, it faces significant challenges from both established leaders like Endgame and emerging competitors, highlighting the need for strategic adjustments to regain market traction.

Notable Products

In January 2026, the top-performing product for True North Cannabis Co. was Blue Zlushie Shatter (1g) from the Concentrates category, maintaining its number one rank from November 2025 with sales of 164.0 units. The CBD/THC 1:1 Motown Mango Gummies 5-Pack from the Edible category climbed to the second position, improving from the fifth spot in December 2025. Citrus Nano Shot (100mg THC, 50ml) in the Beverage category held steady at the third position, despite a drop in sales from the previous month. Animal Gas Live Nug Run Sauce (1g) made its debut in the rankings at fourth place, indicating a strong entry into the market. Mac Flurry Live Sugar Sauce Disposable (1g) from the Vapor Pens category slipped to fifth place, down from its third position in November 2025, reflecting a decline in consumer interest.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.