Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

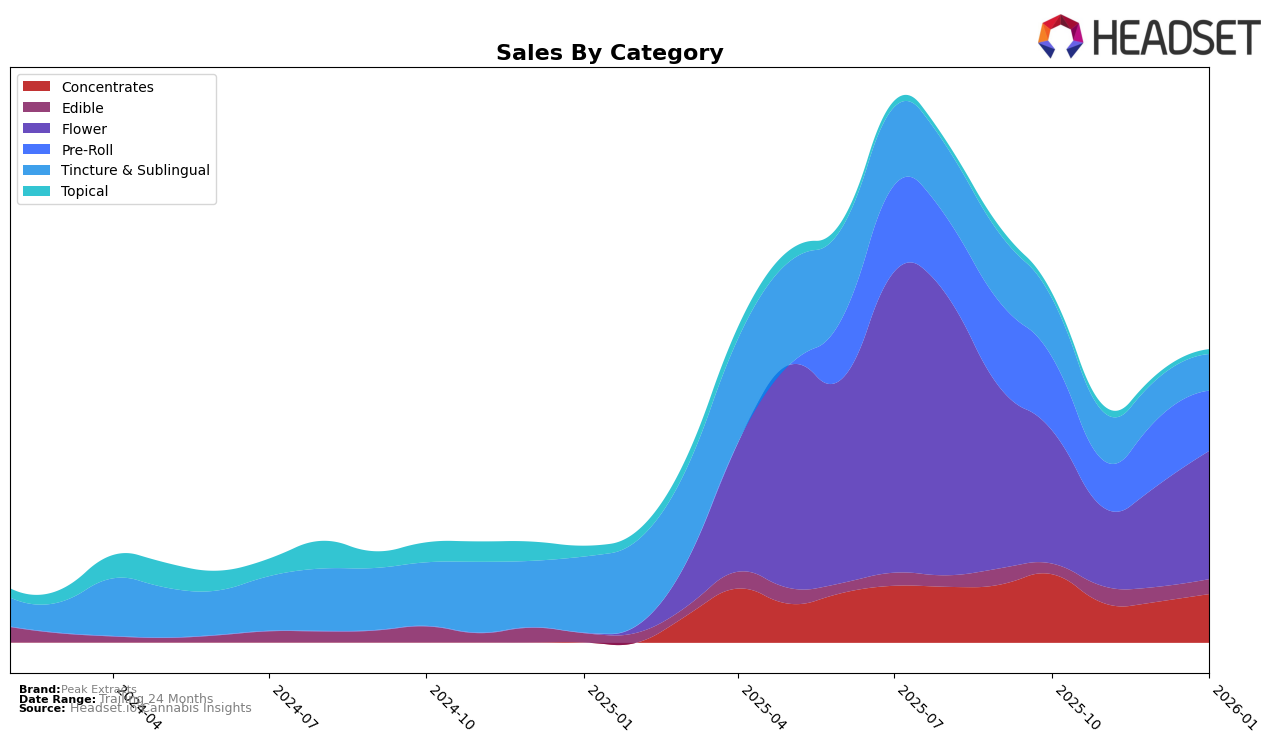

Peak Extracts has shown varied performance across different states and categories, reflecting both challenges and opportunities in the cannabis market. In the Michigan concentrates category, the brand was notably absent from the top 30 rankings in October 2025, November 2025, and December 2025, only reappearing in January 2026 with a rank of 93. This reentry into the rankings suggests a potential recovery or strategic shift that may have helped regain some market presence. In contrast, their performance in the Missouri flower category has been more stable, maintaining a consistent presence around the 60th rank from October 2025 to January 2026, indicating a steady demand for their products in this category.

The brand's performance in the Oregon tincture and sublingual category has seen a gradual decline in rankings from 7th in October 2025 to 11th by January 2026. This downward trend could be attributed to increased competition or shifting consumer preferences within this category. Meanwhile, in Missouri's pre-roll category, Peak Extracts has experienced minor fluctuations in rankings, moving from 64th in October 2025 to 65th in January 2026, after a brief dip in November 2025. This suggests a relatively stable position, albeit outside the top tiers, which could offer room for growth if the brand can capitalize on market trends or introduce innovative products.

Competitive Landscape

In the Missouri flower category, Peak Extracts has shown a relatively stable performance from October 2025 to January 2026, maintaining a rank around 60, with a slight dip in November. This stability is notable given the fluctuating ranks of competitors such as Monopoly Melts, which consistently outperformed Peak Extracts, holding a higher rank in the low 50s. Meanwhile, Flower by Edie Parker and Lush Labs have shown more volatility, with Flower by Edie Parker missing the top 20 in November and January, and Lush Labs experiencing a significant rank improvement by January. Despite these fluctuations, Peak Extracts' sales have shown a positive trend, particularly in January, suggesting resilience and potential for growth amidst competitive pressures. The brand's ability to maintain its position while others experience rank volatility indicates a steady consumer base and effective market strategies in Missouri's flower segment.

Notable Products

In January 2026, Sunrize Social (3.5g) from Peak Extracts led the sales rankings, climbing from fourth place in December 2025 to secure the top spot with notable sales of 444 units. Wise Guy (3.5g) maintained its consistent performance, holding steady at second place for the second consecutive month. The Mini Dark Chocolate Bar (100mg), which had been the top seller in previous months, dropped to third place. The CBN/CBD/THC 4:2:1 TRUCBN Tincture made an impressive entry into the rankings at fourth place. Buff Cherry (3.5g) re-entered the top five, maintaining its fifth position from earlier months despite a hiatus in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.