Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

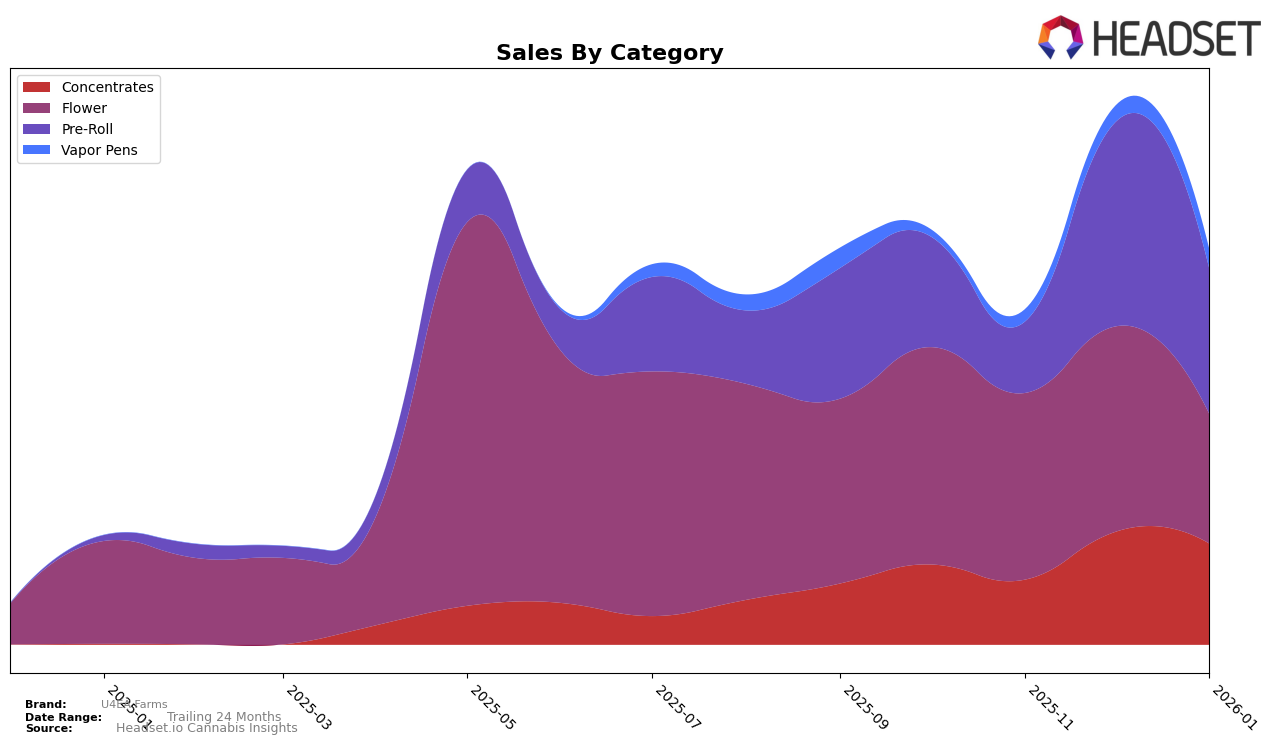

U4EA Farms has shown a notable upward trajectory in the Concentrates category within Massachusetts. Starting from an unranked position in October 2025, the brand climbed to the 30th spot by January 2026. This improvement suggests a strengthening market presence and possibly effective strategies in product placement or consumer engagement. The sales figures support this trend, with a significant increase from November to December, despite a slight dip in January. Such movements indicate that U4EA Farms is successfully capturing consumer interest and expanding its footprint in the Massachusetts concentrates market.

Despite the positive momentum in Massachusetts, U4EA Farms' absence from the top 30 rankings in other states or categories could be seen as a missed opportunity or an area for growth. The lack of presence in these rankings suggests that the brand may need to explore more aggressive strategies or innovations to penetrate other markets effectively. Analyzing the factors contributing to their success in Massachusetts could provide valuable insights for replicating this success in other regions. Understanding these dynamics can offer a roadmap for U4EA Farms to enhance its competitive edge across various states and categories.

Competitive Landscape

In the Massachusetts concentrates market, U4EA Farms has shown a notable upward trend in its rankings over the past few months, moving from a position outside the top 40 in October 2025 to securing the 30th spot by January 2026. This positive trajectory suggests an effective strategy in capturing market share, especially when compared to competitors like Natural Selections, which maintained a relatively stable position in the mid-20s, and DRiP (MA), which fluctuated slightly but remained consistently ahead. Meanwhile, MPX - Melting Point Extracts experienced a decline, dropping from 32nd to 38th, indicating potential challenges in maintaining their market position. U4EA Farms' sales growth, particularly the substantial increase from November to December 2025, highlights its strengthening presence and suggests that it is effectively capitalizing on market opportunities, setting a promising stage for continued advancement in the competitive landscape.

Notable Products

In January 2026, the top-performing product for U4EA Farms was Where's My Bike Pre-Roll (1g) in the Pre-Roll category, which climbed to the first rank with sales of 784 units. This product has shown a significant improvement from its fifth rank in December 2025. Where's My Bike (3.5g) in the Flower category also performed well, securing the second position, up from being unranked in December. Permanent Marker Pre-Roll (1g) maintained a steady position in the third rank, consistent with its performance in previous months. Moon Pie Bubble Hash Infused Pre-Roll (1g) entered the rankings at fourth, while Cherry Whip Pre-Roll (1g) dropped to fifth from second in December 2025.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.