Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

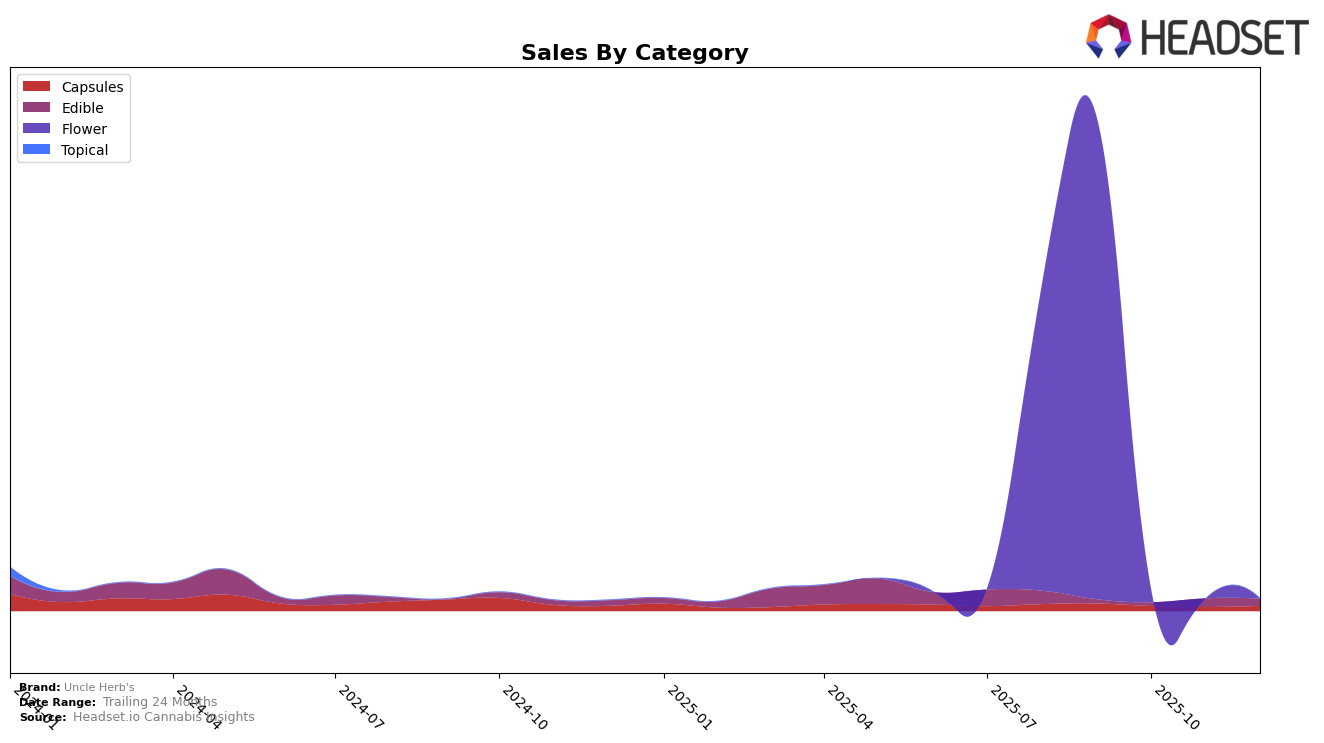

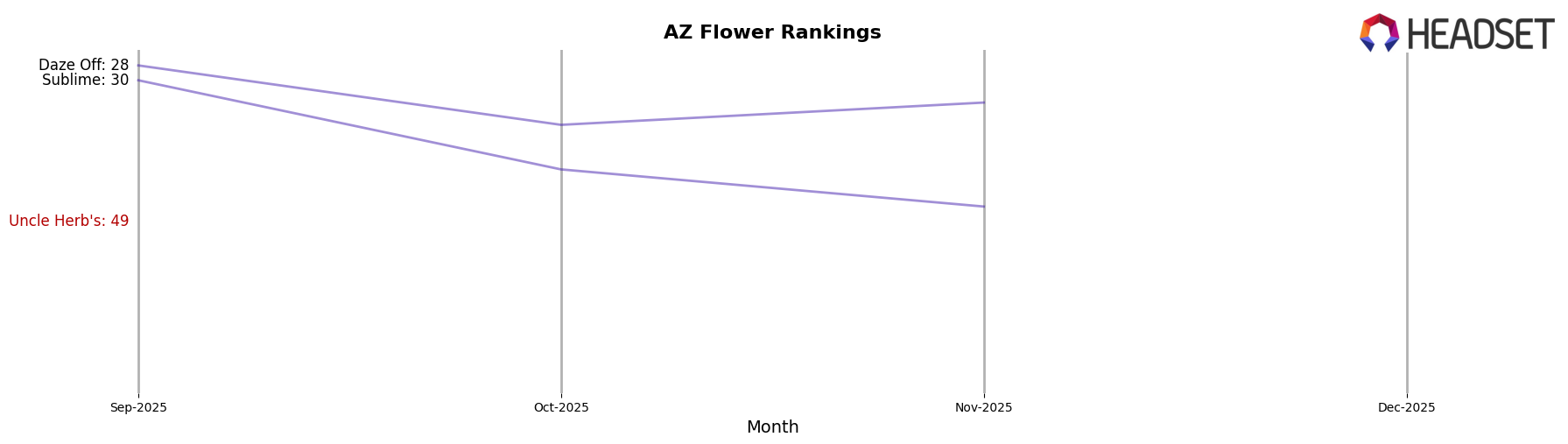

Uncle Herb's has shown a varied performance across different states and product categories. In Arizona, the brand's presence in the Flower category is notable, although it did not make it into the top 30 rankings from October to December 2025. This absence suggests a challenging market environment or increased competition in the state, which might have impacted its visibility and sales in that category. Despite not being in the top 30, Uncle Herb's initial rank of 49 in September 2025 indicates a potential for growth if strategic adjustments are made.

Examining broader trends, the fluctuating presence of Uncle Herb's in the rankings highlights the dynamic nature of the cannabis market. The brand's performance in Arizona could be seen as a reflection of the competitive pressures and evolving consumer preferences within the Flower category. While specific sales figures for the latter months are not provided, the initial sales figure from September 2025 offers a benchmark for evaluating future growth or decline. Understanding these movements can provide valuable insights into how Uncle Herb's might strategize to improve its market position in the coming months.

Competitive Landscape

In the competitive landscape of the Flower category in Arizona, Uncle Herb's has faced significant challenges in maintaining its market position. As of the latest data, Uncle Herb's was not ranked in the top 20 brands from September to December 2025, indicating a struggle to capture market share compared to its competitors. Brands like Daze Off and Sublime have consistently maintained higher sales and rankings, with Daze Off ranking 28th in September and 33rd in November, while Sublime, despite a downward trend, still managed to stay within the top 50. This suggests that Uncle Herb's needs to strategize effectively to improve its visibility and sales performance in a competitive market where even Easy Tiger made an appearance in October, albeit at a lower rank. The absence of Uncle Herb's in the top rankings highlights the need for a robust marketing strategy to enhance brand recognition and consumer engagement in Arizona's Flower market.

Notable Products

In December 2025, Uncle Herb's top-performing product was the Bigfoot Dark Chocolate Bar 10-Pack (100mg) in the Edible category, maintaining its number one rank from November, despite a slight decrease in sales to 58 units. The Night Cap Chills Pill 20-Pack (100mg) in Capsules remained steady at the second position, improving from its previous sales figures to 56 units. Chemmy Jones (14g) in the Flower category, which held the top spot in September, was not ranked in December, indicating a significant shift in consumer preference. Notably, Bigfoot Dark Chocolate Bar showed a remarkable jump from third place in September and October to dominate the top spot in the last two months of the year. These changes highlight a growing consumer trend towards edibles over traditional flower products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.