Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

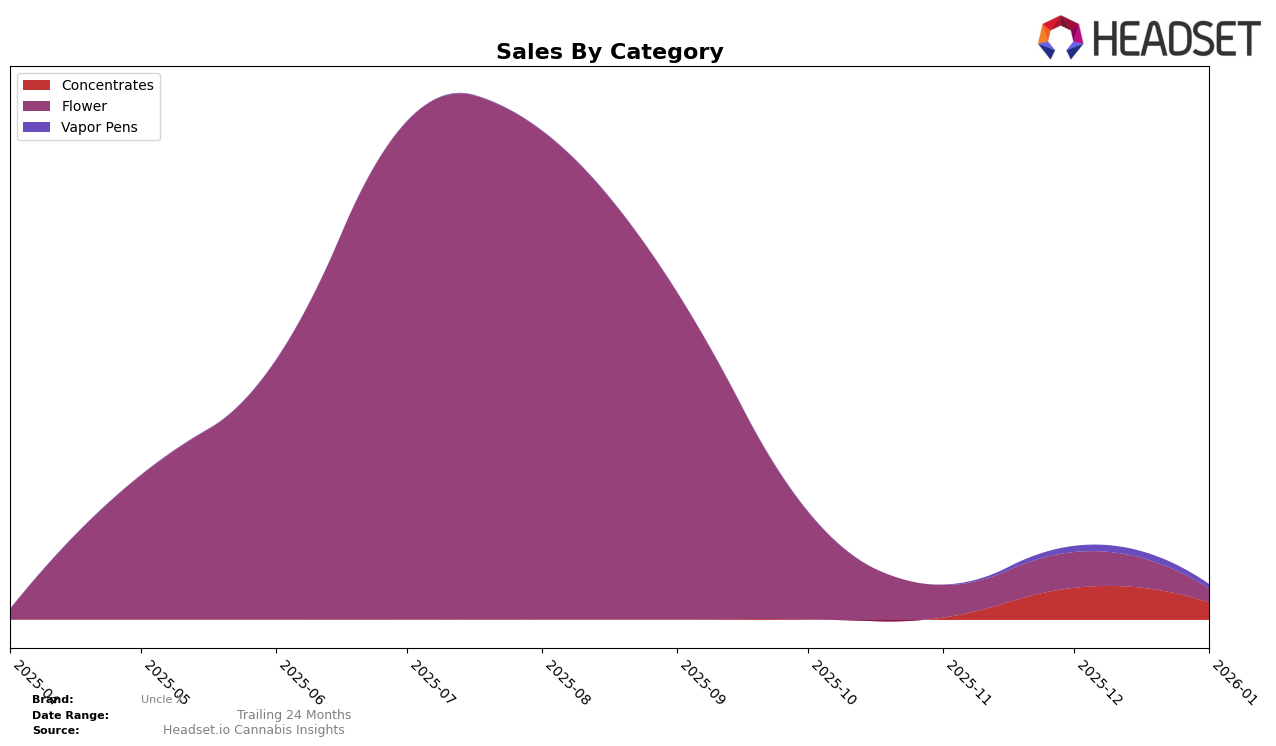

Uncle X has demonstrated a noteworthy presence in the Arizona cannabis market, particularly in the Concentrates category. As of December 2025, Uncle X climbed to the 22nd position, marking its entry into the top 30 brands, and maintained a presence at the 30th position by January 2026. This upward trajectory in Concentrates is indicative of a growing customer base and increased brand recognition in this category. However, the absence of Uncle X from the top 30 brands in earlier months suggests that the brand may have been working to establish its foothold in the market, which it successfully achieved by the end of 2025.

In contrast, Uncle X's performance in the Flower category in Arizona has shown a decline over the same period. Starting at the 33rd position in October 2025, the brand's ranking slipped to 60th by January 2026, indicating challenges in maintaining its competitive edge in this segment. The decrease in sales from October 2025 to January 2026 suggests a need for strategic adjustments to regain momentum. This decline in ranking underscores the competitive nature of the Flower category and highlights the importance of targeted marketing strategies to improve brand visibility and consumer engagement.

Competitive Landscape

In the competitive landscape of the Arizona concentrates market, Uncle X has shown a notable entry and fluctuation in rankings over the past few months. While Uncle X was not in the top 20 brands for October and November 2025, it made a significant leap to rank 22nd in December 2025, before dropping to 30th in January 2026. This suggests a volatile but promising trajectory, potentially driven by strategic marketing or product launches. In comparison, Shango maintained a relatively stable presence, ranking between 13th and 20th before falling out of the top 20 in January 2026, indicating a sharp decline in sales. Meanwhile, Project Packs showed a consistent improvement, peaking at 22nd in November 2025, which could pose a competitive threat to Uncle X if the trend continues. The fluctuating ranks and sales figures highlight the dynamic nature of the concentrates market in Arizona, where brands like Uncle X must continuously innovate and adapt to maintain and improve their market position.

Notable Products

In January 2026, Uncle X's top-performing product was Axilla Badder (1g) in the Concentrates category, achieving the number one rank with sales of 1277 units. Following closely, Strawberry Guava Badder (1g) held the second position, dropping from its previous first-place rank in December 2025, with sales figures at 558 units. Sherbo Sugar (1g) maintained a strong presence in the Concentrates category, moving up to third place from fourth in December 2025. Chem X Papaya (14g) and Gaschata #5 (14g) were the top Flower products, ranking fourth and fifth respectively, indicating a steady performance in the flower category. These shifts in rankings suggest a dynamic market where Concentrates are leading in popularity, while Flower products maintain consistent interest among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.