Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

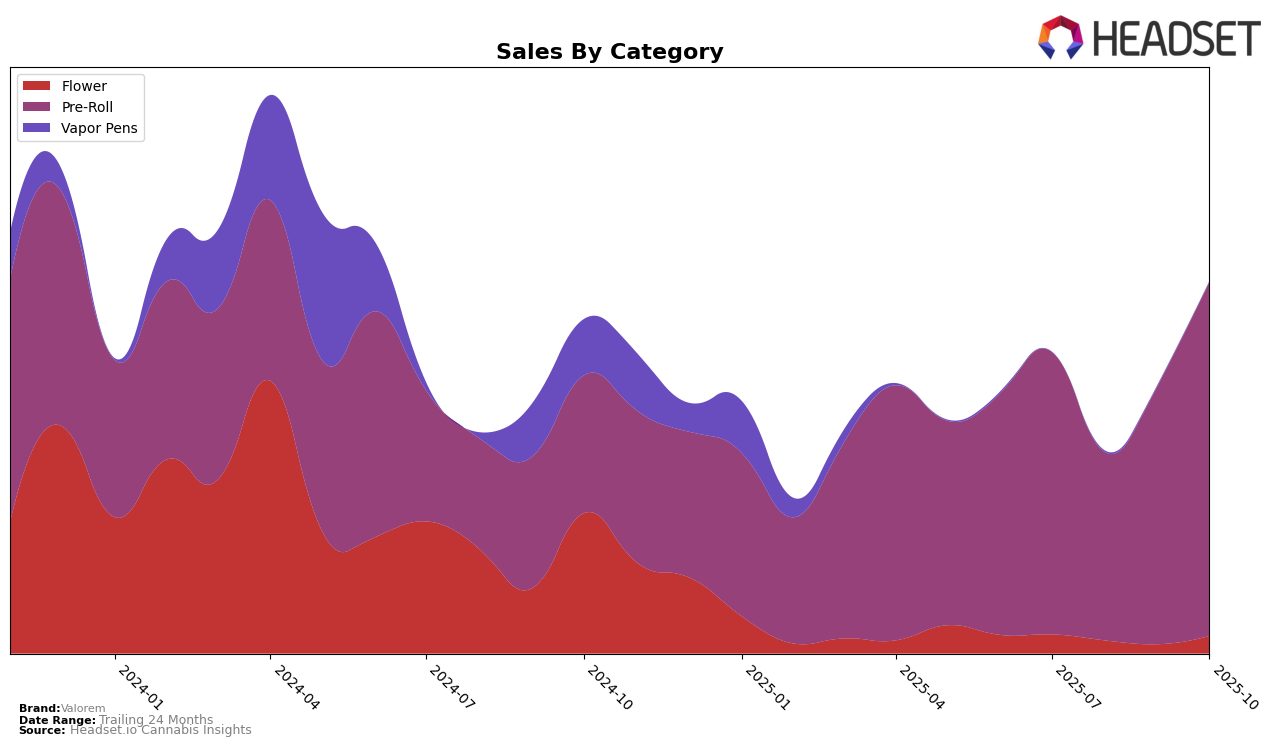

Valorem has shown significant improvement in its performance in the Pre-Roll category in Massachusetts over the past few months. Starting from a rank of 35 in July 2025, the brand was not in the top 30, which could be seen as a challenge for the company. However, by October 2025, Valorem climbed to the 23rd position. This upward trend is indicative of a positive reception of their product offerings or possibly an effective change in their market strategy within the state. The notable increase in their ranking suggests a strengthening presence in the Massachusetts market, which could be a result of increased consumer demand or strategic partnerships.

Despite the progress in Massachusetts, Valorem's journey has not been without its challenges. The brand was absent from the top 30 rankings in August 2025, which might have been a period of difficulty or transition. However, the subsequent recovery and improvement in the rankings by September and October highlight a potential turnaround or successful adaptation to market dynamics. The sales data reflect this resurgence, with October's sales figures showing a substantial rise compared to the previous months. This pattern of growth and adaptation suggests that Valorem is increasingly aligning its offerings with consumer preferences, at least within the Massachusetts Pre-Roll category. For more detailed insights into Valorem's performance across other states and categories, further exploration of available data would be necessary.

Competitive Landscape

In the competitive Massachusetts pre-roll market, Valorem has shown a notable upward trajectory in recent months, moving from a rank of 35 in July 2025 to 23 by October 2025. This improvement is significant, especially when compared to competitors like Dogwalkers, which saw a decline from rank 14 to 24 in the same period. Similarly, Fathom Cannabis and Headliners have experienced fluctuations, with Fathom Cannabis not even making the top 20 in September 2025, and Headliners maintaining a relatively stable position. Valorem's sales have also seen a positive trend, surpassing brands like Native Sun in October 2025, which indicates a growing consumer preference for Valorem's offerings. This upward movement in both rank and sales suggests that Valorem is successfully capturing market share and enhancing its brand presence in Massachusetts.

Notable Products

In October 2025, Valorem's top-performing product was Electric Pineapple Pre-Roll (1g), leading the sales with a notable figure of 6408 units sold. Following closely was Sherbert Honey Pre-Roll (1g) in the second position. Moonbow Pre-Roll (1g) climbed to third place from its previous fourth position in September, showcasing a significant increase in sales. Zweet Inzanity Pre-Roll (1g) maintained its position at fourth place, while Green Crush Pre-Roll (1g) completed the top five. This shift in rankings highlights a dynamic market where consumer preferences are continually evolving.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.