Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

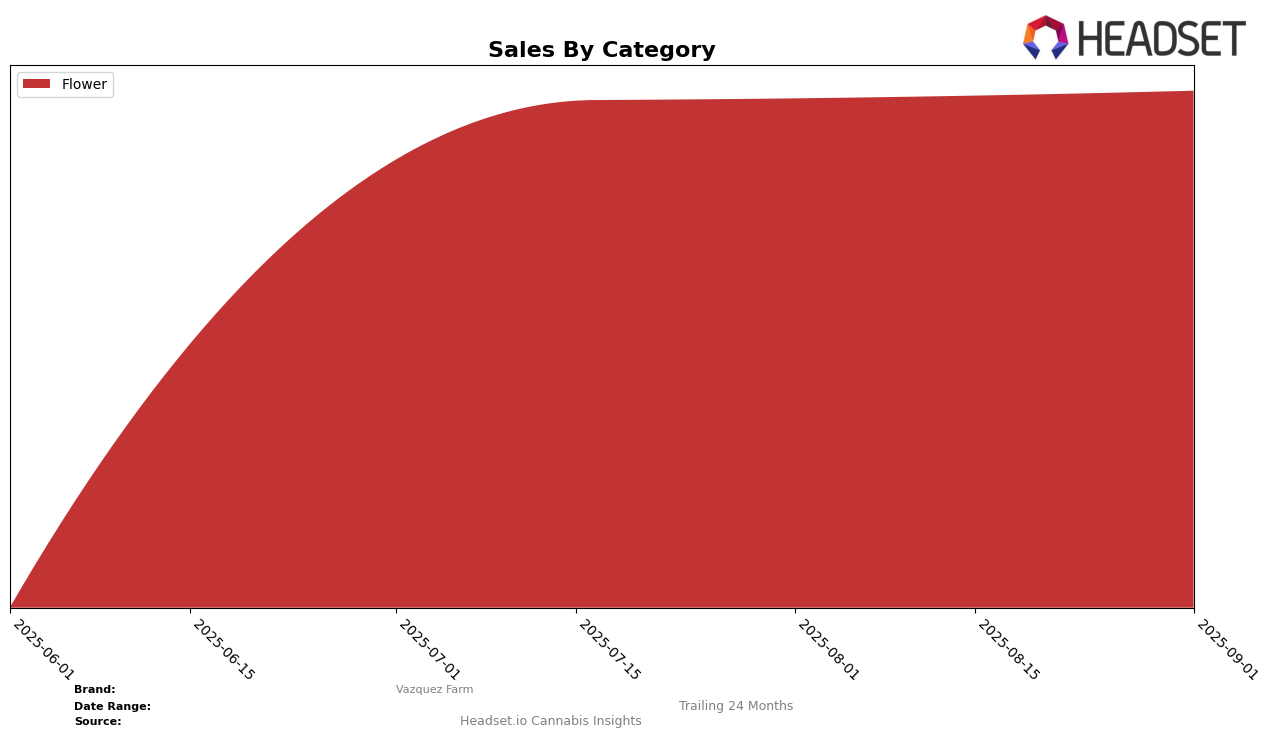

Vazquez Farm has demonstrated a notable upward trajectory in the Colorado cannabis market, particularly in the Flower category. Starting from a position outside the top 30 in June 2025, Vazquez Farm made a significant leap to rank 34th in July, then climbed to 32nd in August, and further improved to 27th by September. This progression is indicative of a strong market penetration and growing consumer recognition within the state. The substantial increase in sales from June to September underscores this positive trend, suggesting that Vazquez Farm is effectively capturing a larger share of the market in Colorado. However, the fact that they were not in the top 30 as recently as June highlights the competitive nature of the market and the brand's relatively recent rise to prominence.

While Vazquez Farm's performance in the Flower category in Colorado is commendable, it is important to note their absence from the top 30 rankings in other states and categories during the same period. This absence suggests that their current market strength is geographically concentrated and may not yet extend to a broader national or multi-category presence. The brand's focused success in Colorado could be a strategic decision, or it might highlight areas for potential growth and expansion. Observing how Vazquez Farm leverages its momentum in Colorado could provide insights into its future strategies and potential market entries in other regions.

Competitive Landscape

In the competitive landscape of the Colorado flower category, Vazquez Farm has shown remarkable progress in its market positioning over recent months. Starting from a rank of 91 in June 2025, Vazquez Farm has climbed steadily to secure the 27th position by September 2025. This upward trajectory is indicative of a significant boost in sales, aligning with a broader trend of increased consumer preference for Vazquez Farm's offerings. In contrast, Nuhi experienced a notable rise from 68th to 29th place, suggesting a parallel increase in market acceptance but still trailing behind Vazquez Farm's momentum. Meanwhile, Boulder Built saw a decline from 11th to 26th, reflecting potential challenges in maintaining its earlier dominance. Fresh Cannabis maintained a consistent position at 25th, indicating stable performance but limited growth. Similarly, The Organic Alternative improved its rank from 44th to 28th, showcasing a positive trend but still not matching the rapid ascent of Vazquez Farm. These dynamics highlight Vazquez Farm's growing influence and competitive edge in the Colorado flower market.

Notable Products

In September 2025, Cuban Empanada (Bulk) emerged as the top-performing product for Vazquez Farm, leading the sales with 2977 units sold. Following closely, Watermelon Wonder (Bulk) secured the second position with significant sales figures, while Black Mamba (Bulk) ranked third. Ben & Gary's Shake (Bulk) witnessed a slight decline, dropping from third place in July to fourth place in September. Do Si Do (Bulk) entered the top five rankings for the first time, indicating a positive shift in consumer preference. Overall, September saw a reshuffling of rankings, highlighting the dynamic nature of product popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.