Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

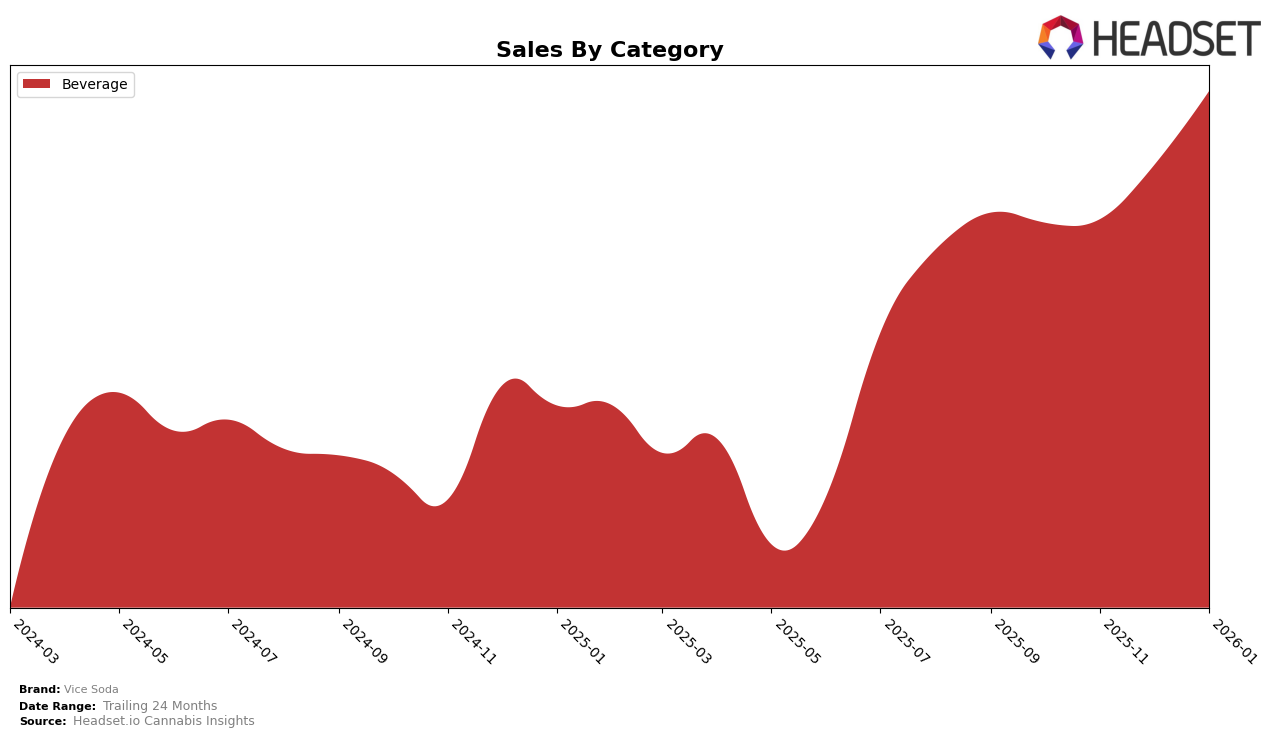

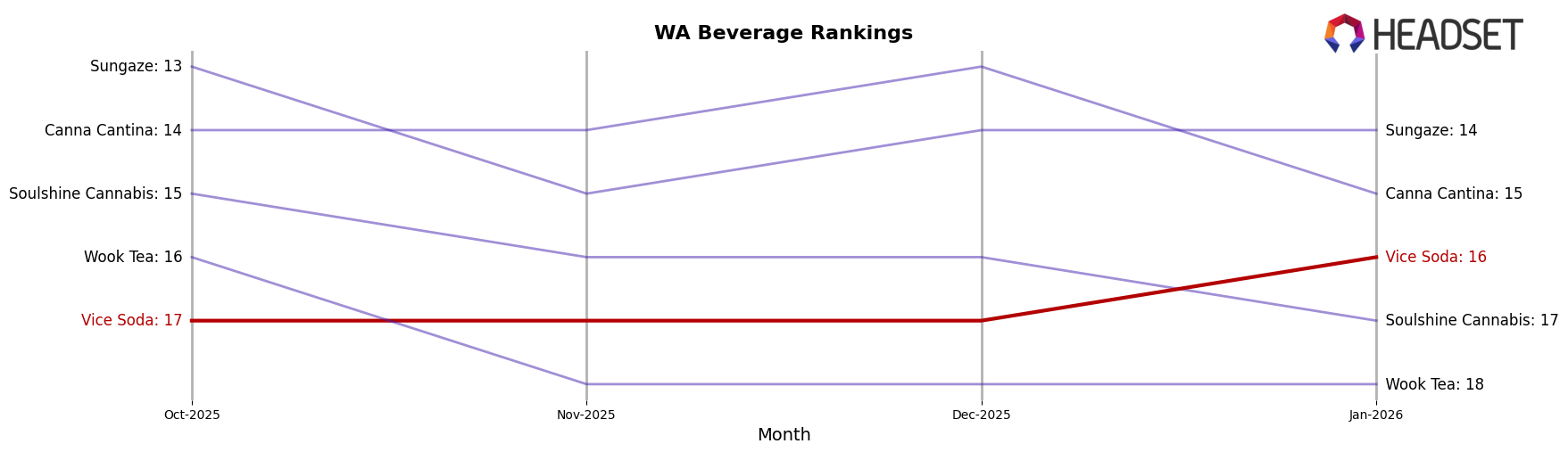

Vice Soda has shown a consistent presence in the beverage category within Washington, maintaining a steady rank of 17th for the last three months of 2025 and improving slightly to 16th in January 2026. This upward movement suggests a positive trajectory in the competitive beverage market. The brand's sales have demonstrated a noteworthy upward trend, with a significant increase from October 2025 to January 2026, indicating growing consumer interest and market penetration. This steady climb in rankings and sales is a positive indicator of the brand's potential for further growth.

However, it's important to note that Vice Soda's absence from the top 30 rankings in other states or provinces could suggest challenges in expanding its market presence beyond Washington. This limitation might be due to various factors such as regional preferences or distribution challenges. The brand's consistent performance in Washington could serve as a foundation for strategic expansion efforts into other markets, but the current data highlights the need for targeted efforts to replicate this success elsewhere. Further analysis would be required to understand the specific barriers and opportunities in other regions.

Competitive Landscape

In the competitive landscape of the beverage category in Washington, Vice Soda has shown a promising upward trend in its rankings and sales. Starting from October 2025, Vice Soda was ranked 17th, maintaining this position through December 2025, before climbing to 16th in January 2026. This improvement in rank is accompanied by a steady increase in sales, culminating in a significant rise by January 2026. In contrast, Soulshine Cannabis experienced a slight decline in rank, dropping from 15th to 17th, while Sungaze maintained a relatively stable position around the 14th and 15th ranks, with consistently higher sales than Vice Soda. Meanwhile, Canna Cantina showed some volatility, peaking at 13th in December 2025 before dropping to 15th in January 2026. Wook Tea also saw a decline in sales and rank, falling from 16th to 18th by January 2026. These dynamics suggest that Vice Soda is gaining traction and could potentially climb higher if current trends continue, despite facing strong competition from brands like Sungaze and Canna Cantina.

Notable Products

In January 2026, the top-performing product for Vice Soda was the CBD/CBN/THC 20:1:20 Blackberry Cream Soda, maintaining its first-place ranking from December 2025 with a notable sales increase to 561 units. The CBG/THC 1:1 Cherry Cola secured the second position consistently over the past two months, although its sales slightly decreased to 286 units. The CBG/THC 1:1 Grapefruit Soda remained steady at third place, showing a minor recovery in sales compared to December. Starfruit Soda dropped from third to fourth place, while the CBG/THC 1:1 Peach Ice Tea held its fifth-place ranking, experiencing a significant increase in sales since November. Overall, January saw a consistent ranking with slight sales fluctuations among the top products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.