Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

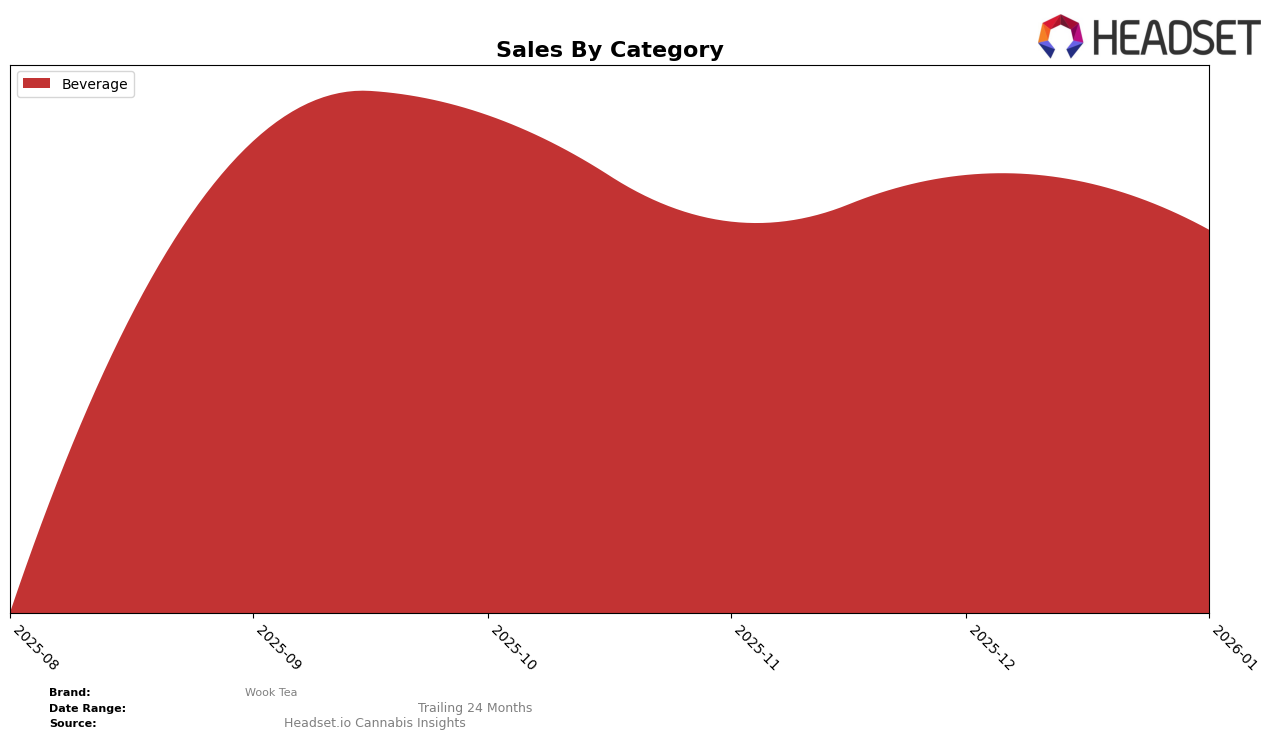

Wook Tea, a brand operating within the Beverage category, has shown varying performance across different states. In Washington, Wook Tea maintained a consistent presence in the rankings, holding steady at 18th place from November 2025 through January 2026 after initially being ranked 16th in October 2025. This indicates a degree of stability in the Washington market, although there is a slight downward trend from their October ranking. The brand's sales in Washington reflected a similar pattern, with a noticeable dip from October to November, followed by a modest recovery in December, and a subsequent decline in January. This fluctuation suggests that while Wook Tea remains a recognized name, there may be challenges in sustaining sales momentum in the Washington market.

In other states, Wook Tea's performance is less prominent, as it did not rank within the top 30 brands in the Beverage category. This absence from the top rankings can be viewed as a potential area for growth or a signal of competitive challenges. The lack of presence in these other markets suggests that Wook Tea may need to explore strategic initiatives to enhance its visibility and sales outside of Washington. The brand's consistent ranking in Washington, however, provides a foundation that could be leveraged for expansion efforts. Understanding the dynamics of these other markets and identifying successful strategies from Washington could be key to improving Wook Tea's overall market footprint.

Competitive Landscape

In the competitive landscape of the beverage category in Washington, Wook Tea has experienced notable fluctuations in its market position over the past few months. Starting from October 2025, Wook Tea was ranked 16th but saw a decline to 18th in November and maintained this position through January 2026. This dip in rank is particularly significant when compared to competitors like Soulshine Cannabis, which consistently held a higher rank, moving from 15th to 17th, and Vice Soda, which improved its rank from 17th to 16th by January 2026. Despite these challenges, Wook Tea's sales trajectory showed some resilience with a peak in December, although it did not translate into a higher rank. Meanwhile, Swell Edibles and HiKu remained in the lower tier, with HiKu dropping out of the top 20 entirely in November and December. These dynamics suggest that while Wook Tea faces stiff competition, particularly from brands like Vice Soda, there is potential for strategic adjustments to regain a stronger foothold in the market.

Notable Products

In January 2026, the top-performing product from Wook Tea was the Raspberry Hibiscus Iced Tea (100mg THC, 12oz), maintaining its first-place rank consistently from October 2025, with sales reaching 439 units. The Peach Ice Tea (100mg THC, 12oz, 355ml) held steady in the second position, showing a slight decline from its peak in previous months. Larry Palmer Ice Tea (100mg THC, 12oz) remained in third place, albeit with a decrease in sales compared to the previous months. Blackberry Lemonade Ice Tea (100mg THC, 12oz, 355ml) experienced a drop to fourth place, reflecting fluctuating sales figures. The CBD/THC 1:1 Larry Palmer Wook Tea Yerba Mate Rosin Infused 10-Pack (150mg CBD, 100mg THC) maintained its fifth position, with sales figures showing a slight increase from December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.