Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

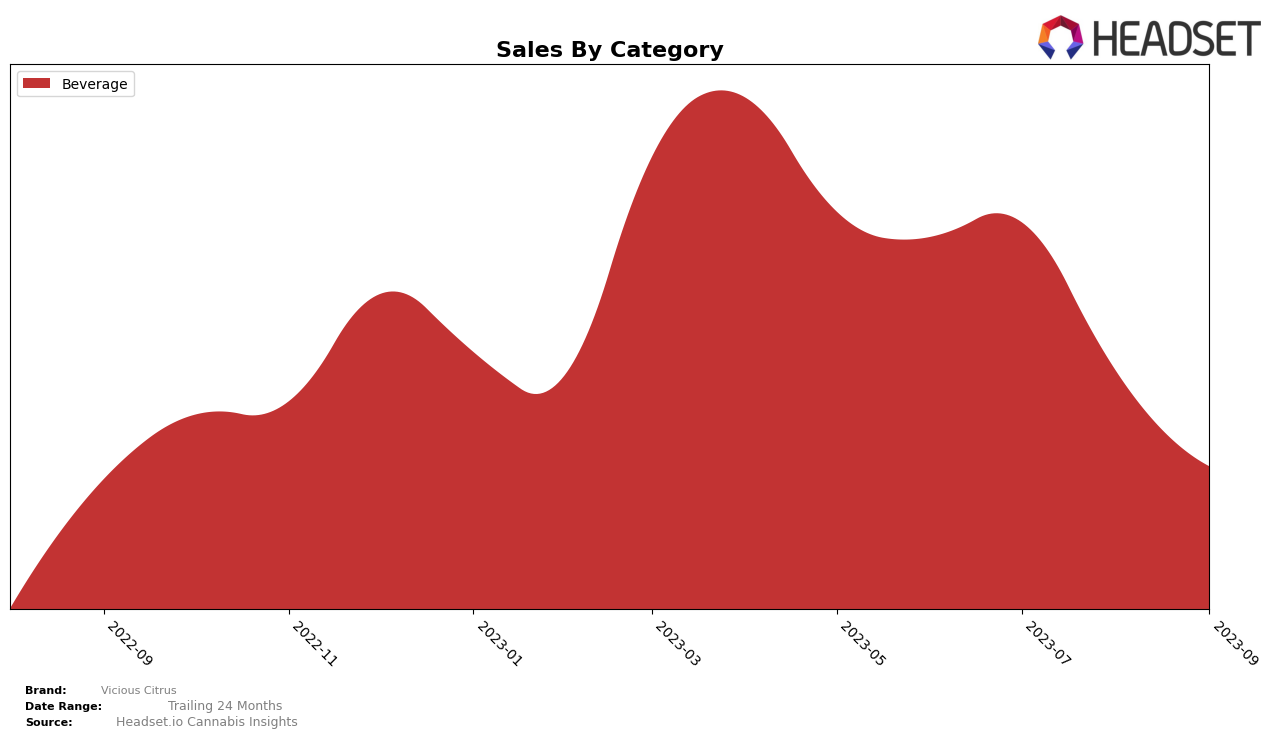

Starting off with Alberta, the Vicious Citrus brand appears to have experienced some fluctuations in the Beverage category. In August 2023, the brand held a respectable 15th place, but this was a slight drop from its 13th place ranking in both June and July. Unfortunately, the brand's ranking dipped further to 20th place in September. This downward trend in ranking, which suggests an increase in competition or a decrease in popularity, coincides with a drop in sales figures for the same period. It's worth noting that Vicious Citrus still managed to stay within the top 20 brands for the category, indicating its resilience in a competitive market.

Moving over to Ontario, the performance of Vicious Citrus in the Beverage category shows a different story. The brand's ranking hovered around the 30th spot from June to August 2023, and slightly worsened in September, moving to the 32nd spot. The absence of the brand from the top 20 list during these months indicates a need for growth or improvement in this particular market. Interestingly, despite the lower rankings, sales did not drastically plummet but instead showed a gradual decrease over the four-month period. This could suggest that while Vicious Citrus may not be a leading brand in Ontario's Beverage category, it maintains a consistent consumer base.

Competitive Landscape

In the Beverage category within Ontario, Vicious Citrus has seen a slight decrease in rank from June to September 2023, moving from 29th to 32nd place. This indicates a drop in sales, although it remains a strong competitor within the top 40 brands. Comparatively, Summit has seen a consistent increase in rank, indicating a potential rise in popularity and sales. However, House of Terpenes and Impromptu have seen their ranks fluctuate over the same period, suggesting inconsistent sales. HYTN, another competitor, has also seen a slight increase in rank, indicating a potential threat to Vicious Citrus. The data suggests a highly competitive market with shifting consumer preferences, impacting Vicious Citrus's rank and sales.

Notable Products

In September 2023, Vicious Citrus saw the CBN:THC 1:1 Honey Neo Lemonade Beverage (10mg CBN, 10mg THC, 350ml) retain its position as the top-selling product, with a total of 1605 units sold. This product has consistently outperformed others, maintaining the top position since August 2023. The second highest selling product was the CBN/THC 1:5 Lemonade (2mg CBN, 10mg THC, 350ml), which also held its rank from the previous month. The CBN:THC OG Slim Lemonade (2mg CBN, 5mg THC) continued to rank third in sales. It's notable that while the rankings remained consistent, there was a significant drop in sales figures for all products compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.