Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

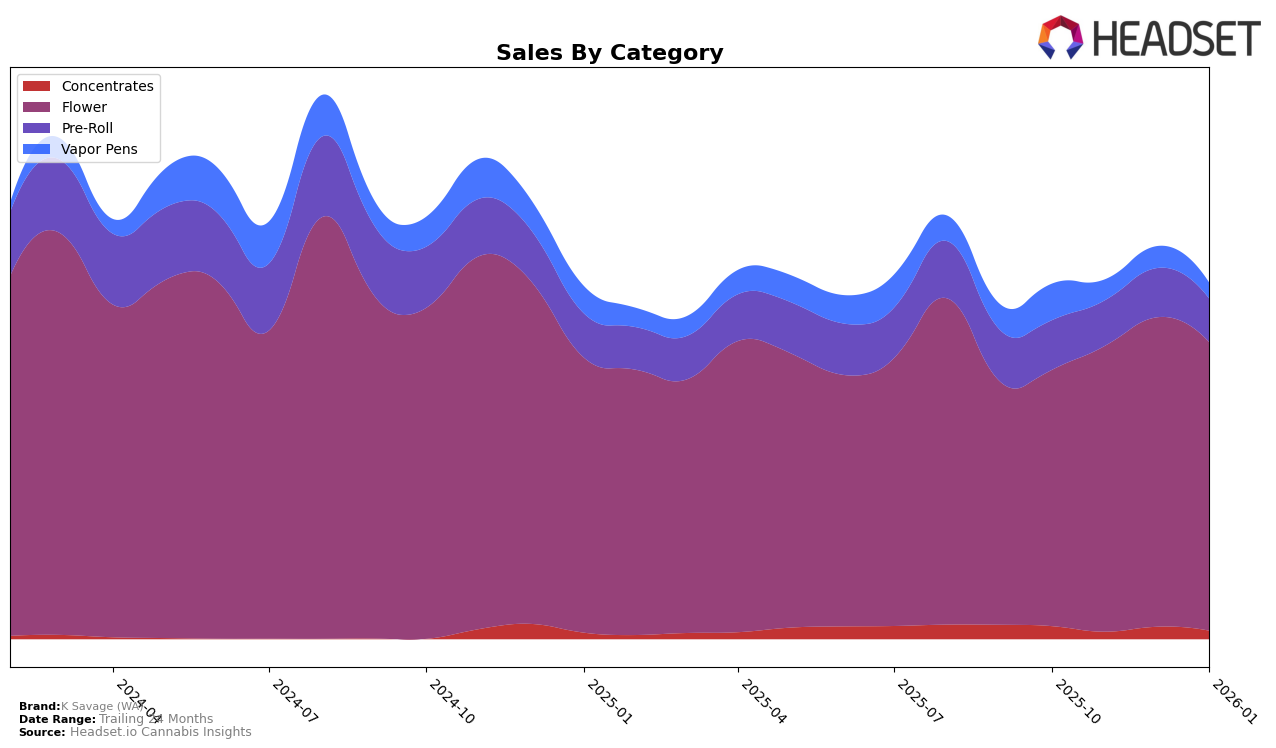

K Savage (WA) has demonstrated notable performance in the Washington market, particularly within the Flower category. Over the four-month period from October 2025 to January 2026, the brand consistently improved its ranking, moving from 15th to 12th place, indicating a positive trend in consumer preference. Sales figures reflect this upward trajectory, with a significant increase from $378,372 in October to $425,940 by January. This consistent improvement in ranking and sales highlights the brand's growing influence and market share within the Flower category in Washington.

In contrast, K Savage (WA)'s performance in other categories such as Concentrates and Pre-Rolls has been less consistent. The brand did not make it into the top 30 for Concentrates and Pre-Rolls, maintaining a rank of 92 in Concentrates and hovering around the mid-50s in Pre-Rolls. This suggests a challenge in gaining traction in these categories compared to their success with Flower. The absence of rankings in the top 30 for Concentrates in November and January further underscores the brand's struggle to capture a significant market share in this segment. Meanwhile, Vapor Pens saw a brief appearance in the rankings but did not sustain a position in the top 30 beyond October 2025, indicating potential areas for growth and strategic focus.

Competitive Landscape

In the competitive landscape of the Washington flower category, K Savage (WA) has shown a notable upward trajectory in rank and sales over the past few months. Starting from a rank of 15 in October 2025, K Savage (WA) improved to 11 by December 2025, before slightly declining to 12 in January 2026. This positive trend in rank is mirrored by a consistent increase in sales, peaking in December. Comparatively, Fifty Fold maintained a higher rank, fluctuating between 6 and 10, indicating strong competition. Meanwhile, Fire Bros. and Momma Chan Farms have experienced more variability in their rankings, with Fire Bros. dropping to 12 in December and Momma Chan Farms falling to 13 in January. Notably, Thunder Chief Farms has been climbing steadily, reaching 14 by January 2026. These dynamics suggest that while K Savage (WA) is gaining ground, it faces stiff competition from brands like Fifty Fold and the rising Thunder Chief Farms, highlighting the need for strategic positioning and marketing efforts to sustain and enhance its market presence.

Notable Products

In January 2026, K Savage (WA) saw Lilac Wine (3.5g) maintain its top position in the Flower category, consistent with its ranking from December 2025, despite a slight decrease in sales to 2080. Angela Pre-Roll 2-Pack (1g) held steady at second place in the Pre-Roll category, although its sales showed a decline from the previous month. Lilac Wine Pre-Roll 2-Pack (1g) improved its ranking to third place in January, up from fourth in December, indicating a resurgence in popularity. Angela (3.5g) experienced a drop in its ranking to fourth place in the Flower category, down from third in December. GMO Pre-Roll 2-Pack (1g) remained stable in fifth place, reflecting consistent performance over the past four months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.