Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

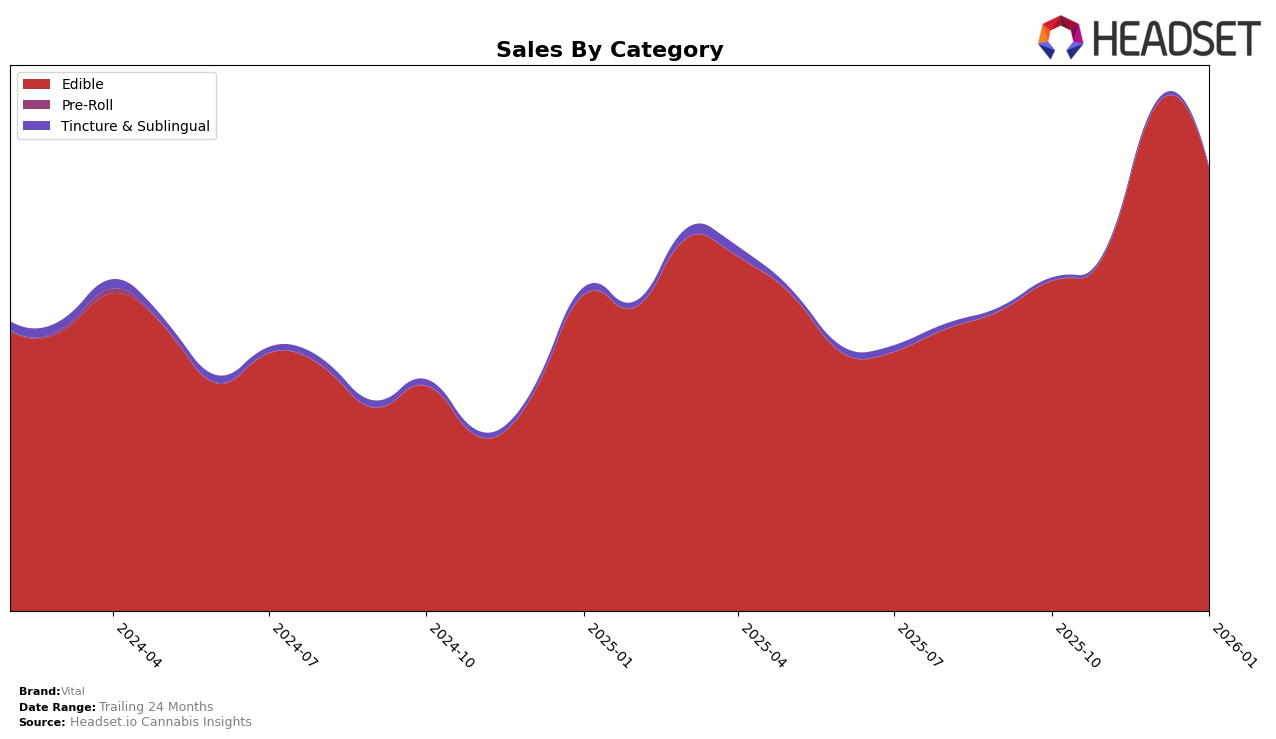

Vital has shown a notable presence in the Edible category within Arizona. Over the span from October 2025 to January 2026, Vital maintained a consistent ranking, initially holding the 11th position in both October and November. A significant improvement was observed in December 2025, where Vital climbed to the 8th position, reflecting a notable increase in sales activity during this period. However, the brand experienced a slight dip in January 2026, moving back to the 10th position. This fluctuation highlights the competitive nature of the Edible market in Arizona and suggests a dynamic consumer response to Vital's offerings.

While Vital's performance in Arizona is commendable, it's important to note that the brand's rankings in other states or provinces are not mentioned, indicating that it may not have been in the top 30 brands in those regions. This absence could be interpreted as a potential area for growth or a reflection of the competitive pressures Vital faces outside Arizona. The brand's ability to sustain and enhance its position in Arizona could serve as a strategic advantage, potentially informing expansion strategies into other markets where its presence is currently less pronounced.

Competitive Landscape

In the competitive landscape of the Edible category in Arizona, Vital has demonstrated notable fluctuations in its rank and sales performance over the four-month period from October 2025 to January 2026. Vital started at the 11th position in October and November, then climbed to 8th in December, before slightly dropping to 10th in January. This upward movement in December coincided with a significant sales boost, surpassing competitors like Pure Edibles and Good Tide, who experienced more stable or declining sales. Meanwhile, Flav maintained a consistent 8th position, indicating a steady market presence, while Jams showed a gradual improvement, closing the gap with Vital by January. Vital's ability to temporarily surpass its competitors in December highlights its potential for strategic growth, although maintaining a consistent upward trajectory remains a challenge amidst fluctuating market dynamics.

Notable Products

In January 2026, the top-performing product for Vital was Tropical Mango RSO Gummies 10-Pack (100mg) in the Edible category, maintaining its consistent rank of 1 since October 2025 with sales reaching 5471 units. The Grape Fast Acting Gummies 10-Pack (100mg) also held its position at rank 2, despite a slight decrease in sales from the previous month. Black Cherry Pectin RSO Gummies 10-Pack (100mg) remained steady at rank 3, reflecting stable performance over the months. The CBN/THC 1:2 Indica Cran Raspberry Pectin Gummies showed improvement, climbing from rank 5 in November and December 2025 to rank 4 in January 2026. Newly introduced Indica Sour Blue Raspberry Pectin Gummies 10-Pack (100mg) debuted at rank 5, indicating a promising start in the Edible category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.