Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

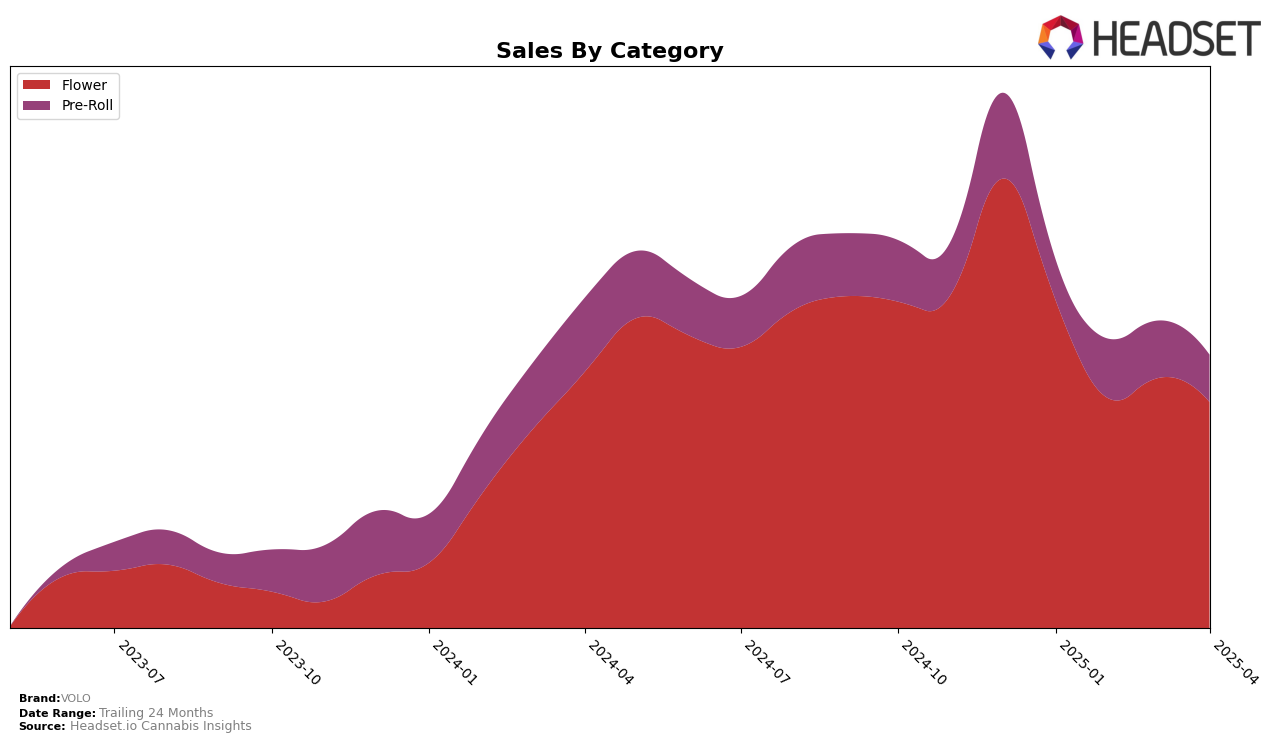

VOLO has demonstrated varying performance across different categories and regions, with notable movements in the flower category. In Ontario, VOLO maintained a consistent presence in the top 30 brands for the flower category, although its ranking slightly fluctuated from 22nd in January to 27th by April 2025. This indicates a stable yet slightly declining position in the market, with a notable dip in sales from January to April. In contrast, VOLO's performance in Alberta for the same category was not as strong, as it did not appear in the top 30 rankings, which suggests potential challenges in gaining market traction in that province.

In the pre-roll category, VOLO's performance was less prominent in both Ontario and Alberta. In Ontario, VOLO consistently ranked in the lower 90s, indicating a struggle to climb higher in this competitive category. Meanwhile, in Alberta, VOLO entered the rankings in February at 79th but fell out of the top 30 by April, reflecting a downward trend. This suggests that while VOLO has some presence in the pre-roll market, it faces significant competition and market penetration challenges in both provinces.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, VOLO has experienced notable fluctuations in its rank and sales over the first four months of 2025. Starting the year at rank 22, VOLO saw a decline to rank 26 in February, followed by a slight improvement to rank 25 in March, and then a dip to rank 27 in April. This pattern indicates a competitive pressure from brands like Divvy and BLKMKT, which maintained more stable positions within the top 30, with Divvy consistently ranking between 24 and 26, and BLKMKT between 25 and 28. Despite these rank changes, VOLO's sales figures reflect a peak in March, suggesting a potential for recovery or strategic adjustments. Meanwhile, Sixty Seven Sins demonstrated a significant upward trend, climbing from rank 53 in January to 26 in April, indicating an emerging threat to VOLO's market share. These dynamics highlight the importance for VOLO to innovate and strategize effectively to regain and sustain its competitive edge in the Ontario Flower market.

Notable Products

In April 2025, Marshmallow Milk (3.5g) maintained its position as the top-performing product for VOLO, reclaiming the number one rank from March with sales of 1761 units. Grapes of Wrath (3.5g) slipped to the second position after leading in March, showing a notable decrease in sales. Commando (7g) made its debut in the rankings, securing the third spot, indicating a strong market entry. Woof Walkers Pre-Roll 6-Pack (1.8g) improved its standing to fourth place from a consistent fifth position in the previous months, while CAP Junky x Jealousy Blunt (1g) remained steady at fifth place. These shifts highlight a dynamic market where product performance can vary significantly month to month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.