Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

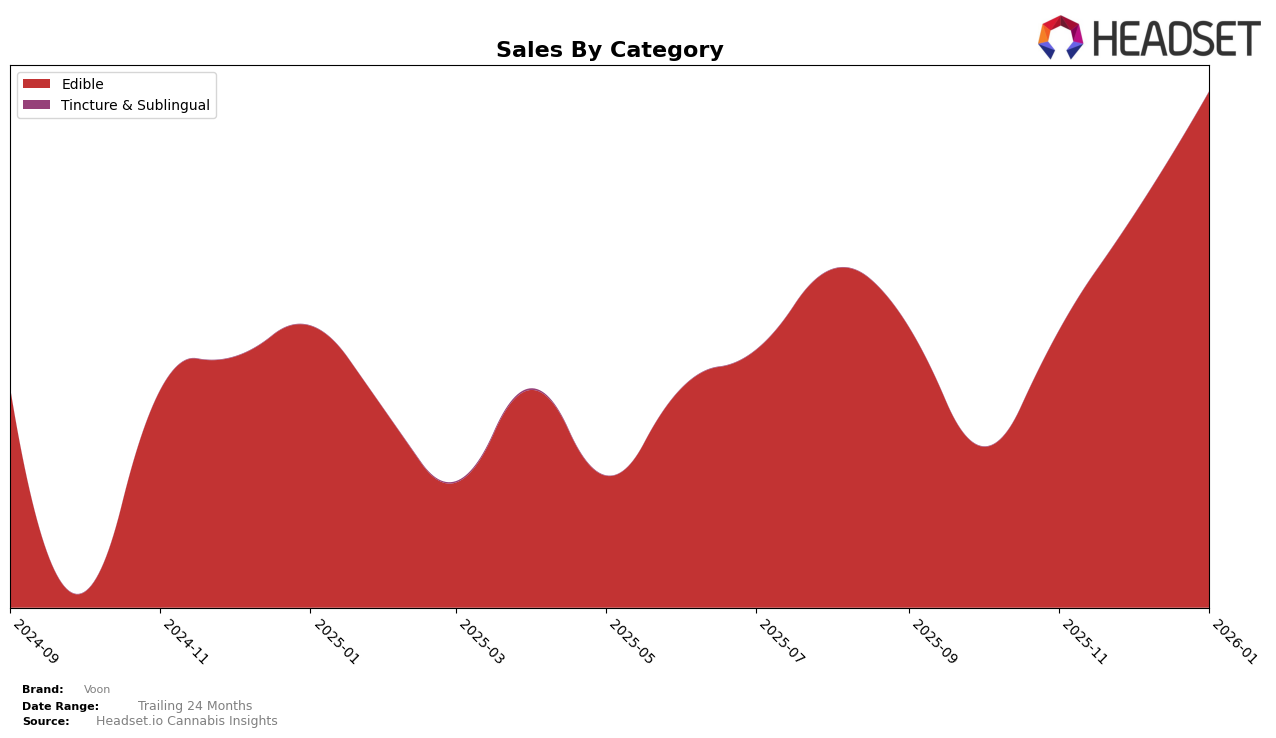

In the Nevada market, Voon has shown a consistent upward trajectory in the Edible category over the past few months. Starting from a rank of 34 in October 2025, Voon made significant strides, climbing to the 22nd position by January 2026. This upward movement indicates a growing consumer preference and increased market penetration. The brand's sales figures reflect this positive trend, with a notable increase from $11,344 in October 2025 to $36,465 in January 2026. Such growth suggests that Voon's strategies in Nevada are resonating well with consumers, contributing to their improved standing in the competitive edible landscape.

However, it's important to note that Voon's presence in other states or provinces is not highlighted in the data, as they did not rank in the top 30 brands in those markets. This absence in other regions could be seen as an area of potential growth for the brand, indicating opportunities for expansion and increased market share. The data from Nevada provides a glimpse into Voon's potential, but the lack of visibility in other markets suggests that there might be challenges or untapped opportunities that the brand could explore to enhance its footprint beyond Nevada.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Nevada, Voon has demonstrated a notable upward trajectory in recent months. Starting from a rank of 34 in October 2025, Voon has ascended to the 22nd position by January 2026, indicating a significant improvement in market presence. This rise is particularly impressive when compared to competitors like Evergreen Organix, which fluctuated around the 20th rank but ultimately dropped to 23rd by January 2026, and CAMP (NV), which saw a decline from 16th to 20th place over the same period. Meanwhile, Just Edibles experienced a recovery from 25th to 21st, yet Voon's consistent climb suggests a more robust growth strategy. Notably, BITS entered the top 20 in January 2026, but Voon's steady increase in sales and rank highlights its potential to become a formidable player in the Nevada edibles market.

Notable Products

In January 2026, the top-performing product for Voon was the Fresh Wintergreen Trainwreck Sublingual 10-Pack (200mg), which climbed to the first position with notable sales of 814 units. The Super Lemon Haze Chocolate 10-Pack (200mg) maintained its consistent performance, holding the second rank for two consecutive months. Blueberry Kush Chocolate 10-Pack (200mg) experienced a slight drop, moving from first in December 2025 to third in January 2026. The Trainwreck Chocolate Pouch 10-Pack (200mg) remained steady in fourth place, while GDP Sublingual 10-Pack (200mg) continued to decline, dropping to fifth rank after leading in October and November 2025. This shift highlights a significant increase in demand for the Fresh Wintergreen Trainwreck Sublingual, as it rose from fourth to first place over the last two months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.