Jul-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

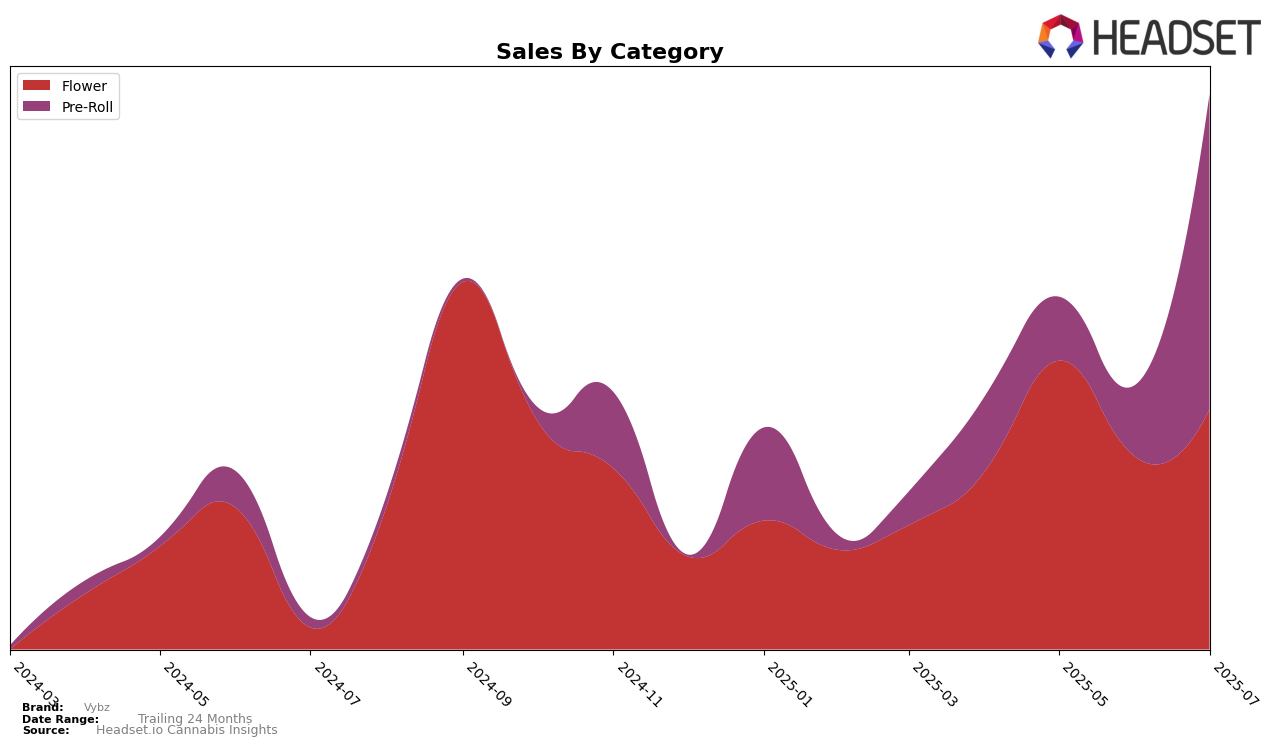

Vybz has shown a dynamic performance across various categories and states, with some noteworthy movements in the rankings. In Nevada, the brand's presence in the Flower category has fluctuated significantly. Although it did not make it into the top 30 brands in April and June 2025, it managed to climb back to the 52nd position by July, indicating a potential recovery or strategic shift. Meanwhile, Vybz's sales in this category reflect a positive trend, with a notable increase from June to July. This suggests a growing consumer interest or effective marketing strategies that are beginning to pay off.

In the Pre-Roll category, Vybz has made impressive strides in Nevada. Despite starting off outside the top 30 in April and May, by July 2025, Vybz had catapulted to the 18th position. This significant leap in rankings is indicative of a strong market penetration or an innovative product offering that resonates well with consumers. The sales figures for July further underscore this success, as they reflect a substantial increase, marking a potential turning point for the brand in this category. Such performance highlights the brand's potential for growth and its ability to adapt to market demands effectively.

Competitive Landscape

In the Nevada Pre-Roll market, Vybz has demonstrated a remarkable upward trajectory in recent months. Starting from a rank of 54 in April 2025, Vybz was not in the top 20, but by July 2025, it climbed to rank 18, indicating a significant improvement in its market position. This surge is particularly notable when compared to competitors like The Grower Circle, which experienced a decline from rank 11 in April to rank 16 in July, and Hustler's Ambition, which also saw a drop from rank 12 in May to rank 17 in July. Meanwhile, LP Exotics maintained a relatively stable presence, hovering around the lower teens. The impressive rise of Vybz in rank is mirrored by a substantial increase in sales, particularly in July, where it saw a dramatic boost, contrasting with the fluctuating sales figures of its competitors. This trend suggests that Vybz is gaining traction and could continue to challenge its competitors in the Nevada Pre-Roll category.

Notable Products

In July 2025, Vybz's top-performing product was Sin City Funk Pre-Roll (1g) in the Pre-Roll category, which climbed to the number one rank with impressive sales of 4851. Strange Haze #8 Pre-Roll (1g) maintained its second position from the previous month, showing consistent popularity with sales reaching 4339. Glitter Bomb Pre-Roll (1g) rose to the third spot, improving from its fourth-place rank in June. Purple Slush Pre-Roll (1g) debuted in the rankings at fourth place, while GovernMint Oasis (3.5g) entered the top five for the first time, securing the fifth position. The rankings highlight a strong performance in the Pre-Roll category for Vybz this month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.