Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

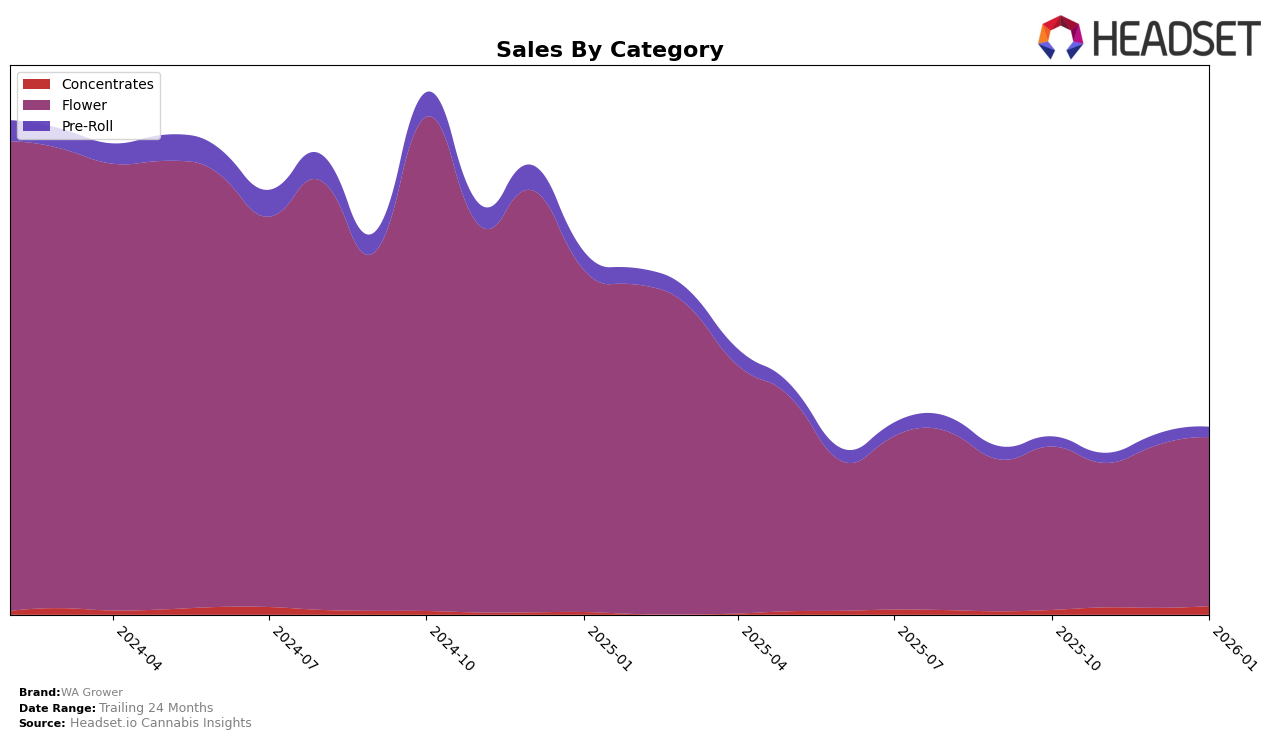

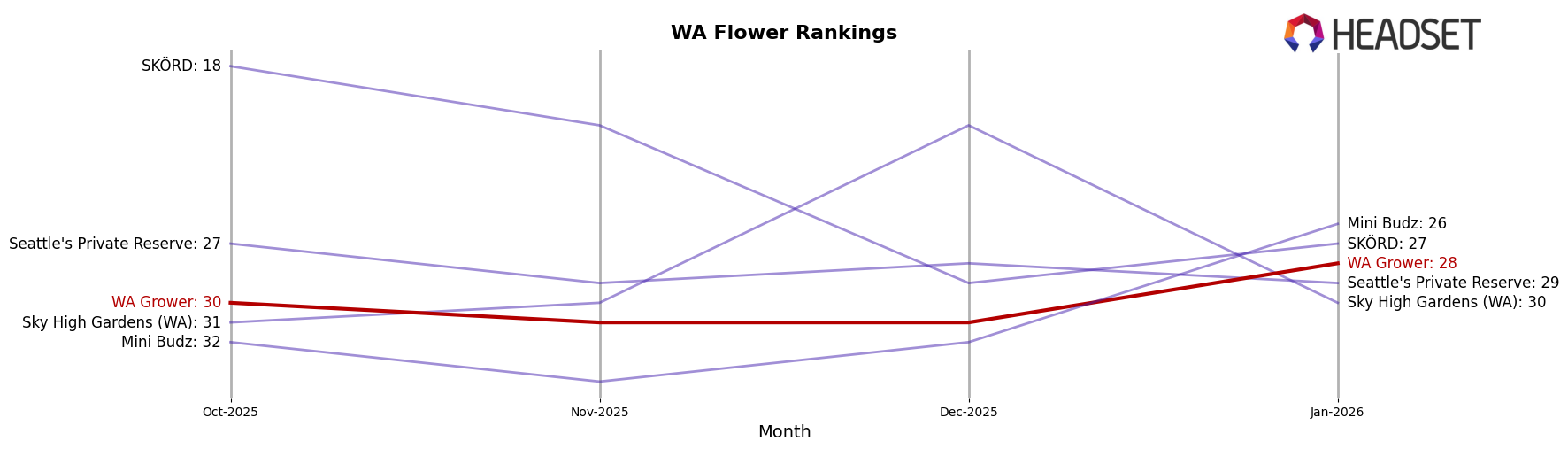

WA Grower has demonstrated a notable performance trend in the Flower category within Washington. After a dip in the rankings in November and December 2025, where the brand fell just outside the top 30, WA Grower bounced back to secure the 28th position by January 2026. This recovery is a positive indicator of the brand's resilience and ability to regain market share, especially considering the competitive nature of the Flower category. The sales figures reflect this upward trajectory, with January 2026 seeing a noticeable increase from the previous months.

Despite the fluctuations in their rankings, WA Grower's ability to return to the top 30 in Washington suggests a strategic adjustment or market response that could be worth exploring further. While the brand did not make it into the top 30 in November and December 2025, the regained position in January 2026 signals potential growth opportunities. Observing how WA Grower continues to navigate the Flower category in Washington could provide insights into their market strategies and consumer appeal.

Competitive Landscape

In the competitive landscape of the Flower category in Washington, WA Grower has experienced notable fluctuations in its market positioning from October 2025 to January 2026. Initially ranked at 30th in October 2025, WA Grower saw a slight dip to 31st in both November and December before improving to 28th by January 2026. This upward movement in January indicates a positive trend, potentially driven by increased sales efforts or product offerings. In comparison, Sky High Gardens (WA) showed a similar pattern, starting at 31st, peaking at 21st in December, and then dropping back to 30th in January. Meanwhile, Seattle's Private Reserve maintained a relatively stable position, hovering around the late 20s, while SKÖRD experienced a decline from 18th to 27th over the same period. Interestingly, Mini Budz showed a significant improvement, climbing from 32nd to 26th by January 2026. These dynamics suggest that while WA Grower is making strides to improve its rank, it faces stiff competition from brands like Mini Budz, which are also gaining traction in the market.

Notable Products

In January 2026, the top-performing product for WA Grower was Gorilla Glue #4 (3.5g) in the Flower category, maintaining its number one rank for four consecutive months with a notable sales figure of 1123 units. Indica RSO (1g) in the Concentrates category saw a significant rise in its ranking, moving from fourth place in November and December 2025 to second place in January 2026. Gorilla Glue #4 (7g), also in the Flower category, experienced a slight drop in rank, moving from second place in the previous months to third in January 2026. Alaskan Thunder Fuck (7g) made its first appearance on the list, securing the fourth position in January 2026. Meanwhile, HYBRID RSO (1g) entered the rankings for the first time, achieving fifth place in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.