Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

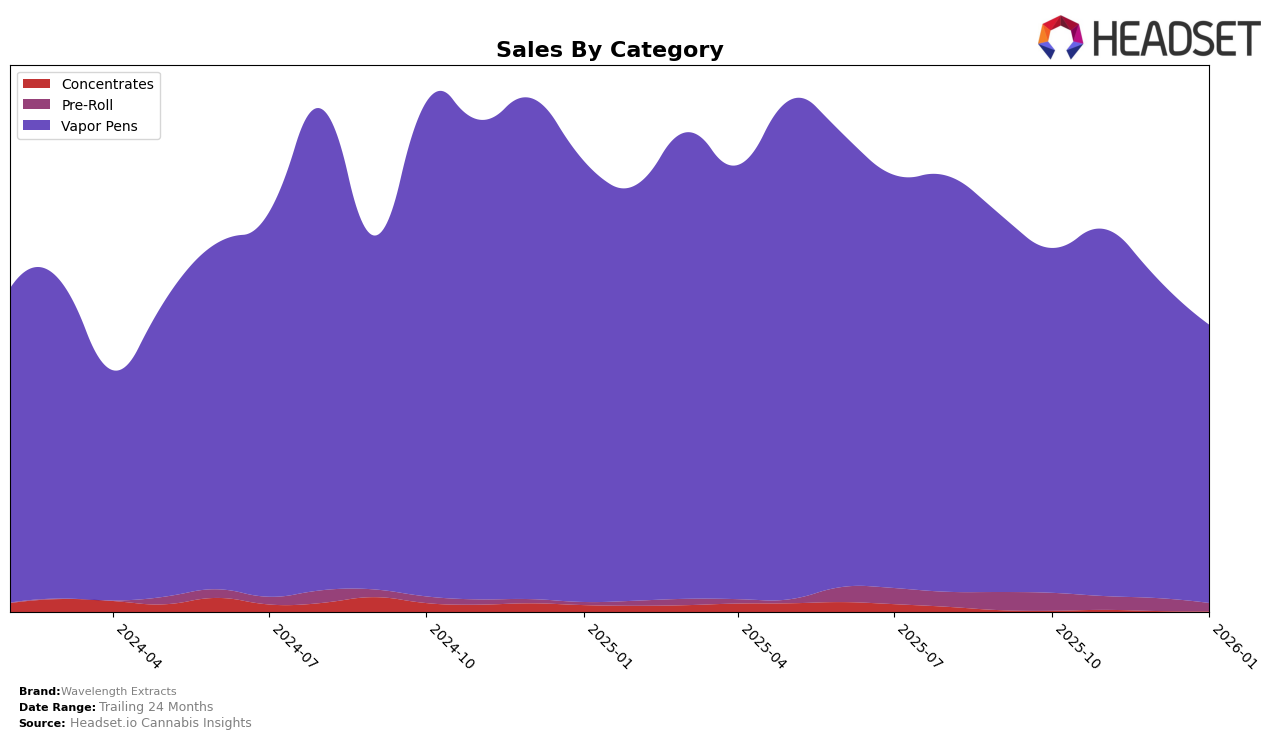

Wavelength Extracts has shown varied performance across different states and product categories. In Colorado, the brand's Vapor Pens category saw a notable improvement, moving from the 43rd position in October 2025 to 25th in November 2025. However, it slipped back to 35th place by December and maintained that position into January 2026. This fluctuation indicates a competitive market environment, with Wavelength Extracts managing to enter the top 30 only once in the four-month period. Despite the rank changes, the sales figures in November 2025 were significantly higher than in other months, suggesting a possible seasonal demand or successful promotional strategy during that time.

In Missouri, Wavelength Extracts' performance in the Vapor Pens category has been relatively stable, maintaining a consistent presence within the top 20. The brand held the 14th position in both October and November 2025, and only saw a slight drop to 15th and 16th in December 2025 and January 2026, respectively. This stability contrasts with their Pre-Roll category in the same state, where they did not break into the top 30 at any point, with rankings hovering around the 50s and 70s. This discrepancy highlights the brand's stronger foothold in the Vapor Pens category within Missouri, while indicating potential challenges or opportunities for growth in the Pre-Roll segment.

Competitive Landscape

In the Missouri vapor pens category, Wavelength Extracts has experienced a notable shift in its competitive landscape over the past few months. Initially ranked 14th in October 2025, Wavelength Extracts maintained this position in November before slipping to 15th in December and further to 16th by January 2026. This downward trend contrasts with the performance of competitors such as Batch Extracts, which improved its rank from 15th in October to 14th in January, and Buoyant Bob, which climbed from 17th to 15th in the same period. Despite these shifts, Wavelength Extracts still outperformed Platinum Vape and AiroPro in terms of sales volume, although both brands showed resilience in maintaining relatively stable rankings. These dynamics suggest that while Wavelength Extracts remains a strong player, it faces increasing pressure from competitors who are gaining traction in the market.

```

Notable Products

In January 2026, the top-performing product for Wavelength Extracts was Amplitude - GMO Distillate Cartridge (1g) in the Vapor Pens category, securing the first rank with sales of 1533 units. Amplitude - Jack Herer Distillate Cartridge (1g) maintained its strong performance, ranking second, consistent with its position in December 2025, though slightly down from its first-place finish in October 2025. Amplitude - Tiger's Blood Distillate Cartridge (1g) climbed to third place, showing a recovery from its absence in December's top ranks. Amplitude - Northern Lights Distillate Cartridge (1g) dropped to fourth from its December first-place position, indicating a notable shift in consumer preference. Fruit Bedrock Distillate Cartridge (1g) remained steady in fifth place, maintaining its rank from December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.