Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

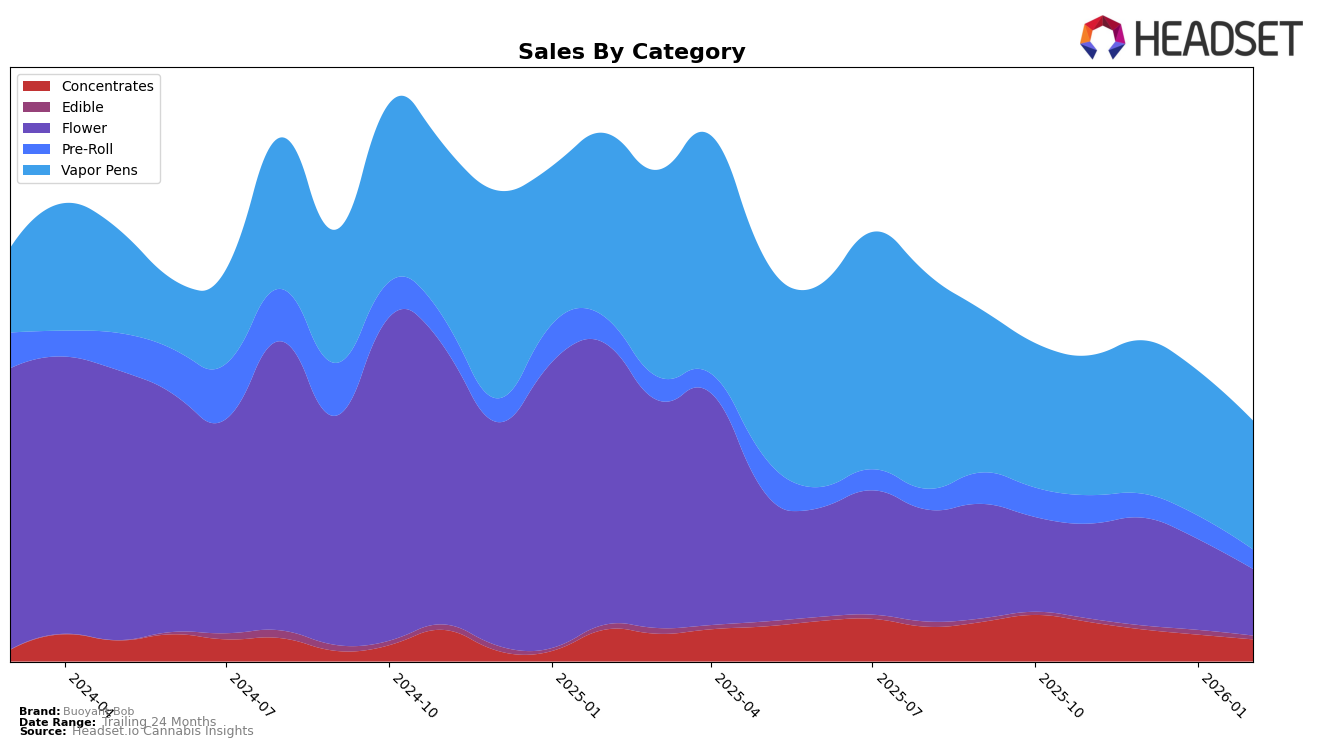

Buoyant Bob's performance across various categories in Missouri presents a mixed picture. In the Concentrates category, the brand has maintained its position at rank 13 through November and December of 2025, before slipping to rank 18 in January and February of 2026. This decline is coupled with a consistent drop in sales figures over the months, indicating a potential need for strategic adjustments. In contrast, the Vapor Pens category has shown remarkable stability, with Buoyant Bob holding steady at rank 15 from December 2025 through February 2026, despite a slight decrease in sales. This suggests a loyal customer base or effective marketing strategies that could be further leveraged.

In New Jersey, Buoyant Bob's presence in the Flower category reveals some volatility. The brand improved from rank 77 in November 2025 to 58 in December, only to fall back to 73 in January 2026. By February, Buoyant Bob no longer appeared in the top 30, possibly indicating a significant drop in competitiveness or market penetration. This fluctuation could be attributed to various factors, such as changes in consumer preferences or increased competition. The absence from the top 30 in February should be a point of concern and could prompt the brand to reassess its strategies in this market.

Competitive Landscape

In the competitive landscape of vapor pens in Missouri, Buoyant Bob has maintained a relatively stable position, consistently ranking 15th from December 2025 to February 2026, after a slight improvement from 16th in November 2025. This stability in rank is noteworthy given the fluctuations experienced by competitors such as Wavelength Extracts, which dropped from 14th to 17th place over the same period. Despite a dip in sales from December 2025 to February 2026, Buoyant Bob's performance remains competitive, particularly against AiroPro, which has consistently ranked lower. However, Batch Extracts and Vibe Cannabis (MO) continue to outperform Buoyant Bob in both rank and sales, indicating areas for potential growth and strategic focus for Buoyant Bob to climb higher in the rankings.

Notable Products

In February 2026, Buoyant Bob's top-performing product was the Hard Lemonade Distillate Cartridge (1g) in the Vapor Pens category, maintaining its first-place ranking consistently from previous months with a sales figure of 3039. The Strawberry Daiquiri Distillate Cartridge (1g) saw a notable rise, moving up to second place from fourth in December 2025. Mai Tai Distillate Cartridge (1g) held steady in third place, showing a slight decrease in sales compared to January. The Rambutan Pre-Roll (1g) also maintained its fourth rank from January to February. Blue Dream Distillate Cartridge (1g) experienced a drop, falling to fifth place after not ranking in January, indicating a shift in consumer preference towards other products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.