Jul-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

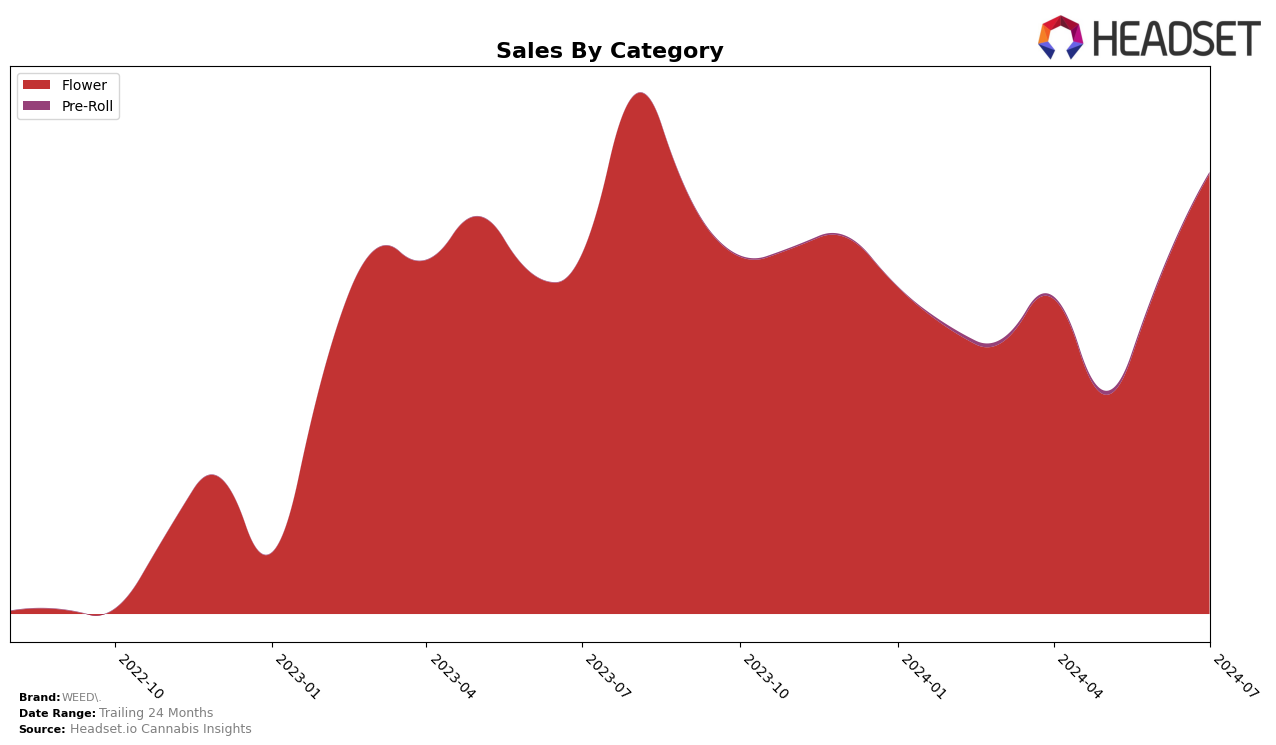

WEED. has shown notable performance fluctuations across various states and categories in recent months. In Michigan, the brand experienced significant movement within the Flower category. Despite not ranking in the top 30 brands in April and May, WEED. made a dramatic comeback by securing the 29th position in July. This upward trend is indicative of a strong recovery, likely driven by strategic adjustments or market demand shifts. The brand's ability to climb the ranks in such a competitive market underscores its resilience and potential for sustained growth.

Across other states, WEED.'s performance has been more variable. The brand did not appear in the top 30 rankings for several months in some categories, which could be seen as a challenge in maintaining consistent market presence. However, the significant jump in sales from May to July in Michigan, from approximately $479,999 to $964,032, highlights a positive trend and suggests a potential for similar growth in other regions if the brand can replicate its Michigan strategy. Observing these trends can provide valuable insights into WEED.'s market dynamics and strategic adjustments, which are essential for stakeholders and market analysts.

Competitive Landscape

In the competitive landscape of the Michigan Flower category, WEED. has shown a notable fluctuation in its ranking over the past few months, impacting its market positioning and sales trajectory. Despite a challenging period in May 2024, where WEED. dropped to the 66th rank, it rebounded significantly to secure the 29th position by July 2024. This recovery is particularly impressive when compared to competitors like Traphouse Cannabis Co., which has steadily climbed from the 42nd rank in April to the 27th rank in July, and Redemption, which experienced a dip in June but also managed to improve its rank by July. Additionally, Goldkine has shown a strong presence, maintaining a relatively stable rank with a slight drop in July. The most striking competitor, however, is The Limit, which peaked at the 15th rank in May before settling at the 31st position in July. These dynamics suggest that while WEED. faces stiff competition, its ability to bounce back and improve its ranking indicates a resilient market strategy that could be further bolstered by advanced data insights.

Notable Products

In July 2024, the top-performing product for WEED. was Ice Cream Cake Smalls (57g) in the Flower category, with sales reaching 2864 units. Hot Fudge Sundae Smalls (57g), also in the Flower category, secured the second position. Mountain Peaches Smalls (57g) ranked third, maintaining a strong presence after being second in June 2024. Kush Mints Smalls (57g) moved up to fourth place from its fifth position in the previous two months. Ill Treats Pre-Roll 5-Pack (3.5g) saw a drop, ranking fifth after leading in May 2024 and holding the third spot in June 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.