Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

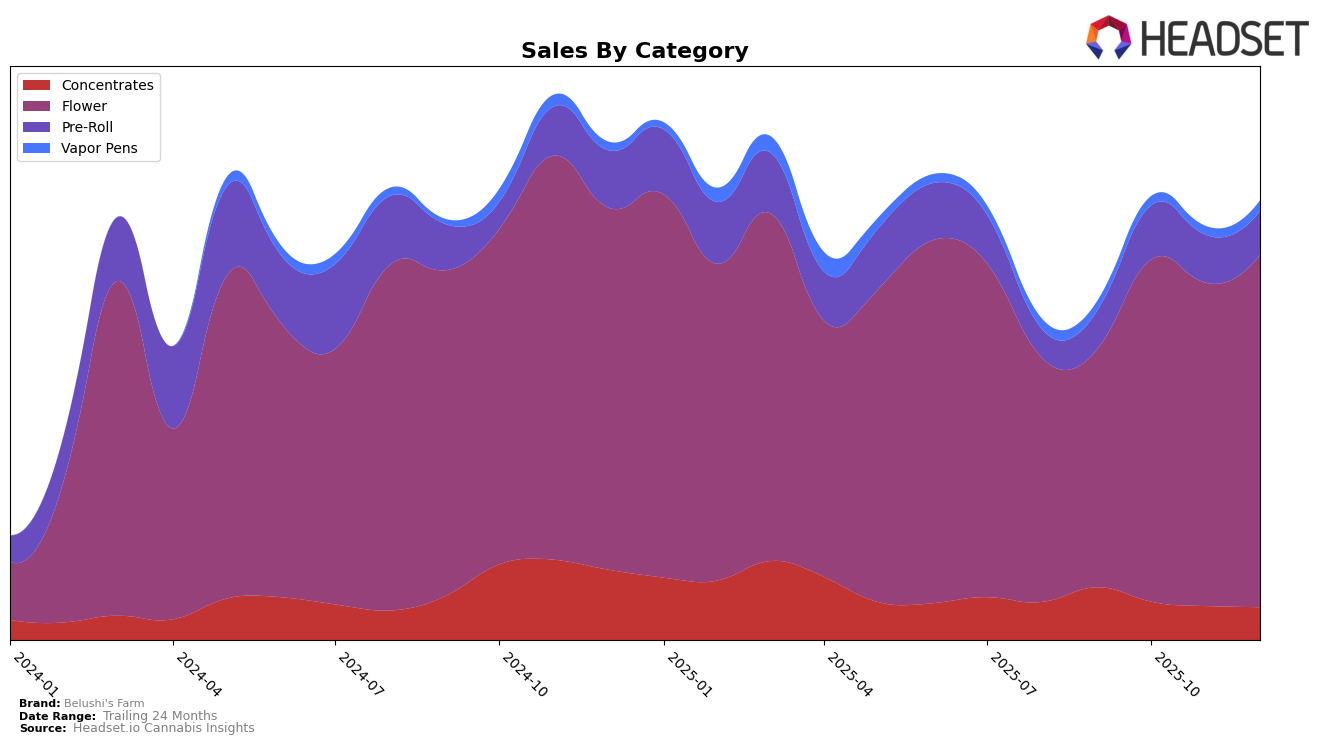

Belushi's Farm has shown varied performance across different states and product categories. In Illinois, the brand's Flower category did not make it into the top 30 rankings from September to December 2025, indicating a challenging market presence in this state. Conversely, in Ohio, the Flower category saw a significant upward trajectory, moving from rank 48 in September to breaking into the top 30 by December. This suggests a growing popularity and acceptance of their products in Ohio. In Missouri, the Flower category maintained a consistent presence within the top 50, with slight fluctuations, while the Pre-Roll category struggled to break past the 70s ranking, indicating a potential area for improvement.

In Massachusetts, Belushi's Farm's Concentrates showed some resilience, maintaining a presence in the rankings, though never breaking into the top 30, which could be seen as both a steady performance and a missed opportunity for higher visibility. Meanwhile, in Maryland, the brand's Concentrates and Pre-Roll categories both held steady rankings, with the Pre-Roll category even improving its position over the months. However, the Flower category saw a slight decline in rankings from September to December. The market in Michigan presented challenges for Belushi's Farm, as the Concentrates category did not sustain its initial ranking past September. These mixed results across states and categories highlight the dynamic nature of the cannabis market and the varying consumer preferences in different regions.

Competitive Landscape

In the competitive landscape of the Flower category in Ohio, Belushi's Farm has demonstrated a notable upward trajectory in brand ranking from September to December 2025. Starting at rank 48 in September, Belushi's Farm climbed to rank 30 by December, indicating a significant improvement in market position. This rise in rank is accompanied by a steady increase in sales, reflecting growing consumer preference and brand recognition. In contrast, competitors such as Galenas and The Botanist have shown fluctuating ranks, with Galenas experiencing a drop from rank 26 in September to 28 in December, and The Botanist maintaining a relatively stable but lower position. Meanwhile, Cheech & Chong's saw a similar upward trend, moving from rank 50 to 31, yet their sales figures remain lower than those of Belushi's Farm. This competitive analysis highlights Belushi's Farm's successful market penetration and potential for continued growth in Ohio's Flower category.

Notable Products

In December 2025, Mule Fuel 3.5g reclaimed its position as the top-selling product for Belushi's Farm, following a slight dip to fourth place in November. The Mule Fuel Pre-Roll 2-Pack 1g maintained strong performance, ranking second, though it saw a decrease from its leading position in October. Notably, Motor Breath Pre-Roll 2-Pack 1g entered the rankings for the first time in December, securing the third spot. Hashburger 3.5g experienced a consistent decline, dropping to fourth place from its second position in September. Muul Fuel 2.83g debuted in the rankings at fifth place, indicating a new entry in the competitive landscape.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.