Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

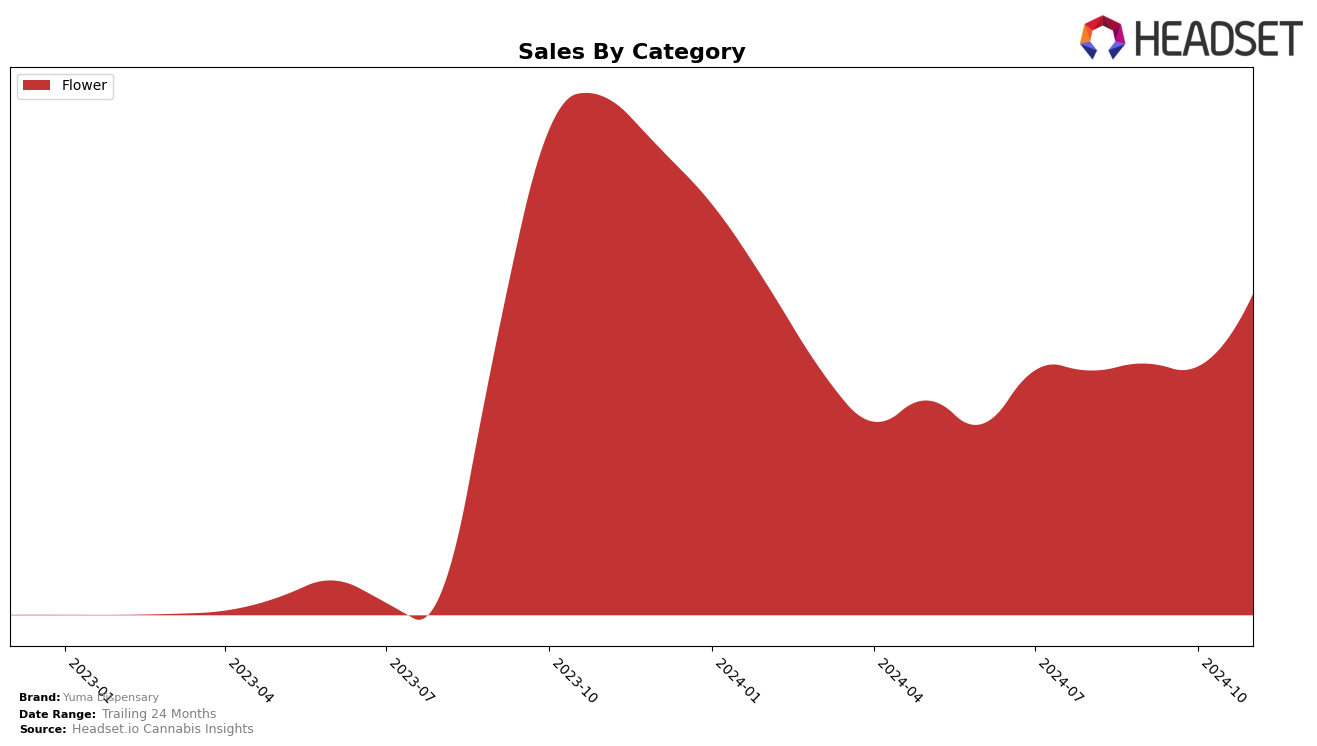

Yuma Dispensary has shown a commendable upward trajectory in its performance within the Flower category in Arizona. Over the months from August to November 2024, the brand has steadily climbed from a rank of 38 to breaking into the top 30 by November. This consistent improvement is indicative of a strategic push or market adaptation that has resonated well with consumers. The notable increase in sales from October to November suggests a successful campaign or product launch that has bolstered their market presence, marking a significant milestone for the brand.

However, it's important to note that Yuma Dispensary has not made it into the top 30 brands in any other state or category beyond Flower in Arizona. This absence could be seen as a potential area for growth or a reflection of the competitive landscape in other markets. As it stands, their concentrated success in Arizona's Flower category might offer insights into consumer preferences or operational strengths that could be leveraged for broader geographical expansion. The brand's ability to maintain and improve its standing in a single market highlights both opportunities and challenges in scaling its success elsewhere.

Competitive Landscape

In the competitive landscape of the Flower category in Arizona, Yuma Dispensary has shown a steady improvement in its ranking over the past few months, moving from 38th in August 2024 to 30th by November 2024. This upward trend in rank suggests a positive reception in the market, despite its sales figures being lower compared to some of its competitors. For instance, Seed & Strain Cannabis Co. consistently held higher ranks, peaking at 8th in September 2024, although it experienced a significant drop to 33rd by November 2024. Similarly, Classix saw a decline from 14th in September to 31st in November, indicating a potential opportunity for Yuma Dispensary to capture market share from these fluctuating competitors. Meanwhile, Daze Off and HYH Society have maintained relatively stable positions, with HYH Society slightly outperforming Yuma Dispensary in November. The consistent improvement in Yuma Dispensary's rank, despite the competitive pressures, highlights its growing presence and potential for increased market penetration in Arizona's Flower market.

Notable Products

In November 2024, Golden Lemons (3.5g) emerged as the top-performing product at Yuma Dispensary, with sales reaching 642 units. Following closely, Banana Kush (3.5g) secured the second position, while Super Boof (3.5g) ranked third. Tiramisu (3.5g) and Bubba Diagonal (3.5g) completed the top five, ranking fourth and fifth, respectively. This marks a notable debut for these products in the rankings, as they were not previously listed in the top positions in earlier months. The Flower category dominated the top spots, indicating a strong preference among consumers for these specific products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.