Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

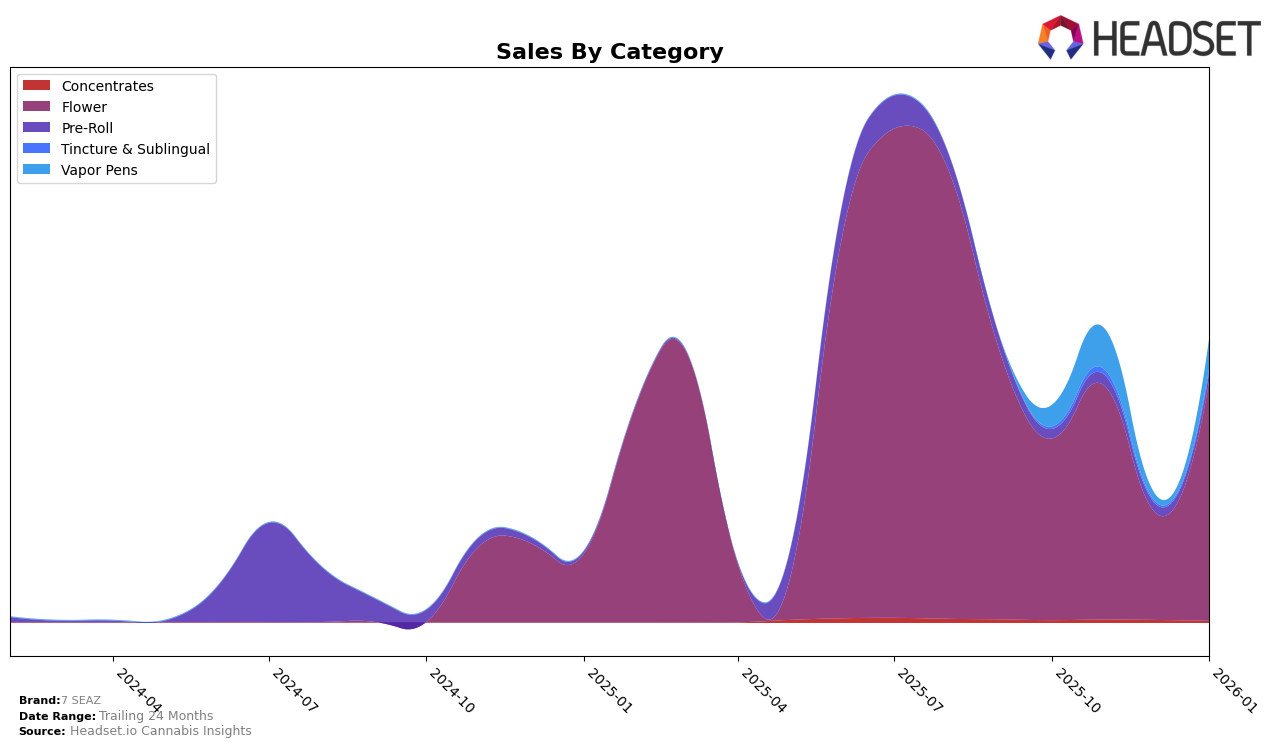

In New York, 7 SEAZ has shown a dynamic performance across different product categories. Specifically, in the Flower category, the brand has experienced significant fluctuations, starting from a rank of 33 in October 2025, improving to 26 in November, then dropping to 60 in December, before climbing back to 30 in January 2026. This rollercoaster trend suggests a volatile market presence, yet the recovery in January indicates potential resilience or successful strategic adjustments. Meanwhile, in the Vapor Pens category, 7 SEAZ was absent from the top 30 rankings in December, which could be a cause for concern, as it implies a lack of competitive edge or market penetration during that period.

The sales figures for 7 SEAZ in New York reflect these ranking movements, with Flower sales peaking in January 2026 at $476,689, indicating a strong finish to the period. Conversely, the Vapor Pens category did not report a ranking in December, potentially signaling a gap in consumer demand or distribution challenges. However, the brand managed to secure a position back in the top 70 by January, which might suggest efforts to regain market traction. The varying performance across categories highlights the challenges and opportunities 7 SEAZ faces in maintaining a consistent presence in the competitive New York cannabis market.

Competitive Landscape

In the competitive landscape of the New York flower category, 7 SEAZ has experienced notable fluctuations in rank and sales over the past few months. Starting from a rank of 33 in October 2025, 7 SEAZ improved to 26 in November, but then dropped significantly to 60 in December, before recovering to 30 in January 2026. This volatility contrasts with competitors like Jetpacks and Runtz, which maintained more stable rankings, albeit outside the top 20. Hashtag Honey showed a strong upward trend, surpassing 7 SEAZ in December with a rank of 23 and maintaining a higher rank in January. Despite these challenges, 7 SEAZ's sales rebounded in January, indicating potential for recovery and growth amidst a competitive market. This dynamic environment underscores the importance of strategic positioning and market adaptation for 7 SEAZ to enhance its competitive edge.

Notable Products

In January 2026, 7 SEAZ's top-performing product was Black Panther (7g) in the Flower category, with sales reaching 997 units, securing the number one rank. Following closely, Incredible Hulk (7g) and Great White Shark (7g) held the second and third positions, respectively, indicating strong consumer preference for these Flower products. Cheese Quake (7g) and Hawaiian God (7g) rounded out the top five, maintaining their positions from previous months. Notably, Black Panther (7g) showed a significant rise to the top spot, suggesting a surge in popularity or effective marketing strategies. Overall, the rankings highlight a consistent demand for Flower products within the brand's lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.