Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

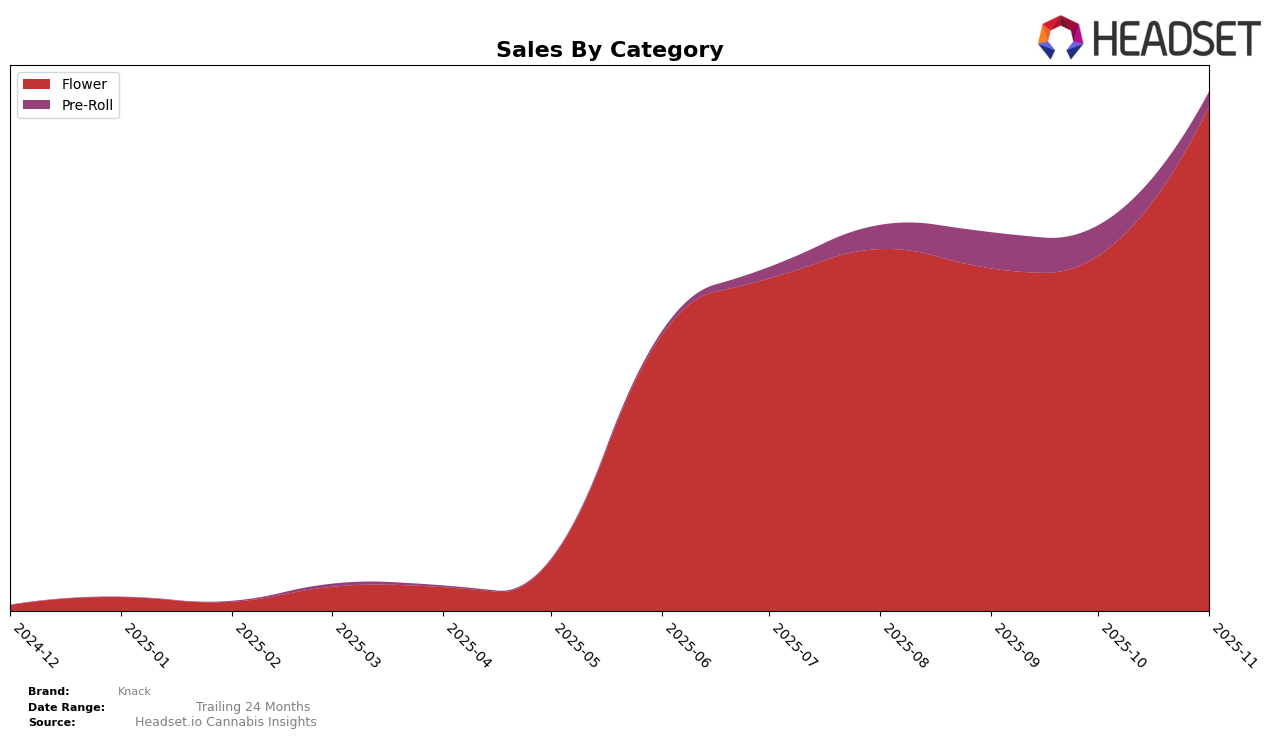

In the ever-evolving cannabis market, Knack has demonstrated notable performance fluctuations across various states and categories. In New York, Knack's presence in the Flower category has seen a commendable upward trend. The brand's ranking improved from 38th in August 2025 to 27th by November 2025, showcasing a significant leap into the top 30. This upward movement is indicative of Knack's growing market influence and consumer preference in New York's competitive landscape. It's worth noting that Knack was not in the top 30 in August and September, highlighting their progress as they climbed the rankings.

Despite this positive momentum in New York, Knack's performance in other states and categories remains a mystery, as they did not appear in the top 30 rankings, signaling potential areas for growth or challenges in those markets. The Flower category in New York, however, appears to be a stronghold for Knack, with sales figures reflecting a healthy increase from October to November 2025. This suggests a potential seasonal trend or successful marketing strategies that have resonated with consumers. Observing these movements, stakeholders might consider focusing on strategies that replicate New York's success in other regions to enhance overall brand performance.

Competitive Landscape

In the competitive landscape of the Flower category in New York, Knack has shown a notable upward trajectory in its ranking over the past few months. Starting from a rank of 38 in August 2025, Knack improved to 27 by November 2025, indicating a positive shift in market presence. This improvement is significant when compared to competitors like Good Green, which maintained a relatively stable rank around the mid-20s, and Spacebuds Moonrocks, which fluctuated slightly but remained in a similar range. Meanwhile, Hepworth experienced a decline from rank 20 to 28, suggesting a potential opportunity for Knack to capture more market share. Additionally, 7 SEAZ saw a significant drop from rank 16 to 26, which further highlights Knack's potential to capitalize on shifting consumer preferences. Overall, Knack's consistent sales growth, especially in November, positions it well against its competitors, suggesting a promising trend for future performance in the New York Flower market.

Notable Products

In November 2025, New York Cheddar (3.5g) emerged as the top-performing product for Knack, climbing from second place in October to secure the number one spot with sales reaching 599 units. Platinum Grapelato Pre-Roll (1g) saw a significant rise in popularity, advancing from fifth place in October to second place in November, with sales figures hitting 491 units. Purple Brulee (28g) made its debut in the rankings, capturing the third position, while Diesel Kush Cake (3.5g) followed closely in fourth place. Tropical Treats (28g) rounded out the top five, maintaining its position from the previous month. Overall, November saw dynamic shifts in product rankings, with notable upward movements for several key items.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.