Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

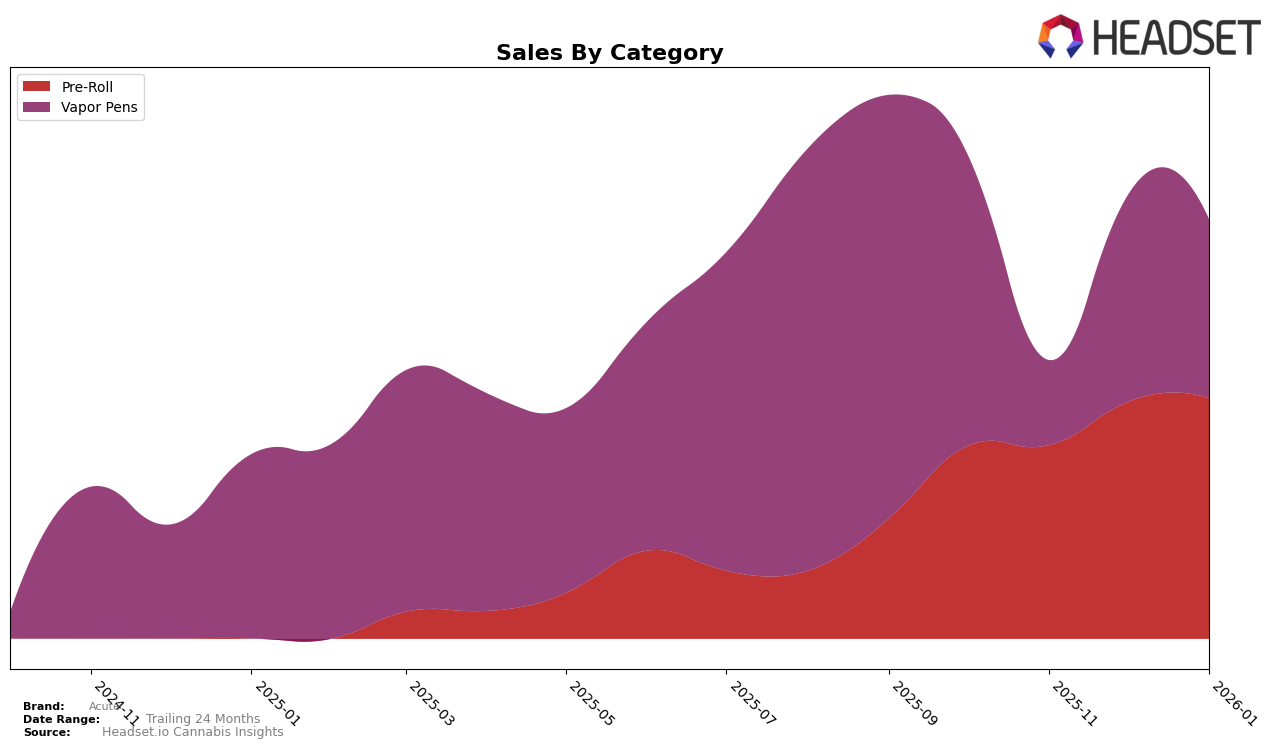

In the state of Missouri, Acute has shown a consistent performance in the Pre-Roll category, maintaining a steady rank of 22 from October 2025 through January 2026. This stability is mirrored by a positive trend in sales, which saw an increase from approximately $191,273 in October to $238,488 by January. This suggests a growing consumer preference or effective market strategies in this category. However, in the Vapor Pens category, Acute experienced a more volatile performance. Starting at rank 30 in October, the brand dropped out of the top 30 in November, only to climb back to rank 40 in December and improve slightly to rank 37 in January. This fluctuation, coupled with a sales dip in November, indicates potential challenges in maintaining a stronghold in the Vapor Pens market.

The contrasting performances in different product categories within Missouri highlight the complexity of market dynamics Acute faces. While their Pre-Roll products enjoy a stable and growing market presence, the Vapor Pens category presents a more challenging landscape. The drop in rank and sales in November for Vapor Pens could be indicative of increased competition or shifts in consumer preferences. Despite these challenges, the ability of Acute to regain and improve its position by January suggests resilience and adaptability. This mixed performance across categories underscores the importance of targeted strategies to address specific market conditions and consumer behaviors.

Competitive Landscape

In the competitive landscape of the Missouri pre-roll category, Acute has shown a consistent presence in the rankings, maintaining its position at 22nd from October 2025 through January 2026. This stability in rank suggests a steady performance amid fluctuating sales figures for other brands. Notably, Franklin's has consistently outperformed Acute, holding a higher rank at 18th for most of the period, although it dropped to 20th in January 2026. Meanwhile, Plume Cannabis (MO) experienced a decline from 16th in October to 21st in January, indicating potential challenges that Acute could capitalize on. Brands like Safe Bet and Farmer G did not make it into the top 20, suggesting that Acute is outperforming these competitors in terms of market presence. Overall, while Acute's sales have shown an upward trend, the brand's consistent rank highlights its resilience and potential for growth in a competitive market.

Notable Products

In January 2026, the top-performing product for Acute was Maui Wowie Infused Pre-Roll 2-Pack (1g) in the Pre-Roll category, which climbed to the number one spot with sales of 2,579 units. Pineapple Express Infused Pre-Roll 2-Pack (1g) also performed well, securing the second position, improving from its fifth rank in December 2025. Juice - Strawberry Infused Pre-Roll 2-Pack (1g) held strong in the third position, although it dropped from first place in November 2025. Lemon Peel Distillate Disposable (1g) entered the rankings at fourth place, showing renewed interest in the Vapor Pens category. Maui Wowie Distillate Disposable (1g) rounded out the top five, experiencing a slight decline from its second-place position in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.