Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

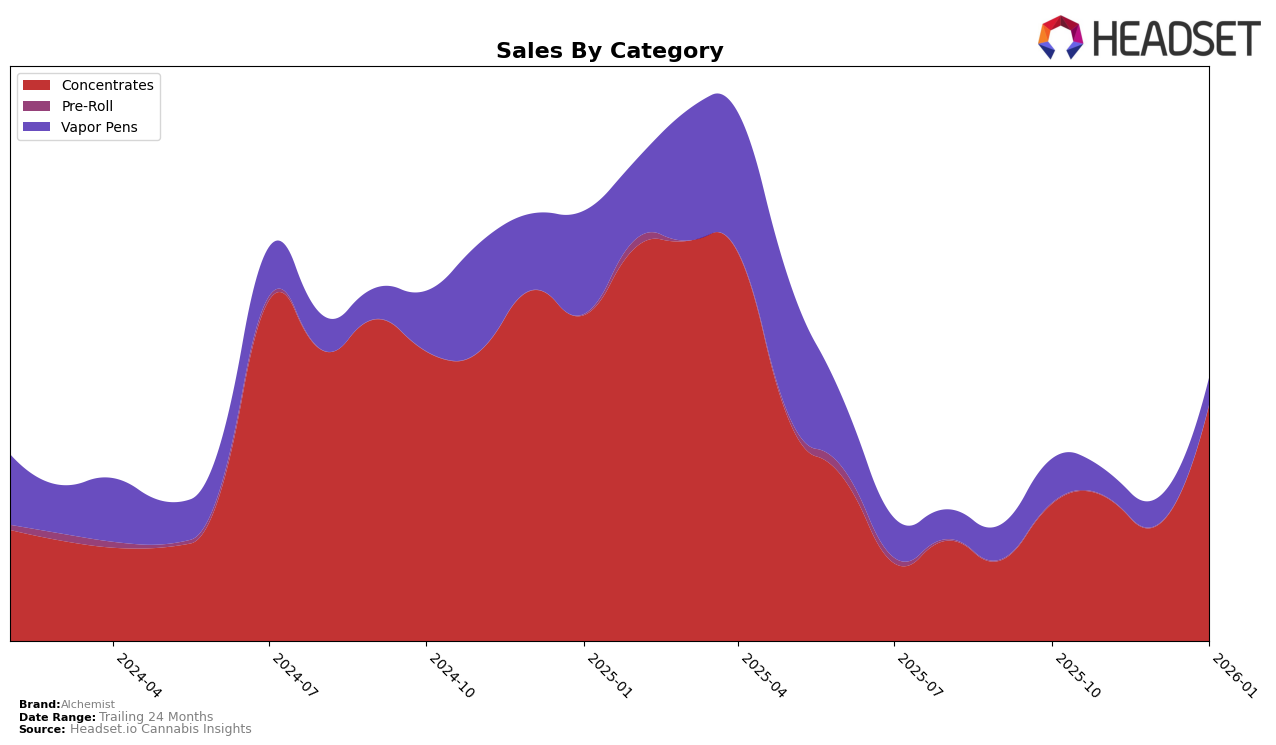

Alchemist has demonstrated notable performance within the Concentrates category in Maryland, showing a strong upward trajectory. Starting from the 18th position in October 2025, the brand climbed to the 16th rank by November, then slightly dropped to 20th in December, before making a significant leap to the 10th spot by January 2026. This upward movement indicates a growing preference for Alchemist's products in this category, which is further supported by a substantial increase in sales, particularly evident in January. However, the Vapor Pens category tells a different story, as Alchemist did not make it into the top 30 rankings throughout the observed months, suggesting challenges in this segment within the same state.

Despite the challenges faced in the Vapor Pens category in Maryland, Alchemist's overall performance in Concentrates provides a positive outlook. The brand's ability to break into the top 10 by January 2026 is a testament to its strength and potential for growth in this category. The data reflects a strategic focus on areas where they can capitalize on consumer demand, although there is room for improvement in other categories. Understanding these dynamics can offer insights into market strategies and potential areas for expansion or restructuring. Such insights are crucial for stakeholders looking to align with market trends and consumer preferences effectively.

Competitive Landscape

In the Maryland concentrates market, Alchemist has shown a remarkable recovery in its rankings over the past few months, which could indicate a strategic shift or successful marketing efforts. Starting from October 2025, Alchemist was ranked 18th, and despite a slight dip to 20th in December, it made a significant leap to the 10th position by January 2026. This upward trajectory suggests a positive reception of their products or a successful campaign that resonated with consumers. In contrast, competitors like Kind Tree Cannabis maintained a stable position within the top 10, consistently ranking 8th, while SunMed experienced fluctuations, dropping to 12th in November before rising back to 9th by January. The sales figures for Alchemist also reflect this positive trend, with a noticeable increase in January 2026, aligning with their improved rank. This indicates that Alchemist is effectively capturing market share from its competitors, potentially setting the stage for continued growth in the Maryland concentrates category.

Notable Products

In January 2026, Dirty Taxi Cured Resin Sugar (1g) emerged as the top-performing product for Alchemist, securing the number one rank with sales reaching 681 units. Banana Kush Live Resin Sugar (1g) and Funky Guava Cured Resin Sugar (1g) tied for the second position, each with notable sales figures of 601 units. Filthy Animals Cured Resin Sugar (1g) followed closely, ranking third with 527 units sold. Jack Herer Live Resin Sugar (1g) entered the top five, achieving fourth place with 504 units sold. Notably, Funky Guava Cured Resin Sugar (1g) dropped from first place in December 2025 to second in January 2026, while Banana Kush Live Resin Sugar (1g) improved its position from fourth to second in the same period.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.