Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

Alchemy Pure's performance in the Alberta market for Vapor Pens has shown some fluctuations. Notably, they did not rank in the top 30 in December 2024, which might be a point of concern for stakeholders. However, there is a consistent presence just outside the top 60 in the following months, with a slight improvement in March 2025. This suggests a potential for growth if the brand can leverage its current trajectory. The sales figures reflect a dip in January 2025 but show signs of recovery by March, indicating a potential upward trend that could be capitalized on with strategic efforts.

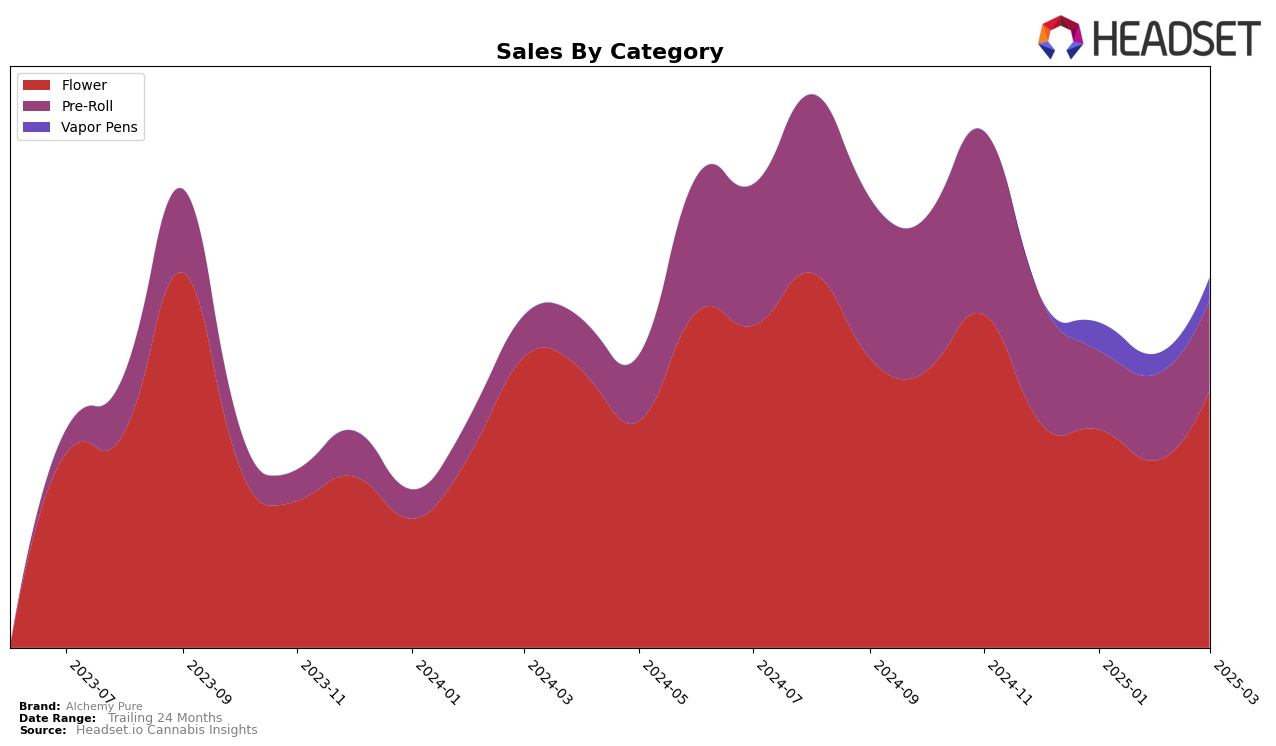

In New York, Alchemy Pure's presence in the Flower category remains relatively stable, with rankings hovering around the 30s. Despite a slight dip in February 2025, the brand managed to climb back up in March, which is a positive sign. Their performance in the Pre-Roll category, however, has seen them consistently outside the top 30, indicating a potential area for improvement. The sales figures in the Flower category have shown resilience, especially with a notable increase in March 2025, suggesting that this category might be a stronghold for Alchemy Pure in New York.

Competitive Landscape

In the competitive landscape of the New York flower category, Alchemy Pure has experienced notable fluctuations in its market position over recent months. Starting from a rank of 26 in December 2024, Alchemy Pure saw a dip to 32 in February 2025, before rebounding to 29 in March 2025. This recovery in rank is accompanied by a significant increase in sales, suggesting a positive trend in consumer preference or strategic marketing adjustments. In contrast, Hudson Cannabis consistently maintained a higher rank than Alchemy Pure, despite a gradual decline from 25 to 31 over the same period, indicating potential challenges in sustaining their market position. Meanwhile, Gypsy Weed showed stable performance with a rank hovering around 26-29, and Hashtag Honey experienced a drop from 21 to 30, reflecting volatility in their market standing. Notably, Cookies was absent from the top 20, highlighting a competitive edge for Alchemy Pure in this segment. These dynamics underscore the importance for Alchemy Pure to capitalize on its recent sales growth to further enhance its competitive standing in the New York flower market.

Notable Products

In March 2025, the top-performing product from Alchemy Pure was Catskill Blue Dream (3.5g) in the Flower category, maintaining its leading position for three consecutive months with sales reaching 1200 units. Hooch (3.5g) emerged as a new contender, securing the second spot with notable sales figures. Trainwreck (3.5g), also in the Flower category, experienced a slight drop, moving to the third rank from its consistent second position in previous months. Nectarine Jelly (3.5g) remained steady at the fourth rank, with a gradual decline in sales over the months. The Sativa Sun Live Resin Cartridge (1g) entered the rankings at fifth place, showing potential growth in the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.