Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

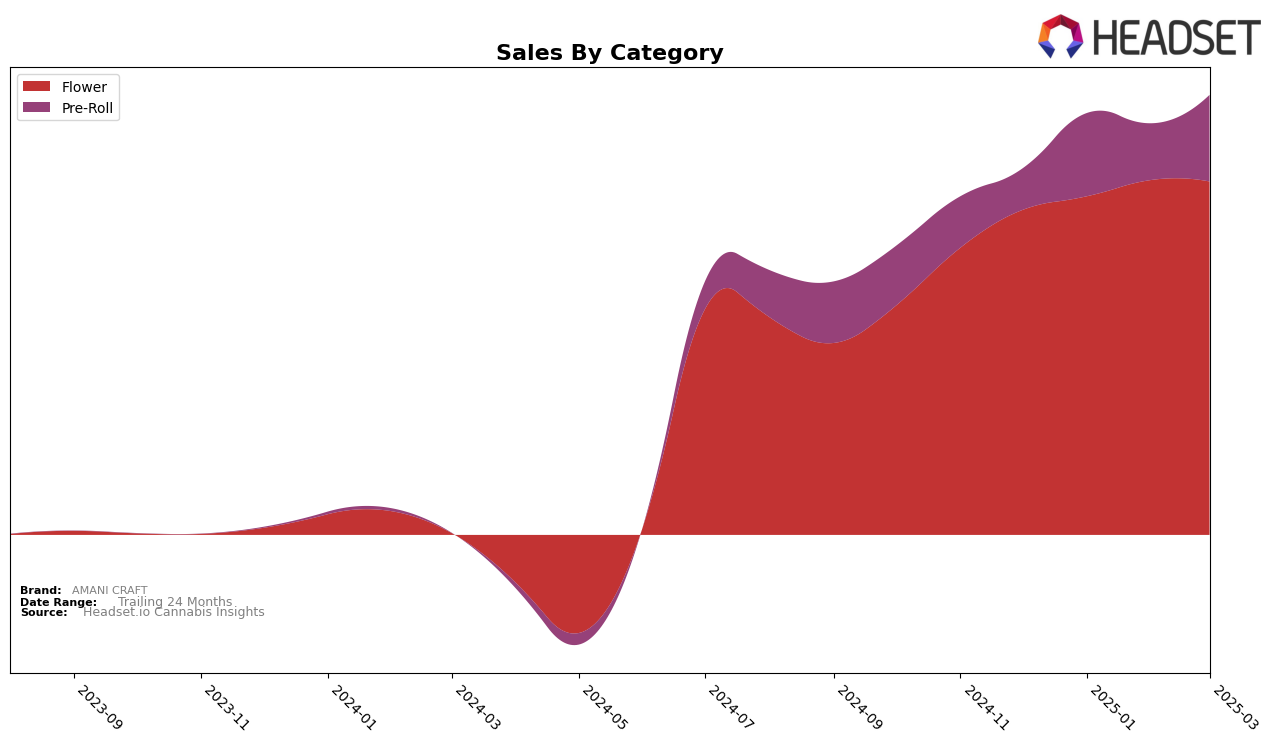

In the British Columbia market, AMANI CRAFT's performance in the Flower category has shown noteworthy progress. Starting from a rank of 31 in December 2024, the brand climbed to 29 by March 2025. This upward trend is accompanied by a steady increase in sales, with a notable jump from $187,569 in December 2024 to $203,966 in March 2025. Such movements suggest that AMANI CRAFT is gaining traction and possibly increasing its market share in this category. The consistent improvement in rankings indicates a positive reception among consumers in British Columbia, positioning the brand as a rising contender in the Flower segment.

Conversely, AMANI CRAFT's journey in the Pre-Roll category in British Columbia presents a more challenging scenario. The brand did not make it into the top 30 in December 2024, and its ranking fluctuated between 79 and 94 in the subsequent months. Despite these rankings, there was a significant increase in sales from February to March 2025, suggesting potential growth or a successful promotional strategy. However, the absence from the top 30 in several months highlights a competitive landscape where AMANI CRAFT might need to bolster its presence or refine its offerings to capture a more significant portion of the market in this category.

Competitive Landscape

In the competitive landscape of the Flower category in British Columbia, AMANI CRAFT has experienced a fluctuating rank trajectory, indicating a dynamic market presence. Over the months from December 2024 to March 2025, AMANI CRAFT's rank improved from 31st to 29th, suggesting a positive trend in market positioning. However, it faces stiff competition from brands like Magi Cannabis, which consistently maintained a higher rank, peaking at 24th in January 2025. Despite AMANI CRAFT's upward movement, Hiway also showed significant improvement, jumping to 23rd in February 2025, which could challenge AMANI CRAFT's growth. Meanwhile, Happy Hour exhibited a volatile pattern, yet managed to surpass AMANI CRAFT in February 2025. The competitive dynamics suggest that while AMANI CRAFT is making strides, it must strategize effectively to outpace these competitors and enhance its sales performance in the region.

Notable Products

In March 2025, the top-performing product for AMANI CRAFT was Gastro Pop Pre-Roll 2-Pack (1.5g) in the Pre-Roll category, which regained its number one rank after dropping to second place in February. Gastro Pop Smalls (3.5g) in the Flower category improved its ranking from third in February to second in March, with notable sales of 2,272 units. Gastro Pop (7g) saw a decline, moving from first place in February to third in March. Queen of the Tropics Pre-Roll 2-Pack (1.5g) entered the rankings for the first time, securing fourth place. Meanwhile, Queen of the Tropics Smalls (3.5g) dropped from fourth to fifth place, indicating a decrease in its sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.