Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

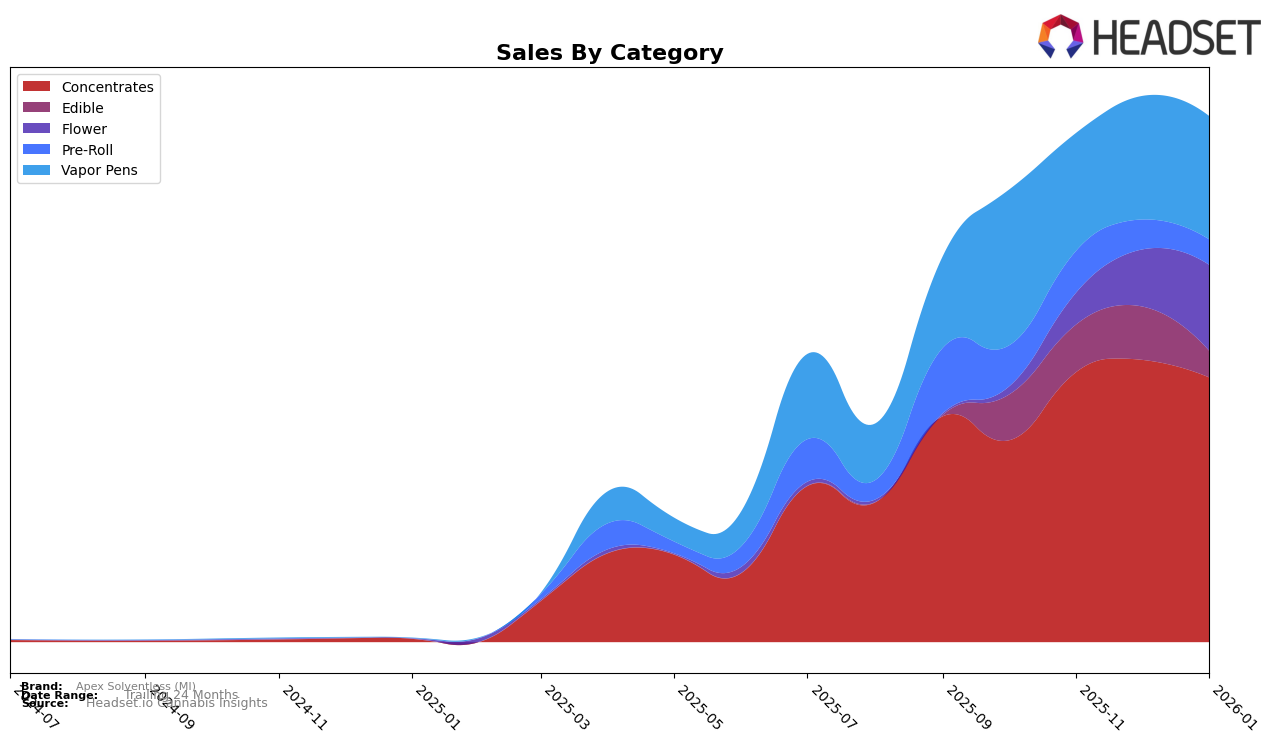

Apex Solventless (MI) has shown a notable performance in the Michigan concentrates category, steadily climbing from a rank of 25 in October 2025 to 19 by January 2026. This upward trajectory indicates a strengthening position in the market, suggesting that their products are gaining traction among consumers. The brand’s sales figures in this category reflect a robust performance, with a peak in November 2025, followed by a slight dip in January 2026. This trend highlights their ability to maintain a competitive edge in a dynamic market. However, their presence in other categories like vapor pens and edibles is less pronounced, with rankings not breaking into the top 30 in some months, indicating potential areas for growth and improvement.

In the edibles category, Apex Solventless (MI) has struggled to secure a strong foothold, with rankings hovering around the 80s and even dropping to 91 in January 2026. This decline suggests challenges in capturing consumer interest or possibly increased competition. The vapor pens category presents a mixed picture, with rankings fluctuating between 67 and 80, indicating an inconsistent performance. Despite these challenges, the brand's ability to maintain a presence in the concentrates category suggests a strategic focus that could be leveraged to improve standings in other segments. Understanding these dynamics is crucial for stakeholders looking to capitalize on the brand’s strengths and address its weaknesses.

Competitive Landscape

In the competitive landscape of the Michigan concentrates market, Apex Solventless (MI) has shown a consistent improvement in its ranking, moving from 25th in October 2025 to 19th by January 2026. This upward trajectory is indicative of a positive sales trend, although it still trails behind competitors like Common Citizen, which fluctuated but maintained a stronger position, peaking at 16th in December 2025. Meanwhile, Afternoon Delite made a remarkable leap from 91st to 17th, suggesting a significant surge in sales that could pose a future threat to Apex Solventless (MI). Made By A Farmer also showed a notable rise, ending at 18th, just ahead of Apex Solventless (MI), while Peachy Hash & Co. remained relatively stable, indicating a competitive but not insurmountable market environment. As Apex Solventless (MI) continues to climb the ranks, understanding these dynamics and the performance of its competitors will be crucial for maintaining its growth momentum.

Notable Products

In January 2026, Apex Solventless (MI) saw Laughing Gas Smalls (Bulk) leading as the top-performing product with impressive sales of 1297 units, marking its first appearance in the rankings. Cherry Bombz Pre-Roll (1g) maintained a strong presence, climbing to the second position from third in December with sales reaching 1289 units. G13 Skunk Rosin Disposable (0.5g) debuted at the third rank, showcasing a significant entry with sales of 1004 units. Super Buff Cherry Smalls (Bulk) held the fourth position, while Garlic Ice Cream Rosin (1g) consistently ranked fifth, mirroring its December placement. The data highlights a dynamic shift in product rankings, with new entries and steady performers shaping the sales landscape.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.