Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

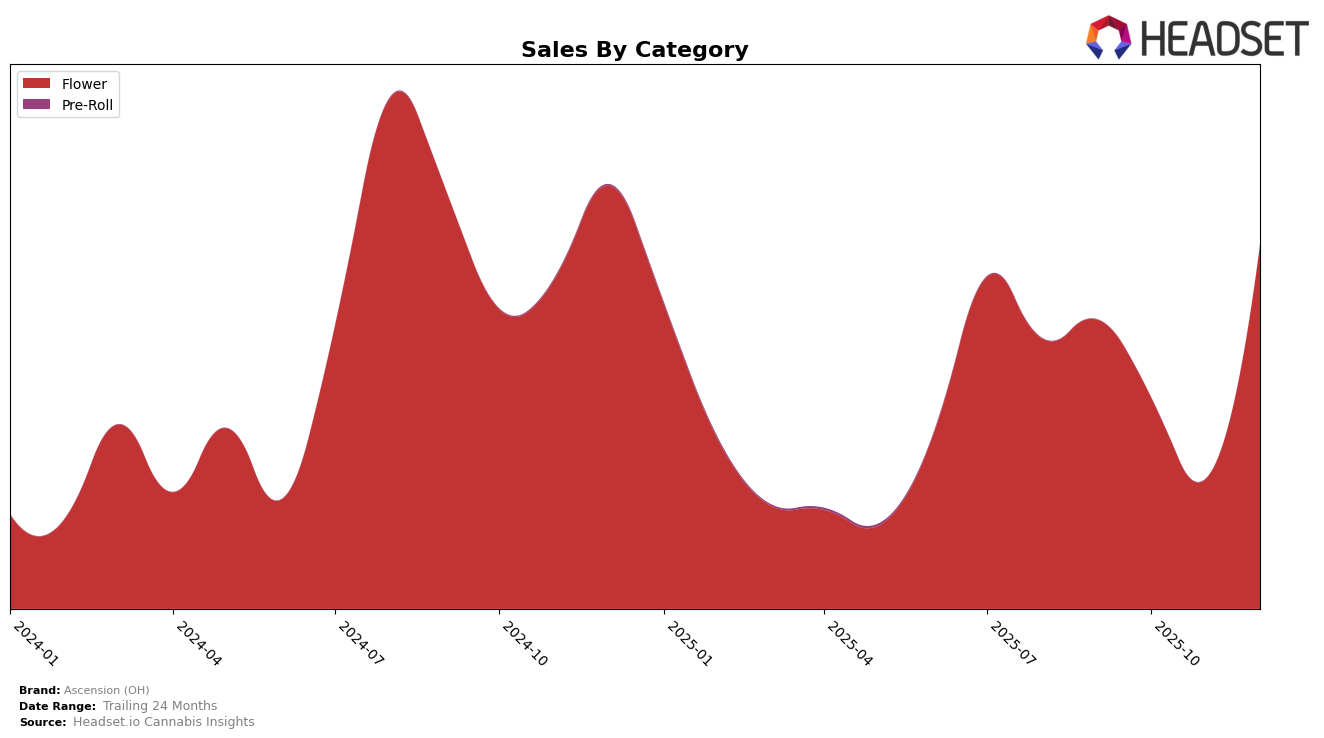

In the state of Ohio, Ascension (OH) has shown a notable performance in the Flower category over the last few months. After not ranking in the top 30 throughout the fall, the brand made a significant leap to the 27th position in December 2025. This upward movement is particularly impressive considering the previous months where they were ranked 38th in September, 44th in October, and 48th in November. This suggests a positive shift in consumer preference or possibly a strategic change by the brand that resonated well with the market in December.

While Ascension (OH) has demonstrated a strong finish to the year in Ohio, the brand's earlier performance in the Flower category indicates areas for potential improvement. The drop in sales from September to November, before the December rebound, highlights a period of struggle for Ascension. This fluctuation could be due to various factors such as market competition or seasonal changes in consumer behavior. However, the brand's ability to break into the top 30 by December suggests resilience and a capacity to adapt to changing market dynamics, which could be a promising sign for future performance.

Competitive Landscape

In the competitive landscape of the Flower category in Ohio, Ascension (OH) has shown a notable upward trajectory in its ranking from November to December 2025, jumping from 48th to 27th position. This significant improvement suggests a strategic shift or successful campaign that has resonated with consumers. Despite this positive trend, Ascension (OH) faces stiff competition from brands like Ohio Clean Leaf, which consistently ranks higher and demonstrated strong sales performance, particularly in October 2025. Additionally, Woodward Fine Cannabis and Firelands Scientific maintain a steady presence in the top 30, indicating a stable consumer base. Ascension (OH)'s December sales figures surpassed those of Galenas, which could indicate a growing preference for Ascension's offerings. As Ascension (OH) continues to climb the ranks, understanding these competitive dynamics and leveraging advanced data insights will be crucial for sustaining its upward momentum and capturing a larger market share.

Notable Products

In December 2025, Blue Boi (14.15g) emerged as the top-performing product for Ascension (OH), climbing from fourth place in November to first place, with a notable sales figure of 1179.0. Waken Cake (14.15g) maintained a strong presence, moving up from fifth to second place with a significant increase in sales. Cherry Star (2.83g) held steady in third place from the previous month, indicating consistent demand. Animal Mints (2.83g) made an impressive leap from being unranked in November to securing fourth place in December. Original Mandarin Cookies (14.15g) experienced a decline, dropping from the top spot in November to fifth place in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.