Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

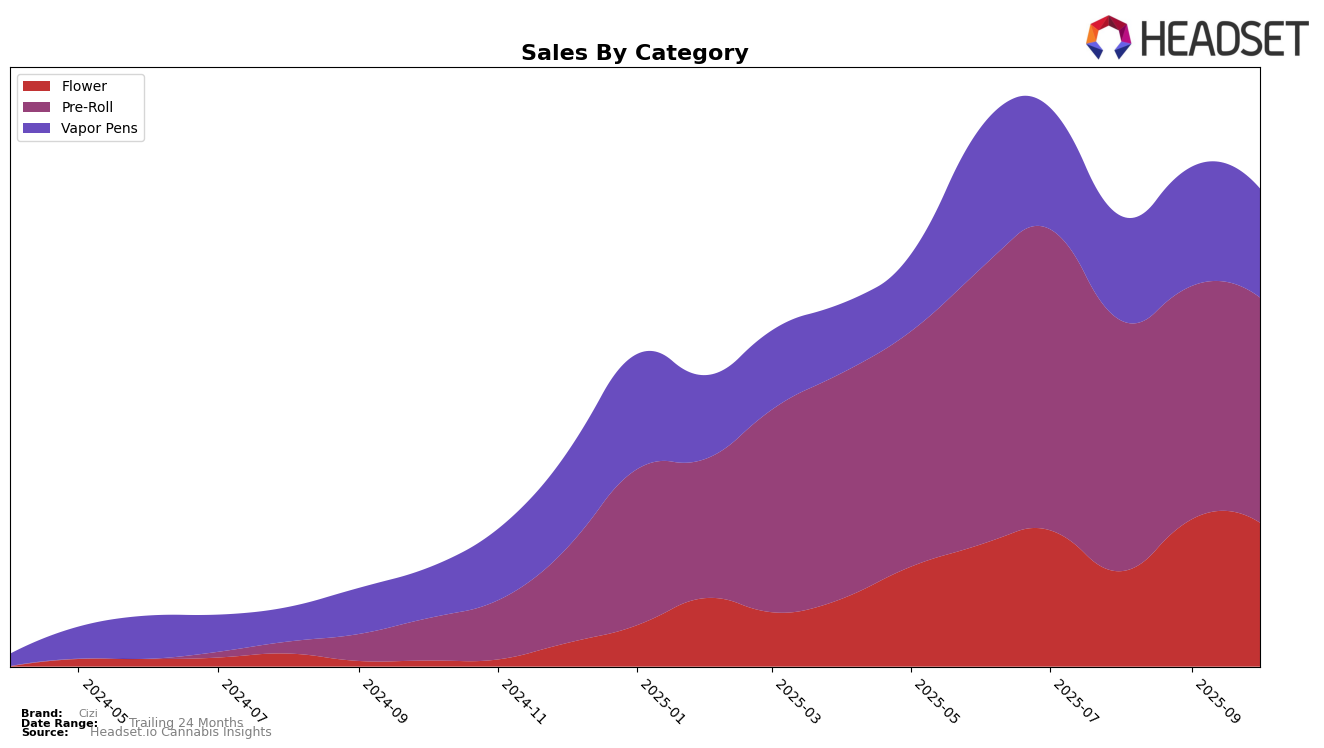

In the competitive landscape of California, Cizi's performance across various cannabis categories presents a mixed picture. In the Flower category, Cizi did not make it into the top 30 in August but showed resilience by climbing back to the 70th position in September before slightly dropping to 74th in October. This fluctuation indicates a volatile market presence in this category, suggesting potential challenges or opportunities for growth. In contrast, the Pre-Roll category reveals a more stable trajectory, with Cizi maintaining a consistent presence within the top 30, though experiencing a slight decline from 20th in July to 26th by October. This steady yet declining trend could point towards increasing competition or shifting consumer preferences within California's Pre-Roll market.

The Vapor Pens category reflects a different narrative for Cizi in California. Here, Cizi has shown a relatively stable performance, with a gradual improvement from 59th in August to 53rd by October. This positive trend, despite not breaking into the top 50, suggests a slow but steady increase in market acceptance or strategic adjustments that are beginning to pay off. However, the absence of Cizi in the top 30 for any category in August highlights a period of potential setbacks or strategic recalibration. Overall, while Cizi demonstrates potential in certain categories, the brand's varied performance across different product lines and months underscores the dynamic and challenging nature of the cannabis market in California.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in California, Cizi has experienced notable fluctuations in its market position over the past few months. Starting from a rank of 20 in July 2025, Cizi's rank slipped to 24 in August, then slightly improved to 23 in September, before dropping again to 26 in October. This downward trend in rank is mirrored by a consistent decline in sales figures over the same period. In contrast, brands like Sublime Canna and Selfies have shown more stable or improving ranks, with Selfies climbing from 28 to 24 from July to October. Meanwhile, CAM demonstrated a strong performance in September with a rank of 19, although it fell to 25 in October. These shifts suggest that while Cizi remains a significant player, it faces increasing competition from brands that are either stabilizing or improving their market positions, potentially impacting Cizi's sales momentum and necessitating strategic adjustments to regain its competitive edge.

Notable Products

In October 2025, the top-performing product from Cizi was the Godfather OG Pre-Roll (1g), maintaining its number one rank from September with a notable sales figure of 18,767 units. The White Widow Pre-Roll (1g) held steady in the second position, despite a slight decrease in sales from the previous month. The Pink Rozay Pre-Roll (1g) made an impressive debut, securing the third rank without any prior data. MAC 1 Pre-Roll (1g) followed closely at the fourth spot, showing a strong entry into the market. Finally, the F1 Pre-Roll (1g) rounded out the top five, marking its initial appearance in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.