Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

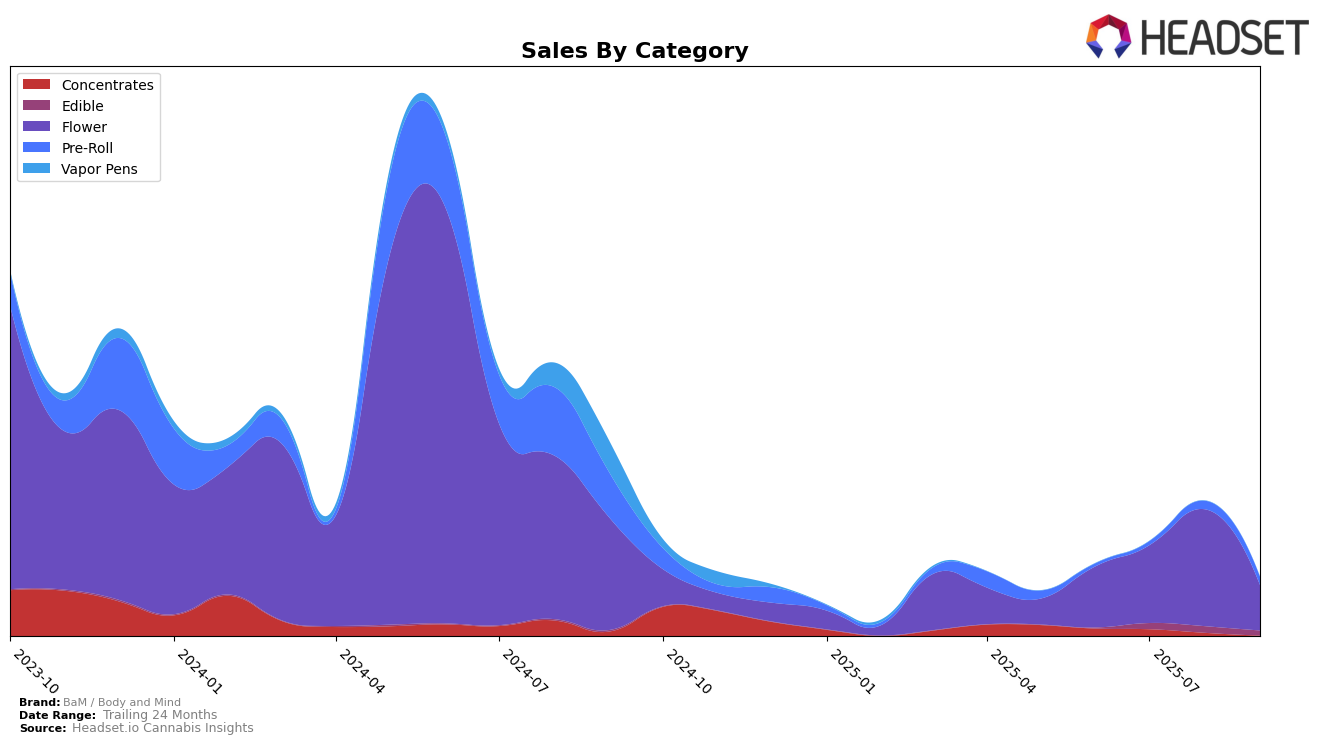

In Nevada, BaM / Body and Mind's performance in the Flower category has seen some fluctuations over the months from June to September 2025. Starting at rank 47 in June, the brand improved its standing to rank 31 by August, indicating a positive trend in consumer preference. However, by September, there was a notable decline as the brand fell to rank 50, which suggests potential challenges in maintaining its market position. This drop is significant as it indicates that BaM / Body and Mind did not make it into the top 30 brands in the Flower category for Nevada in September, a critical insight for stakeholders monitoring competitive dynamics in this space.

In the Pre-Roll category within Nevada, BaM / Body and Mind emerged in the rankings in August 2025 at position 63, and slightly improved to 58 by September. This upward movement, albeit starting from outside the top 30, hints at a growing acceptance or strategic push within this segment. Meanwhile, in Ohio, the brand was present in the Concentrates category, achieving a rank of 31 in June 2025, but did not appear in the top 30 in the subsequent months. This absence could reflect either increased competition or a shift in focus away from this category, underscoring the dynamic nature of market trends and consumer behavior.

Competitive Landscape

In the competitive landscape of the Nevada flower category, BaM / Body and Mind has experienced notable fluctuations in its ranking over the past few months, reflecting a dynamic market environment. Starting from June 2025, BaM / Body and Mind was ranked 47th, showing a promising upward trend by climbing to 31st in August, before dropping to 50th in September. This volatility suggests a competitive pressure from brands like Remedy, which maintained a relatively stable position around the 49th rank, and Fleur, which consistently outperformed BaM / Body and Mind by maintaining a rank in the low 40s. Despite a significant sales increase in August, BaM / Body and Mind's drop in September indicates potential challenges in sustaining growth amidst strong competition. Meanwhile, Matrix NV and Vlasic Labs also present competitive threats, with Matrix NV closely trailing BaM / Body and Mind in September. These insights highlight the need for strategic adjustments to enhance BaM / Body and Mind's market position and capitalize on growth opportunities in Nevada's flower market.

Notable Products

In September 2025, the top-performing product from BaM / Body and Mind was Pineapple Breeze Pre-Roll (1g) in the Pre-Roll category, achieving the number one rank with sales of 500 units. Cherry Moon Pre-Roll (1g) climbed to the second spot, improving from its third position in August, with sales slightly decreasing to 476 units. Candy Breeze Kush (14g) in the Flower category took third place, a drop from its first position in June, with 429 units sold. Fruit Pie (14g), another Flower product, entered the rankings at fourth place with 320 units. G-Kandy Pre-Roll (1g) rounded out the top five, making its debut in the rankings with 318 units sold.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.