Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

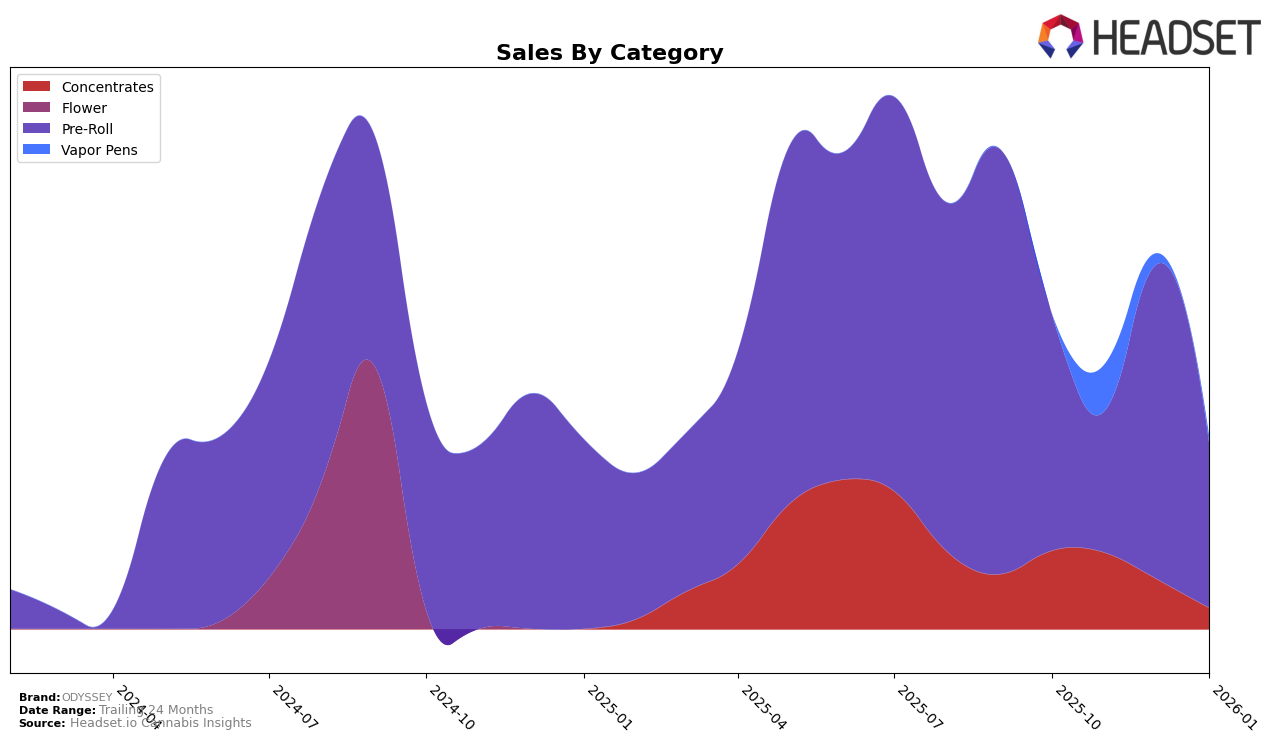

ODYSSEY's performance across different states and categories reveals a varied landscape of successes and challenges. In Michigan, the brand's presence in the Pre-Roll category fluctuated significantly over the analyzed months. Although ODYSSEY was not ranked in November 2025, it re-emerged in December 2025, securing the 62nd position, before dropping to 85th in January 2026. This suggests a volatile market presence in Michigan's Pre-Roll category, with sales peaking in December but experiencing a notable decline by January. Such fluctuations might indicate changing consumer preferences or competitive pressures in the state.

In Nevada, ODYSSEY demonstrated a consistent presence in the Concentrates category, albeit with a downward trend in rankings from 16th in October 2025 to 28th by January 2026. This decline in rank, coupled with decreasing sales figures, might point to growing competition or shifts in consumer demand. Conversely, the brand's entry into the Vapor Pens category in November 2025 at the 47th position, despite not being ranked in the preceding and following months, highlights potential opportunities for growth or a need for strategic reevaluation. The absence of ODYSSEY in the top 30 for Vapor Pens in other months could be an area for further investigation and strategy adjustment.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Michigan, ODYSSEY has shown a dynamic performance over the months from October 2025 to January 2026. Despite not ranking in November 2025, ODYSSEY made a significant comeback in December 2025, achieving the 62nd rank, which indicates a strong recovery and potential growth in market presence. This improvement is noteworthy when compared to competitors like Skymint, which experienced a decline in rank from 67th in November to 90th in January, and GreenCo Ventures, which fluctuated but ended January at the 78th position. Meanwhile, Stickee showed a more consistent performance, peaking at 55th in December before dropping to 81st in January. ODYSSEY's ability to climb back into the rankings suggests a resilient brand strategy that could capitalize on the declining trends of some competitors, potentially leading to increased sales and market share in the future.

Notable Products

In January 2026, the top-performing product for ODYSSEY was the Ogee Crasher Pre-Roll (1g), securing the number one rank with sales of 2990 units. It was followed by the Banana Banshee Pre-Roll (1g) in the second position, while the Lemon Bar Pre-Roll (1g) dropped from first place in December 2025 to third place. The Orange Wedding Cake Pre-Roll (1g) maintained its fourth-place ranking from the previous month. The Sugar Breath Pre-Roll (1g) rounded out the top five, indicating a new entry in the rankings for January. These changes highlight a dynamic shift in consumer preferences within the Pre-Roll category for ODYSSEY.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.