Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

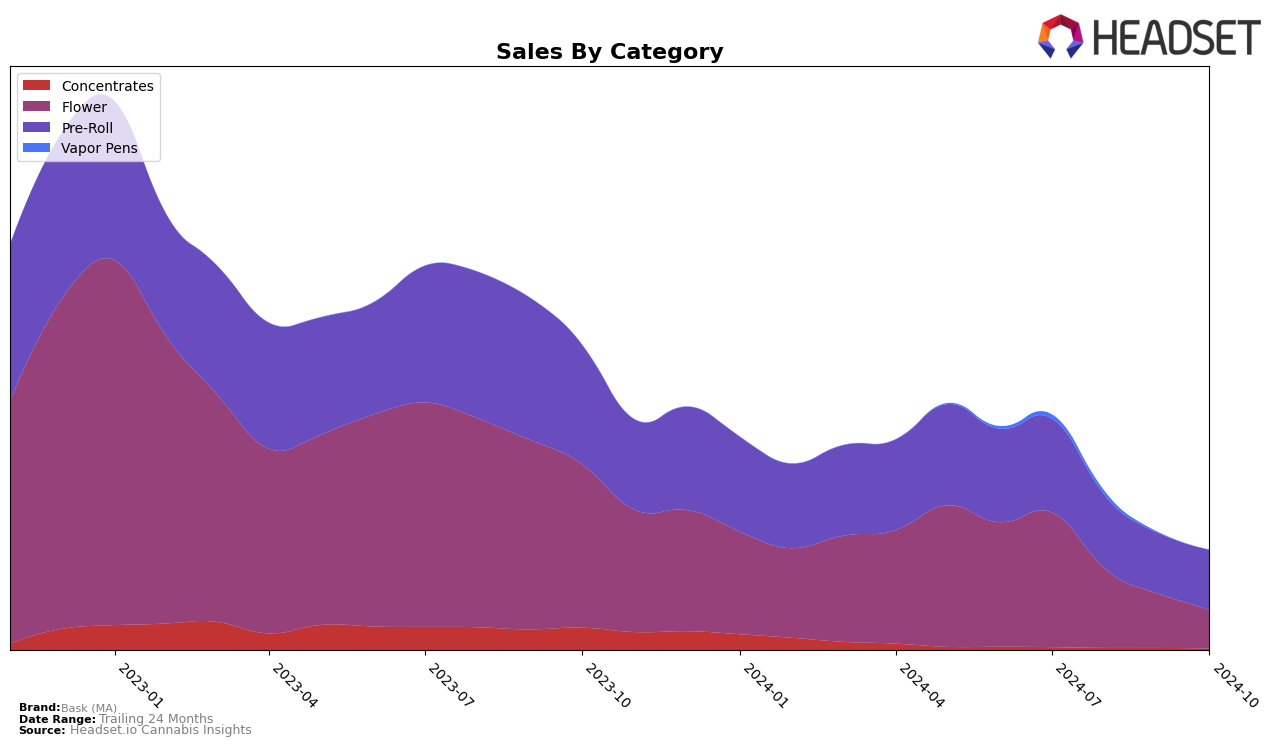

Bask (MA) has shown varying performance across different cannabis categories in the state of Massachusetts. In the Flower category, Bask (MA) has experienced a downward trend, slipping from the 31st rank in July 2024 to 67th by October 2024. This decline is also reflected in their sales, which have decreased significantly over these months. Such a drop in ranking suggests that Bask (MA) is facing stiff competition in the Flower category, and their absence from the top 30 brands in recent months could be indicative of the need for strategic adjustments. On the other hand, their performance in the Pre-Roll category shows a more stable trajectory, maintaining a presence within the top 30 brands, with a slight improvement from September to October 2024, moving from 33rd to 28th place.

In the Vapor Pens category, Bask (MA) has not managed to secure a position within the top 30 brands, as evidenced by their rank of 100 in August 2024 and the absence of subsequent ranking data. This suggests that the Vapor Pens category may not be a stronghold for Bask (MA) in Massachusetts, potentially indicating either a need for product innovation or marketing focus in this segment. The data highlights the brand's challenges in maintaining competitive positioning across various categories, particularly in a market as dynamic as Massachusetts. Understanding these trends can provide valuable insights into market dynamics and the competitive landscape that Bask (MA) is navigating.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Massachusetts, Bask (MA) has experienced some fluctuations in its rankings over the past few months, indicating a dynamic market environment. Notably, Bask (MA) saw a decline in rank from 23rd in July 2024 to 33rd in September 2024, before slightly recovering to 28th in October 2024. This trend suggests a challenging period for Bask (MA) as it faces stiff competition from brands like Strane, which maintained a stronger position, ranking as high as 19th in August 2024, and Stix Preroll Co. / Trailstix, which consistently stayed within the top 26. Meanwhile, Good News made a significant leap from 66th in July to 29th in October, showcasing a robust upward trajectory that could pose a threat to Bask (MA)'s market share. The fluctuating ranks and sales figures highlight the need for Bask (MA) to strategize effectively to regain its competitive edge in the Massachusetts Pre-Roll market.

Notable Products

In October 2024, the top-performing product for Bask (MA) was Donny Burger Pre-Roll (1g) in the Pre-Roll category, maintaining its leading position for the fourth consecutive month with sales of 6024 units. Wedding Cake Pre-Roll (1g) held steady at the second position, showing consistent ranking from the previous months. Whistling Moon Traveler Pre-Roll (1g) improved its rank from fifth in August to third in October, indicating a positive sales trend. Cap Junky Pre-Roll (1g) entered the top rankings in September and moved up to fourth place in October, showing a promising rise in popularity. Notably, Donny Burger (1g) in the Flower category made its debut in the rankings at fifth place, highlighting its emergence as a new contender in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.